- The United States Federal Reserve is set to trim interest rates for the first time in over four years.

- The European Central Bank delivered rate cuts but maintained its cautious approach this week.

- EUR/USD struggles to overcome 1.1100 with a mildly bullish stance.

The EUR/USD pair reverted early losses and finished just below the 1.1100 mark, little changed for the week. The pair bottomed at 1.1001 mid-week, as the US Dollar (USD) benefited from a risk-averse environment. It finally gave up its early gains on Thursday, following the European Central Bank (ECB) monetary policy announcement and United States (US) inflation figures.

ECB delivers cut but remains cautious

The ECB trimmed the deposit facility rate by 25 basis points (bps) to 3.5% as expected, but at the same time, it cut 60 bps from the marginal lending facility rate and the main refinancing operations one. Despite not directly mentioning it, sluggish economic growth in the Eurozone has been among the main reasons behind the decision.

ECB President Christine Lagarde somehow acknowledged the gloomy scenario as she noted that the recovery continues to face some headwinds, while policymakers also see upward risks for inflation. As a result, officials said they would keep policy rates sufficiently restrictive for as long as necessary to achieve such an aim. Finally, Lagarde repeated that the central bank will keep making decisions meeting by meeting and that their decisions will be data-dependent.

The ECB announcement was broadly in line with the market expectations, having a limited impact on the Euro (EUR). EUR/USD advanced as a result of the US discouraging data.

United States inflation disappoints

The US published the Consumer Price Index (CPI) on Wednesday. The US Bureau of Labor Statistics reported that the annual CPI rose 2.5% year-over-year (YoY) in August, easing from the previous 2.9%. Also, the core annual figure matched the July one and expectations by printing at 3.2%. However, the monthly core increase was higher than anticipated, hitting 0.3%.

On Thursday, the country released the Producer Price Index (PPI) for the same month, which rose by 1.7% from a year earlier, below the 1.8% expected and the previous 2.1%. On a monthly basis, the PPI was up by 0.2%, slightly above the 0.1% anticipated.

The figures erased hopes for a 50 basis points (bps) interest-rate cut from the Federal Reserve (Fed) when it meets next week. The Fed will likely deliver a modest 25 bps cut, which, by the way, was long ago priced in.

Federal Reserve’s path taking a turn

The US central bank is expected not only to trim interest rates but also to release a fresh Summary of Economic Projections (SEP), or dot plot. The document anticipates policymakers' views on where growth, inflation, and employment are foreseen in the upcoming years and their intentions on rate changes. The previous SEP was released in June and showed policymakers intended to cut rates by just 25 bps this year. Revisions to such a figure could be a game changer. The higher the intended level of cuts, the more likely the US Dollar will suffer.

Should the Fed surprise with a 50 bps in its September meeting, the USD is also at risk of suffering a steep setback.

The reasoning behind a wider cut is economic progress. Despite the US economy being in much better shape than that of its major rivals, there are still lingering concerns about a soft landing. Recession, at this time, could be too much of a word to use.

Nevertheless, and despite inflation still holding above the Fed’s 2% goal, the economy has been struggling long enough to continue in such a state. It is time for the US to regain its crown.

What else is on the docket

In the upcoming days, the Fed will not be the only central bank to take the stage. The Bank of England (BoE) and the Bank of Japan (BoJ) will also announce monetary policy decisions on Thursday and Friday, respectively, that could impact the USD through the market’s sentiment.

