EUR/USD Weekly Forecast: Risk-off fuels dollar’s demand ahead of Nonfarm Payrolls

- Sluggish growth amid a second coronavirus wave in Europe spurred demand for safety.

- US September Nonfarm Payrolls are seen at 875K, as the pandemic continues taking its toll.

- EUR/USD has posted an interim top at 1.2011 and heads lower, with 1.1500 at sight.

The market made up its mind these days, and the American dollar stands victorious. The EUR/USD pair plummeted to 1.1615, its lowest level since late July. The greenback’s positive momentum gives no signs of receding at the weekly close and will likely extend heading into the next Nonfarm Payroll report release.

Fears mount, but central banks have done enough

The main theme these days was risk-aversion amid record coronavirus contagions in Europe. The Old Continent is in the middle of a second wave, with new restrictions announced in France, Spain and the UK. The pandemic continues to take its toll on economic progress, with softening macroeconomic figures indicating that any possible recovery would take much longer than initially estimated.

Meanwhile, in the US, Federal Reserve’s Chief Jerome Powell testified before Congress and asked lawmakers to provide fiscal support, again, amid the damage the coronavirus made to the economy. In ominous times, the dollar’s safe-have condition imposes itself. However, the deadlock between Democrats and Republicans continues.

On Thursday, news indicated that Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi have agreed to restart formal talks towards a new economic relief bill, but so far, no progress has been announced. Even further, Congress is readying to leave Washington until after the election.

Growth-related macroeconomic data released these days was tepid, to say the least. Markit released the preliminary estimates of its September PMIs, which showed that economic activity contracted in most of the EU, with the indexes falling below 50 in several countries. In the US, the indexes remained within expansion levels but advanced at a softer-than-expected pace.

The greenback remained strong despite mixed US data released at the end of the week, as US Durable Goods Orders were up a measly 0.4% in August, missing expectations of 1.0%, although Nondefense Capital Goods Orders ex Aircraft jumped 1.8%.

Growth and employment under the spotlight

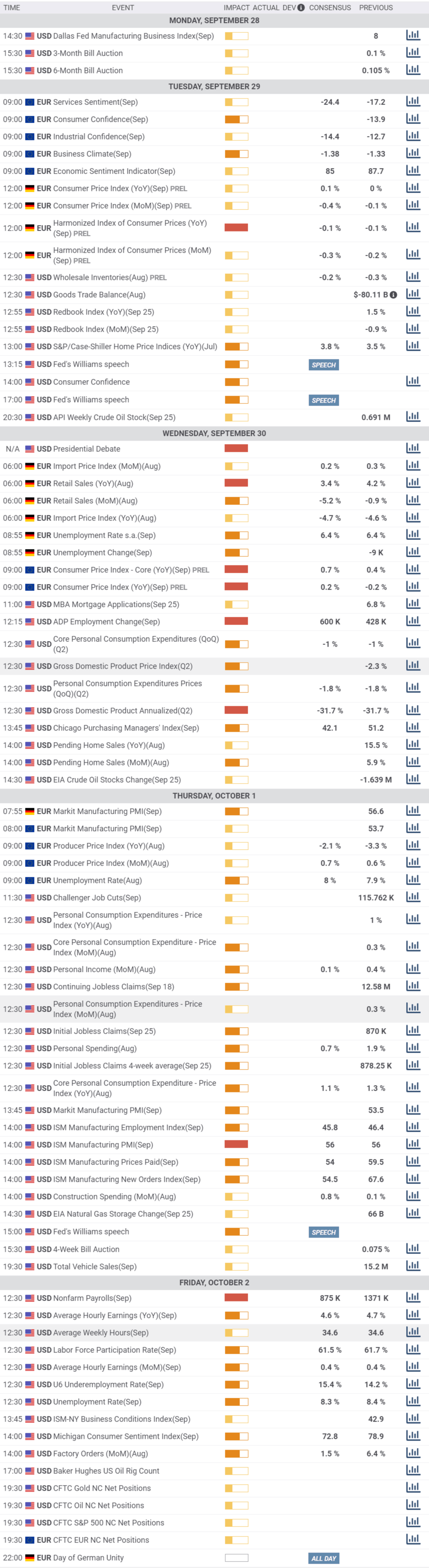

More clues about the economic health of major economies will come next week, starting on Tuesday, with the EU September Economic Sentiment Indicator, and the preliminary estimate of September German inflation. About this last, its worth noting that central banks are keeping rates at record lows and refraining from announcing more stimulus, while inflationary pressures are far from enough to trigger a response from policymakers.

