EUR/USD Weekly Forecast: Buyers in control as Fed seen trimming rates aggressively

- Tepid United States data fueled concerns about the country’s economic health.

- Market players are increasing bets on a Fed 50 bps rate cut in September.

- EUR/USD turned sharply higher and could test the 1.1000 in the upcoming sessions.

The EUR/USD pair fell to a fresh three-week low of 1.0776 on Thursday but managed to finish the week in the green above the 1.0900 threshold. Market players had loads to digest throughout the week, but in the end, mounting speculation that the Federal Reserve (Fed) will trim interest rates aggressively and tepid United States (US) data fueling recession fears weighed more.

Trouble in the Eurozone

The Euro had the chance to rally mid-week, but local data undermined its strength. Macroeconomic figures highlighted softer growth extended into the third quarter of the year, as the final Hamburg Commercial Bank (HCOB) Manufacturing PMI was confirmed at 45.8 in July, matching June’s reading. “The eurozone’s manufacturing sector suffered yet another setback at the start of the third quarter as a steeper reduction in new orders led contractions in output and employment to accelerate,” the official report reads.

Furthermore, Germany reported that the economy contracted in the second quarter of the year, as the Gross Domestic Product (GDP) fell 0.1% in the three months to June, according to preliminary estimates. The EU economy, however, expanded a modest 0.3% in the same period, slightly better than the 0.2% anticipated by market participants.

Finally, both economies reported the preliminary estimates of the July Harmonized Index of Consumer Prices (HICP). The German annual index was up by 2.6%, higher than the previous 2.5% and above the 2.4% anticipated. In Europe, the core annual HICP rose by 2.9%, also above the market’s expectations.

Federal Reserve paves the way for a September cut

As widely anticipated, the Fed left the federal funds rate unchanged at 5.25%- 5.5% in its July policy meeting.

The Fed introduced some changes to its statement, which grabbed investors’ attention. On the one hand, policymakers acknowledged that job gains have moderated, while inflation is now seen as “somewhat elevated.” Additionally, the Fed noted that it is attentive to risks on both sides of its dual mandate, a change from the June statement, in which it said it was “highly attentive” to inflation risks. Finally, the Committee judged that the risks to achieving its employment and inflation goals continued to move into better balance.

The US Dollar came under selling pressure as Chairman Jerome Powell delivered a speech and said that a September rate cut is on the table, particularly if macroeconomic data keeps moving in the current direction. However, he clearly remarked that policymakers have made no future decision on monetary policy, and that they will remain data-dependant. As a result, financial markets moved into pricing in at least two rate cuts before year-end, while there are mounting expectations the Fed will deliver three cuts in 2024.

Central banks in the eye of the storm

However, USD's weakness was short-lived. The Greenback quickly trimmed losses and extended gains against major rivals as markets turned risk-averse. The reason behind the latter was a mixture of central banks’ announcements and tepid US data, fueling concerns about the health of the world’s largest economy.

On the one hand, the Bank of Japan (BoJ) and the Bank of England (BoE) announced their decisions on monetary policy. The first hiked interest rates by 15 basis points (bps), while the second trimmed its benchmark rate by 25 bps. Both decisions were widely anticipated, although only the BoJ is seen continuing its recent policy, putting local stocks in sell-off mode and spurring demand for the safe-haven USD. Meanwhile, tepid earnings reports also weighed on stock markets, fueling USD demand.

Concerns about US economic health

Stock markets tumbled after the US released the ISM Manufacturing PMI on Thursday. The index fell in July to 46.8 from 48.5 in the previous month, missing expectations of 48.8. The ISM report also showed a concerning uptick in Prices Paid, as the sub-index jumped to 52.9, higher than the 51.8 anticipated.