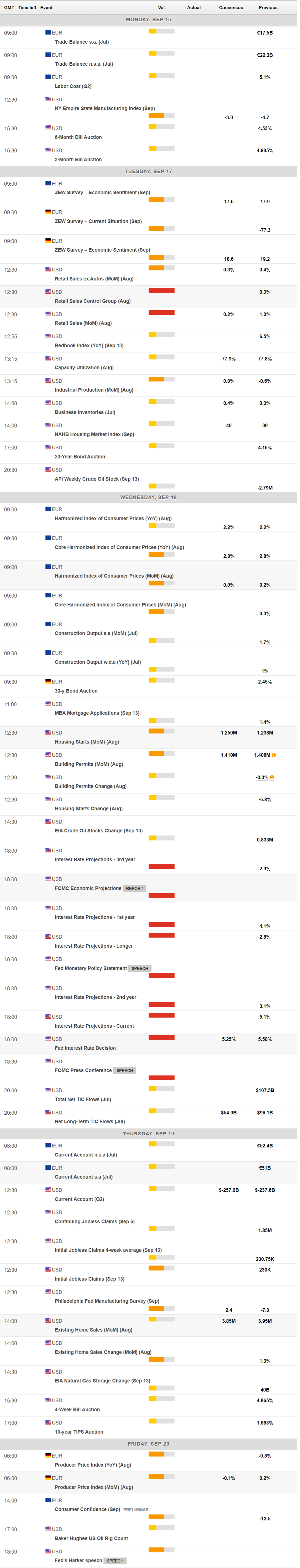

The US will release August Retail Sales ahead of the Federal Open Market Committee (FOMC) announcement, while the Eurozone will publish the final estimate of the August Harmonized Index of Consumer Prices (HICP) and September Consumer Confidence. As for Germany, the country will release the September ZEW Survey on Economic Sentiment and the August Producer Price Index (PPI).

EUR/USD technical outlook

Technically speaking, the risk for EUR/USD is skewed to the upside. In the weekly chart, the pair briefly fell below a flat 200 Simple Moving Average (SMA), but held above it for a fourth consecutive week. At the same time, the 20 and 100 SMAs keep heading north below the longer one, supporting the bullish case. Technical indicators, in the meantime, advance just modestly within positive levels, with limited directional strength.

The daily chart for the EUR/USD pair shows the pair struggles to extend gains beyond a still bullish 20 SMA. Meanwhile, a mildly bullish 100 SMA advances above a flat 200 SMA around the 1.0890 level. Overall, moving averages suggest buyers hold the grip. Technical indicators, however, reflect limited bullish conviction. The Momentum indicator ticked higher but remains below its 100 line, while the Relative Strength Index (RSI) indicator consolidates around 55.

EUR/USD needs to run past 1.1140 to regain its bullish poise, aiming then to test the 1.1200 threshold. The bullish case will strengthen should the pair establish above the latter. Below the 1.1000 level, on the other hand, the pair could experience a major setback, with not much in the way until the 1.0900 region.

(This story was corrected on September 13 at 17:46 GMT to say that the daily chart shows the EUR/USD struggles to extend gains beyond a still bullish 20 SMA, not 100 SMA.)

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Next release: Wed Sep 18, 2024 18:00

Frequency: Irregular

Consensus: 5.25%

Previous: 5.5%

Source: Federal Reserve

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Gold price jumps to fresh record high above $3,200 on US-China tariff war

Gold price sits at all-time highs of $3,219 in the Asian session on Friday. The weakening of the US Dollar and escalating trade war between the US and China provide some support to traditional safe haven asset Gold price amid increased dovish Fed expectations.

USD/JPY recovers losses in sync with US Dollar, retakes 143.50

USD/JPY is trimming losses to retest 143.50 in Asian trading hours on Friday, having tested levels under 143.00. The pair is tracking the US Dollar price action amid persistent trade jitters and US recession fears. The Fed-BoJ divergent policy expectations support the Japanese Yen, keep the weight intact on the pair.

AUD/USD consolidates weekly gains near 0.6250 despite trade tensions

AUD/USD consolidates weekly gains near 0.6250 in Asian trading on Friday. The pair capitalizes on sustained US Dollar weakness even as risk aversion remains at full steam on deepening US-China trade war. The White House confirmed on Thursdayt that the cumulative US tariffs on Chinese goods have risen to 145%.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin dived below $80,000 on Thursday despite US Consumer Price Index data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.