The EU will also publish its September CPI estimates, while Germany will unveil August Retail Sales on Wednesday.

In the US, the presidential debate will take center stage. The format for the first debate will be six 15-minute time segments dedicated to different topics, such as the economy, coronavirus, riots and the Supreme Court, among other things.

Also during this new week, the market will get some final figures on already released estimates, including US Q2 GDP and Markit PMIs. More relevant, the US will publish the official ISM PMI, foreseen in September at 56, in line with the August´s final reading.

The US Federal Reserve has highlighted the need for supporting the battered employment sector. September´s Nonfarm Payroll report will be out next Friday. At the time being, expectations are of 875K new jobs added in the month, quite a poor figure, while the unemployment rate is seen ticking down to 8.3% from the current 8.4%. Average hourly earnings are seen up by 0.4% MoM.

EUR/USD technical outlook

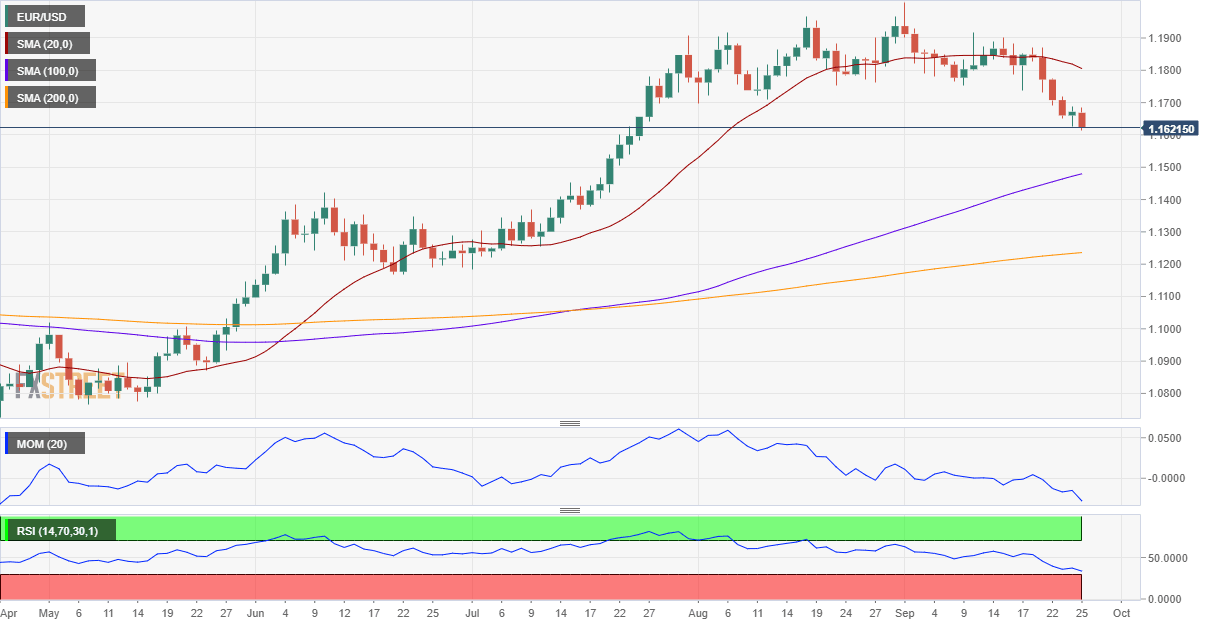

From a technical point of view, the EUR/USD pair seems to have reached an interim top at 1.2011, now biased lower. In the long-term, however, the ongoing decline seems corrective. In the weekly chart, the pair continues developing above all of its moving averages, with the 20 SMA maintaining its bullish slope above the larger ones. Technical indicators, however, turned sharply lower from overbought levels, and while still above their midlines, they signal solid selling interest.

The daily chart shows that after a brief respite on Thursday, the pair has been closing in the red. The EUR/USD pair is now trading below a mildly bearish 20 DMA, as technical indicators gain bearish traction within negative levels. The next relevant support level is the 1.1600 figure, followed by March high at 1.1496. The pair would need to advance beyond 1.1720 to recover some bullish strength and climb towards the 1.1800/40 region next week.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair is nearing a bottom, as the pair is seen on average at 1.1607 in the weekly perspective, with the sentiment neutral. However, the monthly and quarterly views are dominated by bulls, with the pair seen on average at 1.1797 and 1.1835 respectively.

The Overview chart shows that most targets next week accumulates below the current level, reflecting the bearish momentum. In the longer-term perspectives, the moving averages remain flat and with modest downward slopes, somehow suggesting an increased bearish interest, yet to be confirmed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.