- The United States will publish the January Consumer Price Index next Tuesday.

- Euro Zone Gross Domestic Product could be a make-it-or-break-it for the Euro.

- EUR/USD bearish path could extend towards a long-term Fibonacci support at 1.0510.

The EUR/USD pair fell for a second consecutive week, further retreating from the 1.1000 region to settle around the 1.0700 figure. The US Dollar gained the most ground on Monday, mounted on the central banks’ frenzy and the outstanding United States Nonfarm Payroll report.

The US Federal Reserve (Fed) has slowed the pace of tightening and delivered a 25 basis point (bps) rate hike, but refrained from anticipating a pause in hikes while down-talking the chances for a rate cut, something market participants have been betting on since late 2022.

Federal Reserve between a rock and a hard place

The Fed has long remarked that it is willing to tame inflation at the expense of economic growth. Fears of a recession dominated financial markets through 2022. The latest outstanding job report indicated that the labour market remains tight regardless of the Fed's aggressive monetary policy. On the one hand, it means that the resilience of the economy is much higher than expected. Yet at the same time, a tight labor market tends to boost inflation, making Fed’s battle against price pressures more difficult.

At this point, Federal Reserve officials think rate cuts would not be necessary this year, although market players believe otherwise. The latest meeting minutes clearly stated that additional interest rate hikes in the coming months would be “appropriate,” with Chair Jerome Powell & co repeating it ad-exhaustion.

However, Chief Powell's acknowledgement that the disinflationary process has already begun has led investors to believe in a monetary policy pivot. Powell participated on Tuesday in a moderated discussion at the Economic Club of Washington DC and repeated his moderated speech. Powell started restating they would probably need to do further interest-rate increases adding that the process is going to be “bumpy,” and that stronger-than-anticipated data would see the Fed raising rates accordingly. He also said that solid labor market reports or higher inflation reports would result in the Fed raising rates by more than what is currently priced in.

Powell’s words triggered volatile movements, but in the end, his hawkish message undermined demand for high-yielding assets to the benefit of the US Dollar.

European Central Bank sticks to its plan

Across the pond, mixed European data and the absence of fresh monetary policy clues made the Euro an unattractive asset. The Eurozone economic setback continues and would keep the European Central Bank (ECB) on the tightening path for longer than anticipated. Following the latest ECB meeting, President Christine Lagarde said that March would bring another 50 bps rate hike, while it would be a meeting-by-meeting data-dependant decision afterwards.

EU policymakers have spent the last few days cooling expectations for a steep recession, in line with Mme Lagarde’s words of a possible “shallow and sort-lived” economic setback. However, most macroeconomic figures released these days point in the opposite direction.

In the EU Retail Sales fell by 2.8% in January, while German Factory Orders plunged by 10.1% YoY in December. Additionally, the country’s Industrial Production in the same month declined at an annualised pace of 3.9%. On a positive note, the German Harmonized Index of Consumer Prices (HICP) unexpectedly rose by 9.2% YoY in January, below the 10% expected and easing from the previous 9.6%. Easing inflationary pressures are welcomed news but mean the ECB has room to decelerate the pace of tightening.

As central banks hint they would move against speculative interest beliefs, uncertainty increases, leading to risk-averse markets.

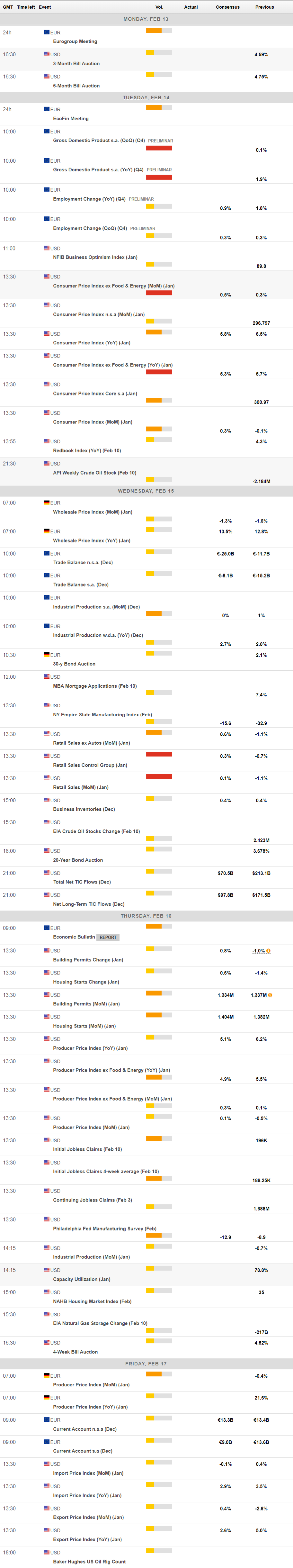

European GDP and US CPI on the docket

Fresh clues on economic developments will be available next week. On Tuesday, the Eurozone will release the preliminary estimate of the 2022 Q4 Gross Domestic Product. The economy grew at an annualized pace of 1.9% in the third quarter and a modest 0.1% in the three months to September. Later on the same day, the United States will publish the January Consumer Price Index (CPI), foreseen up by 5.8% YoY. The core reading, excluding volatile food and energy prices, is expected at 5.3%. Such figures will confirm inflation keeps receding and revive speculation of a Fed’s pivot.

