- European inflation eased by more than anticipated in December.

- Upbeat United States employment-related data boosted demand for the US Dollar.

- EUR/USD entered a corrective phase after rallying three months in a row.

The EUR/USD pair plummeted in the first week of 2023, trading at around 1.0520 ahead of the close. The US Dollar soared on Tuesday without a certain catalyst, falling the next day in the same tenor. The USD finally picked up bullish momentum on Wednesday after the US Federal Open Market Committee (FOMC) released the Minutes of the December meeting, later reinforced by upbeat United States employment-related data.

The Euro initially rallied against its American rival but ended up giving up to evidence the US economic situation is in a better shape to bare with aggressive monetary tightening.

Healthy labor sector

Employment-related data was decisive in terms of US Dollar gains mid-week, as the December ADP survey on private job creation posted a whopping 235K increase, largely surpassing the 150K expected. Additionally, US-based employers reported 43.651K layoffs in December, well below the previous 76.835K. Finally, on Friday, the United States published the Nonfarm Payrolls report for the last month of 2022, which showed the country added 223K new jobs while the Unemployment Rate declined to 3.5%, despite the participation rate rising to 62.3%. On the other hand, Average Hourly Earnings rose by 4.6% YoY, down from 4.8% in November.

Softening inflationary pressures should help the US Federal Reserve to slow down on quantitative tightening. Hence, the US Dollar eased with the upbeat report, recovering from a 4-week low of 1.0480. EUR/USD, however, was unable to extend gains far beyond the 1.0500 threshold.

United States Federal Reserve still worried about inflation

The US Federal Reserve (Fed) hiked rates by 50 bps in the last meeting of 2022, lifting its benchmark interest rate to a 15-year high of 4.25%-4.5%. Back then, policymakers surprised market participants with a hawkish stance, anticipating more rate hikes through 2023, with no cuts foreseen until at least 2024. Investors were speculating the Fed was on its way to pivoting ahead of the event, and the shock put a halt to the US Dollar's three-month slump.

FOMC Meeting Minutes confirmed policymakers’ determination to keep fighting inflation at any cost. The Greenback rallied post-event, gaining additional ground afterwards on the back of solid employment-related figures that hinted at a healthy labor market.

The Euro lacked life of its own, as European data was encouraging but fell short of being impressive. On the one hand, growth-related figures indicated progress but also showed local economies stand in contraction territory. Most of December’s S&P Global PMIs were upwardly revised, although German services output was revised lower.

European inflation improves, ECB maintains the tightening path

On the other hand, inflation figures indicate that the worst on price pressures may be over. The German Harmonized Index of Consumer Prices (HICP) rose in December by 9.6% YoY, well below the 11.3% posted in November. France's inflation increased by 7% YoY, also easing from record highs. Finally, on Friday, the Euro Zone Harmonised Index of Consumer Prices was up by 9.2% on a yearly basis in December, declining from 10.1% in November and below the market expectation of 9.7%. On a down note, core HICP was up by 5.2% YoY, accelerating from 5% in the previous month.

The European Central Bank (ECB) is also concerned about price pressures. Multiple officials hit the wires these days and supported President Christine Lagarde´s hawkish words following the December monetary policy, noting that “of course,” more rate hikes are on the docket. About inflationary pressures, it is worth remembering that, despite easing from a multi-decade high, it still stands far above central banks’ goals of around 2%.

In the United States, the official ISM Manufacturing PMI came down to 48.4 in December, while the ISM Services PMI contracted to 49.6, much worse than anticipated and putting mild pressure on the Greenback ahead of the weekly close.

