- Concerns about central banks’ monetary policy decisions keep investors on their toes.

- The United States will release the July Consumer Price Index next week.

- EUR/USD loses upward momentum, but there are no signs of an upcoming slide.

The EUR/USD pair ended the week as it started, trading a handful of pips above the 1.0900 mark. Panic dominated financial markets throughout the first half of the week as investors assessed United States (US) macroeconomic data that spurred recession concerns. The dismal mood was exacerbated by weekend tensions in the Middle East following an Israeli attack on Iranian territory and continued menaces of retaliation from both sides.

Panic coupled with uncertainty hit the US Dollar

Uncertainty related to central banks’ potential decisions on monetary policy also affected the market’s sentiment. The US Dollar plummeted on Monday, resulting in EUR/USD reaching 1.1008, its highest since early January, as market participants started betting the Federal Reserve (Fed) could trim interest rates before the September meeting. Even further, the USD got hit by a soaring Japanese Yen (JPY) following an unexpected 15 basis points (bps) rate hike from the Bank of Japan (BoJ) and hawkish comments from Governor Kazuo Ueda.

Finally, it is worth remembering the European Central Bank (ECB), the Bank of England (BoE), and even the Bank of Canada (BoC) already trimmed interest rates, further prompting fears the Fed may be behind the curve in lowering borrowing costs and avoiding a recession.

Stock markets collapsed, led by a record decline in the Nikkei 225, while government bond yields also edged sharply lower, with the 10-year Treasury yield hitting its lowest in over a year.

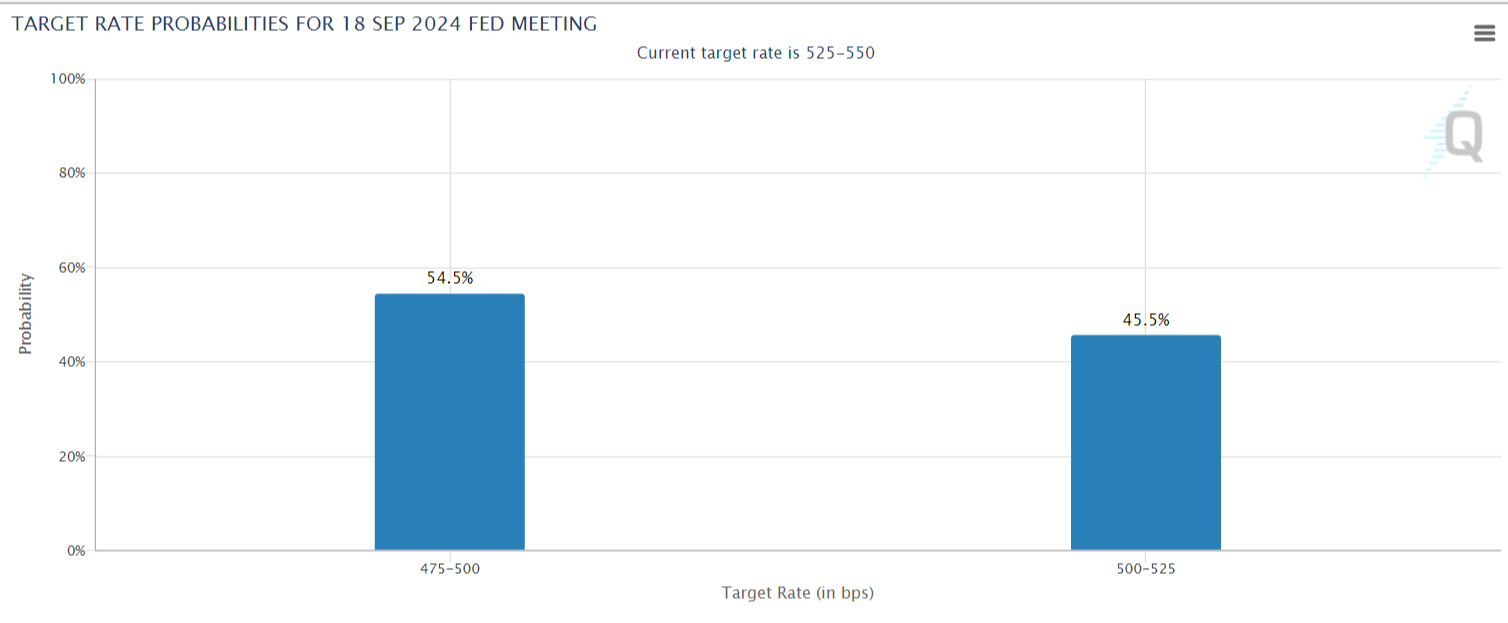

Concerns cooled as the week went by, with stocks bouncing and the US Dollar recovering most of its early losses. More relevant, speculative interest withdraws bets on an out-of-schedule rate cut, leaving September odds split between a cut of 25 or 50 bps.

The ongoing calm could be quickly interrupted as it pends by a thread. Speculative interest is still unconvinced about economic progress and the consequences of monetary policy decisions. Sentiment is expected to keep leading the way in the upcoming days and probably increase ahead of the September monetary policy meetings.

Data under scrutiny

The better sentiment was also backed by some encouraging US headlines, as the ISM Services Purchasing Managers Index (PMI) surged to 51.4 in July from the 48.8 posted the previous month, while Initial Jobless Claims for the week ended August 2 decreased to 233K, beating the expected 240K.

