EUR/USD Weekly Forecast: US Dollar gains momentum ahead of US CPI

- The United States Nonfarm Payrolls report largely surpassed market expectations in September.

- European data keeps highlighting the economy’s fragility and persistent recessionary risks.

- EUR/USD broke below the 1.1000 mark, and could extend its slump in the upcoming days.

The EUR/USD pair kick-started October with a weak note, plummeting to 1.0958 on Friday following an upbeat surprise from United States (US) employment figures. As a result, the US Dollar (USD) advanced amid decreasing bets on another Federal Reserve (Fed) aggressive interest rate cut after encouraging US macroeconomic data. Additionally, the Greenback found support in an escalating Middle-East conflict that pushed speculative interest into safety.

Back-and-forth air strikes between Israel and its Islamic neighbours took centre stage this week and spurred fears the situation will continue to escalate. Concerns about oil supply interruptions dominated the headlines and pushed the price of black gold sharply up. As a result, stock markets struggled for momentum, with US equity indexes heading into the weekly close with a mixed tone.

US employment figures brought relief

The US released multiple employment-related data ahead of September’s Nonfarm Payrolls (NFP) report published on Friday, which showed the labor market is gaining momentum.

The ADP report on private job creation showed the sector added 143K new jobs in September, better than the 120K anticipated. Additionally, the number of job openings on the last business day of August stood at 8.04 million, as reported in the Job Openings and Labor Turnover Survey (JOLTS).

The September Challenger Job Cuts showed that US-based employers announced 72,821 cuts in the month, a 4% decrease from the 75,891 cuts announced one month prior, while Initial Jobless Claims for the week ended September 27 rose by 225K, worse than the 220K anticipated.

Finally on Friday, the NFP report showed the US added 254K new jobs in September, while the Unemployment Rate fell to 4.1%. The US Dollar skyrocketed with the news, retaining its strength ahead of the weekly close.

Other than that, the US published the ISM Services Purchasing Managers’ Index (PMI), which unexpectedly improved to 54.9 in September from 51.5 in August. The ISM Manufacturing PMI for the same month, however, resulted at 47.2, missing expectations of 47.5.

At the end of the week, the odds for a 50 bps rate cut from the Fed plummeted to 5.5%, although the other 94.5% foresees a 25 bps trim.

What’s going on in Europe

The European macroeconomic calendar included inflation and growth-related updates. Germany reported that the September Harmonized Index of Consumer Prices (HICP) declined 0.1%, according to preliminary estimates, while the annual HICP rose 1.8%, below the previous 2%. The broadly Eurozone’s (EU) HICP also rose 1.8% in the year to September, declining from the 2.2% posted in August.

On a down note, the final Hamburg Commercial Bank (HBOC) Purchasing Managers Index (PMI) showed upward revisions to manufacturing and services output. The final EU Composite PMI was confirmed at 49.6, better than the previous 48.9. Also, the EU Producer Price Index (PPI) increased by 0.6% on a monthly basis in August, according to first estimates from Eurostat. The annual PPI printed -2.3%, also better than expected.

Easing inflationary pressures combined with tepid PMIs’ progress brought modest relief, not enough to take the Euro out of its bearish path.

Finally, the European Central Bank (ECB) President Christine Lagarde hit the wires at the beginning of the week but provided no fresh insights on monetary policy. Lagarde repeated that the ECB would keep policy rates “sufficiently restrictive for as long as necessary,” adding that the latest developments strengthened policymakers’ confidence that inflation would return to target in a timely manner.

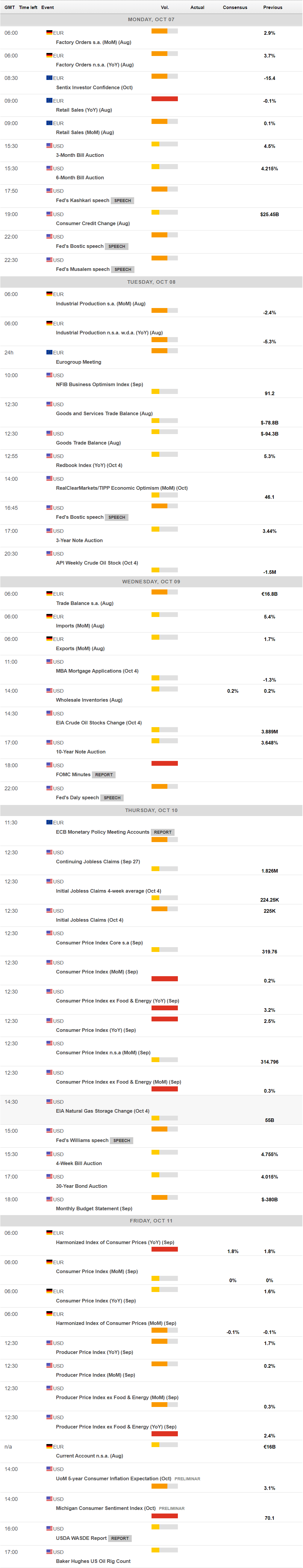

Next in the macroeconomic docket

The upcoming week will feature a couple of critical macroeconomic reports. The US will publish the Federal Open Market Committee (FOMC) meeting Minutes on Wednesday and the September Consumer Price Index (CPI), previously at 2.5% YoY on Thursday. The country will also publish September PPI data and the preliminary estimate of the October Michigan Consumer Sentiment Index on Friday. Across the pond, the calendar will be a tad lighter as the EU will unveil August Retail Sales on Monday and the ECB Monetary Policy Meeting Accounts on Thursday.

Central banks’ statements are not actually expected to shed much light on future monetary policy decisions, as officials at both shores of the Atlantic have reaffirmed that their decisions will be data-dependent and that those decisions will be made meeting-by-meeting. On the contrary, recent data has set policymakers’ course of action.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair shows it trades at levels last seen in mid-August. Even further, the pair broke below an ascendant trend line coming from 1.0665, the June 26 daily low, currently at around 1.0980. The chart shows the pair has broken below a mildly bearish 200 Simple Moving Average (SMA), and nears the 20 SMA, which losses upward strength and provides support in the 1.0930 area. Technical indicators, in the meantime, have turned firmly lower but so far hold above their midlines.

The EUR/USD pair daily chart shows it fell for six consecutive days, maintaining a strong downward momentum. Technical indicators aim lower almost vertically and are approaching oversold readings without any sign of bearish exhaustion. At the same time, the 20 SMA gains downward traction at around 1.1095, while the 100 and 200 SMA have turned flat below the current level, reflecting the lack of buying interest seen in these last few days.

Approaches to the 1.1000 mark should attract sellers to keep the bearish momentum alive, with the following support in the 1.0930 area en route to 1.0860. A steady recovery above the 1.1000 threshold could see the pair recovering towards 1.1070, where it has multiple intraday lows between August and September. Beyond the latter, a run towards 1.1140 should come next, albeit the US Dollar’s weakness seems unlikely at the time being.

Economic Indicator

Consumer Price Index (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as The Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier.The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Thu Oct 10, 2024 12:30

Frequency: Monthly

Consensus: 2.3%

Previous: 2.5%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.