US employment-related data supported the case for rate cuts. The ADP report showed that the private sector added 122K new jobs in July, missing the 150K expected. Also, Initial Jobless Claims for the week ended July 26 unexpectedly rose to 249K, worse than anticipated. Additionally, US-based employers announced 25,885 job cuts in July, a 47% decrease from the 48,786 cuts announced one month prior, according to the Challenger Job Cuts report, while hiring fell to its lowest point in over a decade. Finally, Nonfarm Productivity rose 2.3% in the second quarter of the year, while Unit Labor Cost in the same period printed at 0.9%, much lower than the previous 3.8%.

Finally, the US released the July Nonfarm Payrolls (NFP) report on Friday. The report showed the country added 114,000 new jobs in July, missing the 175,000 expected. Furthermore, the Unemployment Rate rose to 4.3% from 4.1% in the previous month, while the Labor Force Participation Rate ticked up to 62.7% from 62.6%. Finally, Average Hourly Earnings declined to 3.6% from 3.8% in the same period, indicating easing inflationary pressures from that side. Also, Factory Orders fell 3.3% MoM in June, worse than anticipated.

By the end of the week, speculative interest believed the Fed could cut up to 50 bps at the September meeting, while the odds for three rate cuts before year-end continued to increase. Before the NFP release, the chances of a 50 bps cut in September stood at 30%, soaring to roughly 90% afterwards.

Next in the macroeconomic front

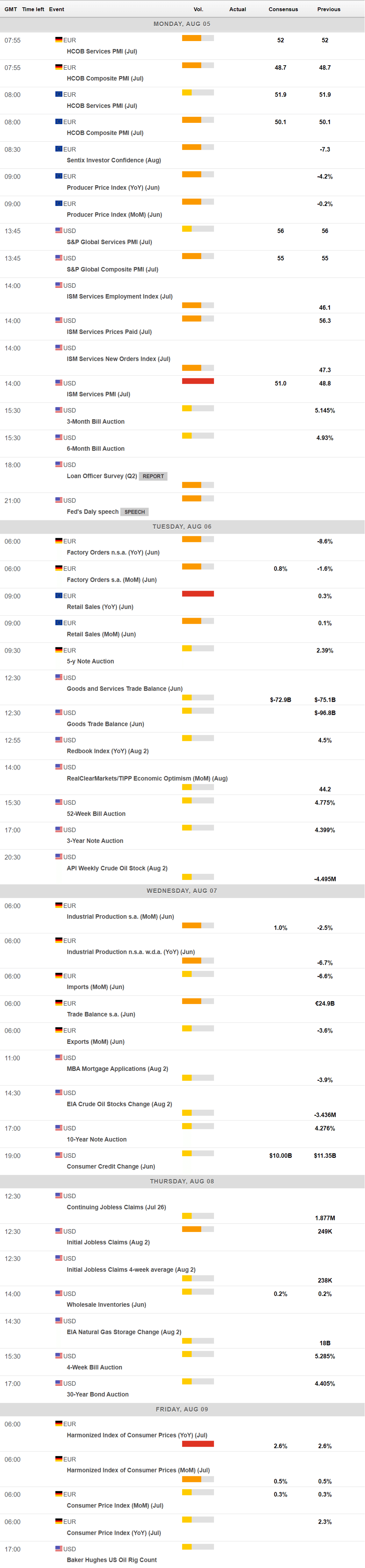

The upcoming week will bring some interesting economic indicators, but for the most, financial markets are expected to trade on sentiment, with the Fed’s future actions in the eye of the storm.

On Monday, the US will publish the July ISM Services PMI, foreseen at 51.0, improving from 48.8 in June. Other than that, HCOB and S&P Global will release the final estimates of the Services and Composite PMIs for most major economies.

Germany will report June Factory Orders and Industrial Production for the same month. By the end of the week, the country will publish the final calculation of July inflation figures. The Eurozone will offer June Retail Sales and August Sentix Investor Confidence.

The scheduled data has a limited potential to impact their respective currencies but would be a good barometer of economic health on both shores of the Atlantic.

