EUR/USD Weekly Forecast: The beginning of the end of the tightening cycle

- Global policymakers quietly confirmed the banking crisis took its toll on their decisions.

- The US Federal Reserve hiked rates by 25 bps, anticipated rate cuts for 2024.

- EUR/USD daily chart hints at another leg lower at the beginning of the next week.

The EUR/USD pair traded as high as 1.0929 this week but ends it with modest gains around the 1.0750 area. The US Dollar eased throughout the first half of the week amid a better market mood, as the banking financial crisis receded on the back of governments’ actions taken throughout the weekend.

On Sunday, the Swiss National Bank announced UBS, Switzerland’s biggest bank, will take over Credit Suisse for $3.25 billion, roughly 60% less than what the bank was worth on Friday. The Swiss government even changed the law to facilitate the deal. Investors gained confidence and moved into the high-yielding Euro ahead of the United States Federal Reserve (Fed) monetary policy decision on Wednesday.

Federal Reserve’s concerns

As widely anticipated, the Board of Governors of the Federal Reserve System voted unanimously to raise the interest rate by 25 basis points (bps) to a range of 4.75% to 5%. The decision, however, was affected by the banking crisis, and the announcement spurred risk aversion, triggering a US Dollar sell-off that saw the pair peak at the aforementioned high.

At the beginning of the press conference, Chair Jerome Powell aimed to cool down markets by saying the American banking system was resilient and that authorities would take appropriate measures to protect it. In fact, US Treasury Secretary Janet Yellen spoke alongside Chief Powell in a separate event and noted the strong actions taken to ensure American deposits are safe, adding she is prepared to take additional action if needed.

Back to the Fed’s announcement, and economic projections, policymakers hinted at one more 25 bps rate hike before pausing, as the terminal rate stands at 5.1% by the end of 2023. Rate cuts are coming in 2024, although the Federal Funds Rate for such a year was upwardly revised to 4.3% from 4.1%. Furthermore, they expected Real GDP to grow by 0.4% this year and 1.2% in 2024, both suffering downward revisions. Inflation, in the meantime, has been upwardly revised as they foresee PCE inflation up to 3.3% this year, from 3.1% previously.

Fed Chairman Jerome Powell offered multiple interesting headlines in the press conference, most of them read as dovish. In regards to how the banking turmoil affected their decision, he acknowledged the committee considered a pause but ended up opting for a hike on the back of stronger-than-expected intermediate data on inflation and the labor market.

Powell added the central bank would continue hiking if needed, but the accompanying statement read, “we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation. Instead, we now anticipate that some additional policy firming may be appropriate,” as they believe financial conditions had tightened further with the latest developments.

Across the pond, European Central Bank (ECB) President Christine Lagarde hit the wires but stuck to the central bank’s message from the previous week, insisting that banks are much stronger than in the 2008 crisis while noting policymakers are still engaged in battling inflation.

It’s clear that while trying to pour cold water on financial tensions, global policymakers are concerned about the side effects of their aggressive monetary tightening. A steeper banking crisis is something fragile economies cannot afford these days. Officials could come out with grandiloquent words about the health and resilience of the sector, but behind those words, their decisions indicate they are worried. The beginning of the end of the tightening cycle has arrived.

The big question now is whether inflation will continue to recede. It does not matter if it is at a slow pace as long as it moves in the right direction. The next big hurdle the market could face is inflation changing direction.

Focus on European inflation

Data-wise, Germany reported the February Producer Price Index rose 15.8% YoY, higher than the 12.4% expected, although below the previous 17.6%. Also, the March ZEW Survey showed that the assessment of the Current Situation in the country fell further to -46.5, while Economic Sentiment plunged to 13. That of the Eurozone fell to 10, both far below anticipated. Finally, Consumer Sentiment in the EU contracted to -19.2 in March, according to preliminary estimates.

United States figures were mixed, as housing and employment-related data were encouraging, but Durable Goods Orders declined 1% MoM in February.

The upcoming week will be a lighter one in terms of macroeconomic releases, with a focus on Europe, as the Eurozone and Germany will publish the preliminary estimates of their March Harmonized Index of Consumer Prices (HICP). Germany will also offer February Retail Sales, while the United States will unveil the Fed’s favorite inflation measure, the Core Personal Consumption Expenditures (PCE) Price Index, foreseen up by 4.4% YoY in February.

EUR/USD technical outlook

The weekly chart for the EUR/USD pair offers a neutral-to-bullish stance as the pair keeps struggling to clear a long-term level, the 61.8% Fibonacci retracement of the 2022 decline at 1.0745. Despite the fresh, almost two-month high, the pair has been unable to close a week above it since breaking lower early in February.

The same chart shows that a firmly bullish 20 Simple Moving Average (SMA) attracted buyers, currently providing dynamic support at around 1.0630. On the other hand, the pair retreated after nearing a bearish 100 SMA, the latter limiting advances at around 1.0980. Finally, technical indicators held within positive territory, the Momentum directionless just above its 100 level, and the Relative Strength Index (RSI) gaining bullish traction at 59, skewing the risk to the upside without confirming so.

The daily chart shows an increased risk of a bearish extension coming up next. EUR/USD fell for a second consecutive day, and while it holds above bullish moving averages, buying interest continues to give up. Technical indicators have turned sharply lower, although still within positive levels. A break below their midlines should mean increased selling interest and hence, anticipate another leg south.

Support could be found around 1.0690, followed by the 1.0600 price zone. Below the latter, the pair could extend its decline towards the next Fibonacci support, the 50% retracement at 1.0515.

On the other hand, the pair would need to advance beyond 1.0840 to recover its positive momentum and extend its rally towards 1.0930 and beyond.

EUR/USD sentiment poll

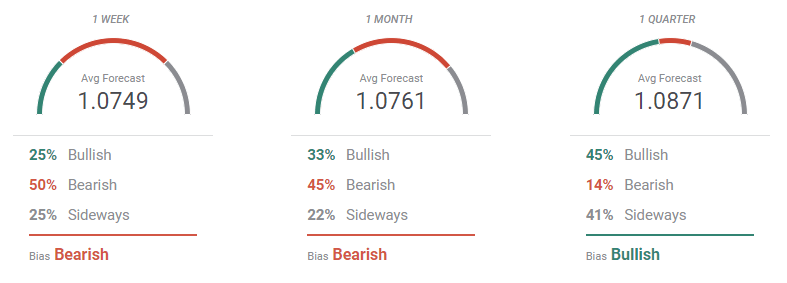

The FXStreet Forecast Poll shows that EUR/USD will likely remain around the current level, although most polled experts are bearish in the weekly and monthly perspectives. In the quarterly view, however, bulls dominate the scene standing at 45%. On average, the target has been lifted to 1.0871.

The Overview chart, on the other hand, shows that bulls dominate EUR/USD. The three moving averages head firmly north and stand at fresh multi-week highs. Furthermore, the base of the range in all cases is higher than in the previous week. In the near-term perspective, the pair is seen mostly between 1.0600 and 1.0800. The range moves lower, to 1.0400/1.0800 in the monthly view, but for the long-term one, the base has been set at 1.0600, with scope to advance up to 1.1200.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.