On Wednesday, the United States will release January Retail Sales, foreseen advancing 0.1% after a 1.1% drop in the previous month. Other than that, market participants will be keeping an eye on policymakers' speeches, although it seems unlikely they will come out with surprise stances.

EUR/USD technical outlook

The EUR/USD pair trades below the 1.0745 level, which stands for the 61.8% Fibonacci retracement of the 2022 yearly slide, quite a discouraging sign for buyers. Technical readings on the weekly chart, however, suggest the ongoing decline remains corrective. Indicators have eased from overbought readings but remain well into positive territory. At the same time, the 20 Simple Moving Average (SMA) maintains its sharply bullish slope far below the current level at around 1.0390. The longer moving averages, in the meantime, remain above the current level, with the 100 SMA acting as dynamic resistance at around 1.1050. The corrective decline could extend to the 1.0510 region, where the pair has the 50% Fibonacci retracement of the aforementioned slide. The long-term bullish trend would not be at risk from such a slump, but for sure, the market’s sentiment will be affected.

The daily chart for EUR/USD suggests more slides are on the docket. Technical indicators head south within negative levels, and while the bearish momentum seems limited, they stand at three-month lows. At the same time, the 20 SMA has turned marginally lower in the 1.0830 price zone, acting now as a dynamic resistance. On a positive note, a bullish 100 SMA crosses above a flat 200 SMA in the 1.0320/30 region. The 38.2% retracement of the 2022 decline stands just below, becoming the last bastion for bulls.

Bulls can recover some strength on a daily close above 1.0745, although they would need to clear the 1.0830/50 region to maintain control and aim for a retest of the 1.1000 threshold.

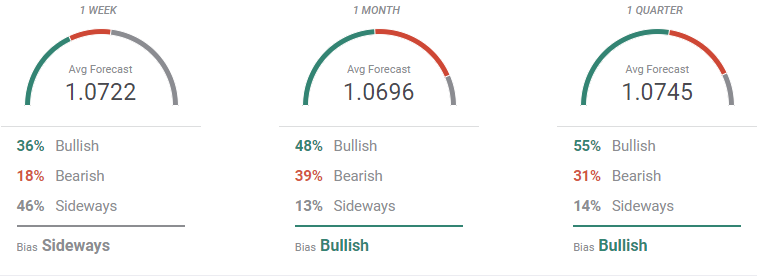

EUR/USD sentiment poll

The FXStreet Forecast Poll suggest that buyers are losing interest. Most polled analysts see the pair hovering around the current price zone, leaving an average target of 1.0722. The longer-term perspectives, however, are still dominated by bulls, which stand for 48% in the monthly view and 55% in the quarterly one. Some firmly bearish institutions skew the average down, but taking a look at the spread of potential targets, it seems that the upward trend will resume after a sharp downward correction.

The Overview chart shows that the near-term moving average has turned lower but the longer ones are neutral. In the monthly perspective, a floor comes at around 1.0350, while the upper end of the range has extended to 1.1000. The quarterly view shows that higher highs are becoming more likely, with the pair seen mostly holding in the 1.0800/1.1400 area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds lower ground near 0.6350 after downbeat Aussie jobs data

AUD/USD is holding lower ground near 0.6350 in Asian trading on Thursday. The downbeat Australian jobs data fans RBA rate cut bets, maintaining the downward pressure on the pair. US-China trade tensions and US Dollar recovery act as a headwind for the pair.

USD/JPY fades the rebound to 142.85 amid US-Japan trade optimism

USD/JPY fades the impressive rebound from seven-month lows of 141.61, falling back toward 142.00 in the Asian session on Thursday. The pair tracks the US Dollar price action, fuelled by contrstructive trade talks between the US and Japan. A tepid risk recovery supports the pair.

Gold price corrects from record highs of $3,358

Gold price retreats from a fresh all-time peak of $3,358 reached earlier in the Asian session on Thursday. Despite the pullback, tariff uncertainty, the escalating US-China trade war, global recession fears, and expectations of more aggressive Fed easing will likely cishion the Gold price downside.

Ethereum face value-accrual risks due to data availability roadmap

Ethereum declined 1%, trading just below $1,600 in the early Asian session on Thursday, as Binance Research's latest report suggests that the data availability roadmap has been hampering its value accrual.

Future-proofing portfolios: A playbook for tariff and recession risks

It does seem like we will be talking tariffs for a while. And if tariffs stay — in some shape or form — even after negotiations, we’ll likely be talking about recession too. Higher input costs, persistent inflation, and tighter monetary policy are already weighing on global growth.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.