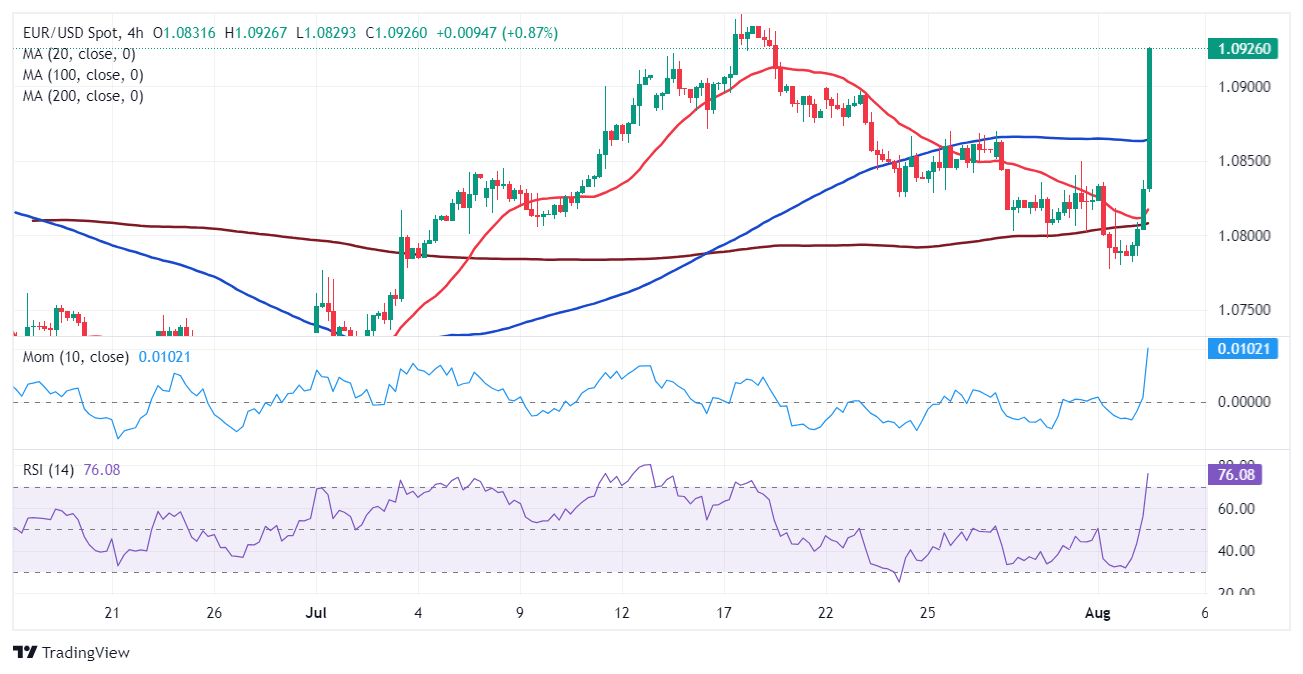

EUR/USD technical outlook

From a technical point of view, the weekly chart for EUR/USD offers a neutral-to-bullish stance. The pair met buyers around a flat 20 Simple Moving Average (SMA), while the 100 SMA grinds higher below the shorter one. Technical indicators, in the meantime, tick higher within positive levels but lack clear directional strength. Finally, a mildly bearish 200 SMA stands at around 1.1080, a critical level to overcome to anticipate a sustained advance in the long term.

Technical readings in the daily chart support a bullish extension, particularly if the pair closes the week above the 1.0900 threshold. EUR/USD has accelerated above all its moving averages after meeting buyers around a mildly bearish 100 SMA and currently stands roughly 50 pips above a mildly bullish 20 SMA. At the same time, technical indicators head north almost vertically, with the Relative Strength Index (RSI) indicator currently standing at 59 but the Momentum indicator battling to overcome its 100 line.

July monthly high provides immediate resistance at 1.0947, with gains beyond this level aiming to test the 1.1000 psychological level. A break above the latter exposes the 1.1080 area. Near-term support can be found at 1.0880, with a more relevant one at 1.0800. A downward acceleration through the latter opens the door for a test of 1.0720.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.