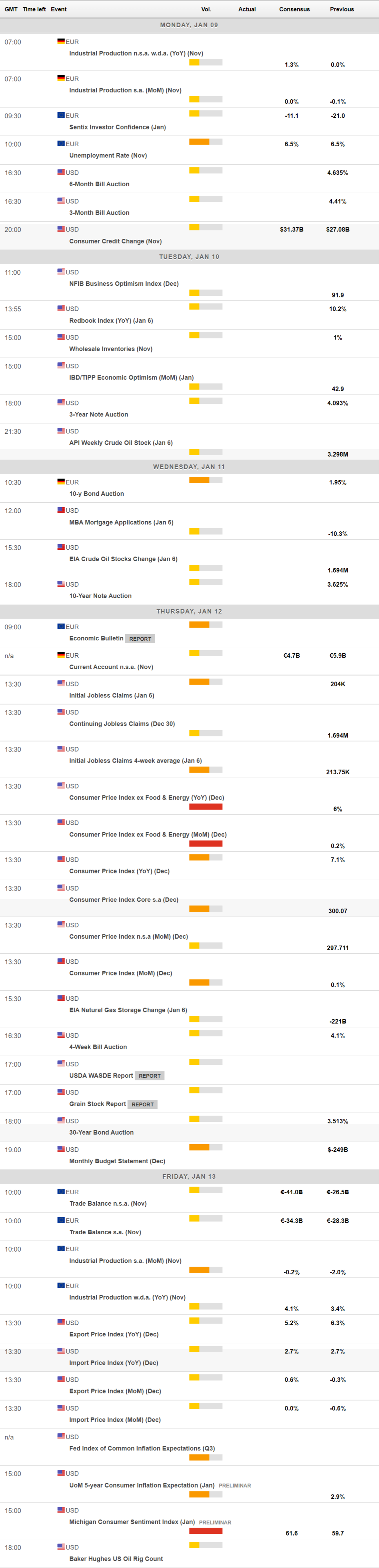

The upcoming week will bring the December United States Consumer Price Index (CPI) and the preliminary estimate of the January Michigan Consumer Sentiment Index.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows that the overdue correction has begun. The pair edged sharply lower and trades near the 23.6% Fibonacci retracement of the September/December rally at 1.0450, an immediate support level. The 38.2% retracement of the same rally stands at 1.0275, a potential target for the ongoing slide and a line in the sand for bulls.

Nevertheless, the risk remains skewed to the upside. Technical indicators are barely correcting extreme overbought conditions, heading south well above their midlines. At the same time, the 20 Simple Moving Average turned north but stands at around the 50% retracement of the aforementioned rally, far away from being relevant. Finally, the 100 and 200 SMAs, maintain their downward slopes far above the current price.

In contrast, the pair is neutral-to-bearish, according to the daily chart. A directionless 20 SMA capped advances in the second half of the week, while technical indicators hold directionless just below their midlines. The 200 SMA heads south at around 1.0300, while the 100 SMA advances and currently stands at 1.0140.

The pair would need to recover beyond 1.0650 to have chances of a bullish continuation towards the 1.0730/50 price zone, although substantial gains beyond that level seem unclear in the new 2023 scenario.

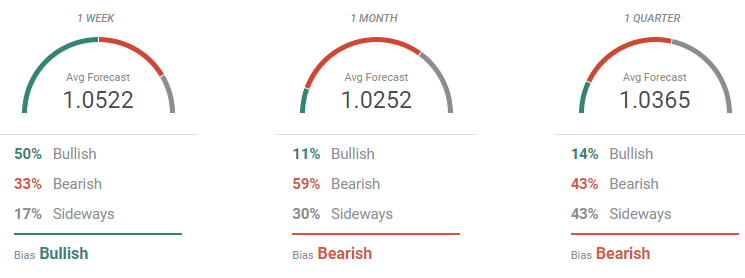

EUR/USD sentiment poll

The FXStreet Forecast Poll suggest that the EUR/USD pair will remain above the 1.0500 threshold in the near term, as 50% of the polled experts bet for an advance. However, the coin for the monthly and quarterly perspectives, bears outpace buyers. The pair is seen quoting at an average of 1.0252 and 1.0365 respectively in the longer term. It is quite notorious that bulls account in both cases for less than 15% of the contributors.

The Overview chart hints at a potential bearish extension for the upcoming days. The near-term moving average has turned lower as most targets accumulate below the current level. However, the monthly and quarterly moving averages have ticked higher. In the first case, most targets accumulate in the 1.0300/1.0600 price zone, while for the three-month perspective, the range increases to 1.0400/1.0800.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD hangs near multi-year low as traders await US NFP report

AUD/USD consolidates just above its lowest level since October 2022 as traders move to the sidelines ahead of Friday's release of the closely-watched US NFP report. In the meantime, rising bets for an early RBA rate cut, China's economic woes, US-China trade war fears, geopolitical risks and a softer risk tone act as a headwind for the Aussie.

USD/JPY bulls turn cautious near multi-month peak ahead of US NFP

USD/JPY moves little following the release of household spending data from Japan and remains close to a multi-month top amid wavering BoJ rate hike expectations. Furthermore, the recent widening of the US-Japan yield differential, bolstered by the Fed's hawkish shift, undermines the lower-yielding JPY and acts as a tailwind for the currency pair amid a bullish USD.

Gold price consolidates below multi-week top; looks to US NFP for fresh impetus

Gold price enters a bullish consolidation phase below a four-week top touched on Thursday as bulls await the US NFP report before placing fresh bets. In the meantime, geopolitical risks, trade war fears and a weaker risk tone might continue to act as a tailwind for the safe-haven XAU/USD.

Ripple's XRP plunges over 4% following funding rates decline

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

How to trade NFP, one of the most volatile events Premium

NFP is the acronym for Nonfarm Payrolls, arguably the most important economic data release in the world. The indicator, which provides a comprehensive snapshot of the health of the US labor market, is typically published on the first Friday of each month.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.