Across the pond, the Hamburg Commercial Bank (HCOB) published the final estimate of the Eurozone July PMIs, upwardly revising the EU Composite PMI to 50.2. Additionally, the June Producer Price Index rose by 0.5% month-over-month (MoM) and declined by 3.2% year-over-year (YoY), surpassing the market’s expectations. Finally, Retail Sales in the same month fell by 0.3% MoM, worse than anticipated.

German data, on the other hand, was slightly more encouraging as Factory Orders rose 3.9% MoM in June, while Industrial Production increased by 1.4% in the same month, beating forecasts. Finally, the country confirmed the July Harmonized Index of Consumer Prices (HICP) at 2.6% YoY as previously estimated.

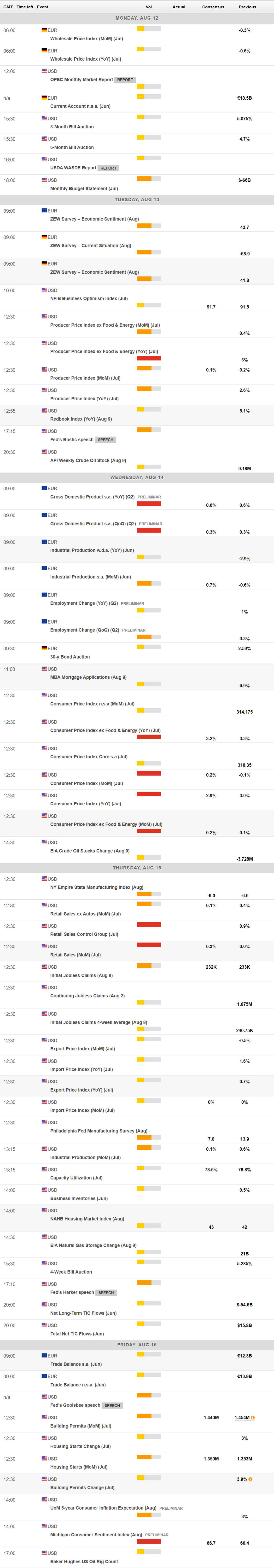

The US will publish the July Producer Price Index (PPI) next Tuesday and the Consumer Price Index (CPI) for the same month a day after. The country will also release Retail Sales data for July and the preliminary estimate for the August Michigan Consumer Sentiment Index.

At the same time, Germany will release the August ZEW Survey on Economic Sentiment on Tuesday, while the EU will publish the second estimate of the Q2 Gross Domestic Product (GDP) and June Industrial Production data on Wednesday.

EUR/USD technical outlook

The EUR/USD pair weekly chart shows the upward momentum receded. The candle has a long upward wick, usually signaling bulls could not overcome selling interest that is willing to add at higher levels. The same chart shows the pair keeps developing above the 20 and 100 Simple Moving Averages (SMAs), while the 200 SMA provides dynamic resistance at around 1.1070. In the meantime, technical indicators lack directional strength but hold above their midlines, far from suggesting an upcoming slide.

In the daily chart, the EUR/USD pair is neutral-to-bullish. The pair met strong buying interest at around a now flat 20 SMA at 1.0880, which remains above the longer ones. Technical indicators, however, have lost their directional strength. The Momentum indicator hovers just above its 100 line, while the Relative Strength Index (RSI) indicator consolidates at around 59, limiting the bearish potential of EUR/USD.

July monthly high provides immediate resistance at 1.0947, with gains beyond the level aiming to test the 1.1000 area. A break above the latter exposes the 1.1080 price zone. On the other hand, near-term support can be found at 1.0880, with a more relevant one at 1.0800. A downward acceleration through the latter opens the door for a test of 1.0720.

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Economic Indicator

Gross Domestic Product s.a. (QoQ)

The Gross Domestic Product (GDP), released by Eurostat on a quarterly basis, is a measure of the total value of all goods and services produced in the Eurozone during a certain period of time. The GDP and its main aggregates are among the most significant indicators of the state of any economy. The QoQ reading compares economic activity in the reference quarter to the previous quarter. Generally, a rise in this indicator is bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Wed Aug 14, 2024 09:00 (Prel)

Frequency: Quarterly

Consensus: 0.3%

Previous: 0.3%

Source: Eurostat

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold retreats from record highs at $3,220 ahead of US data

Gold price is retreating from fresh all-time highs of $3,220 in early Europe on Friday. The US Dollar downward spiral and escalating trade war between the United States and China continue to underpin the safe-haven appeal of Gold price. US PPI inflation data and tariff updates remain on tap.

EUR/USD consolidates weekly gains near 1.1250 ahead of Lagarde's speech

EUR/USD is consolidating the uptick to three-year highs of 1.1385 in Friday's European session. The pait stays supported amid easing US-EU trade tensions and broad US Dollar weakness. Tarff talks will be closely eyed alongside Lagarde's speech and US data.

GBP/USD holds gains near 1.3000 after UK data

GBP/USD is paring back gains to near 1.3000 in Friday’s early European session. The pair stays firm as the US Dollar loses ground amid lingering concerns over US economic growth and US-China trade war. Upbeat UK economic data fail to impress the Pound Sterling.

Bitcoin, Ethereum and Ripple show weakness while XRP stabilizes

Bitcoin and Ethereum prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple broke and found support around its critical level; maintenance suggests a recovery on the cards.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.