EUR/USD Weekly Forecast: King Dollar’s comeback on the table

- The US Federal Reserve and the European Central Bank pledged to keep hiking rates.

- Shocking United States Nonfarm Payrolls January report boosted the US Dollar on Friday.

- EUR/USD ended a second consecutive week unchanged, with bulls dominating the longer-term perspective.

The EUR/USD pair climbed to its highest since last April last Wednesday, hitting 1.1034 in the US Federal Reserve (Fed) monetary policy decision aftermath. Financial markets had no time to recover ahead of the European Central Bank (ECB) decision early on Thursday, which ended up sending the Euro down. Finally, on Friday, the United States published the January Nonfarm Payrolls report, resulting in EUR/USD finishing the week at around 1.0810.

Central banks failed to convince speculative interest

The US Fed raised the main interest rate by 25 basis points (bps) noting that the “ongoing” pace of rate hikes seems adequate. The Federal Open Market Committee (FOMC) statement showed that policymakers acknowledged price pressures eased, as the document reads “inflation has eased somewhat but remains elevated.”

However, the American central bank gave no signs of ending the tightening cycle. Furthermore, Chairman Jerome Powell said that “the job is not fully done,” adding that while recent developments were encouraging, they would need “substantially more evidence to be confident that inflation is on a sustained downward path.” During the press conference, Chair Powell finally admitted the disinflationary process had started.

The US Dollar seesawed between gains and losses but finally collapsed on Powell’s optimistic words suggesting an upcoming pause in monetary tightening.

The ECB delivered as expected, hiking its benchmark rates by 50 bps each. The central bank announced it would raise its interest rates by 50 bps in March too, anticipating market speculation. President Christine Lagarde, however, added that further decisions would be taken meeting-by-meeting and that they would be data-dependent. Financial markets understood it as a hint the tightening cycle is approaching its end, despite President Lagarde denying it, noting they still have “ground to cover.”

Central banks delivered their messages, but the market reacted to its own readings, grappling with hopes monetary tightening will end in the first semester of 2023. Stock markets edged higher as investors rushed into high-yielding assets to the detriment of the Greenback. Tech-related shares led the way north, finding additional support in better-than-anticipated Meta results.

Upbeat Nonfarm Payrolls and scary German data

The release of the US Nonfarm Payrolls report on Friday, shocked market participants. The country added 517K new jobs in January, while the December figure was upwardly revised to 260K. Also, the Unemployment Rate dropped to 3.4%, the lowest since May 1969, while Average Hourly Wages came in at 4.4% YoY vs 4.9% expected and 4.9% previous. Finally, the Labor Force Participation Rate rose to 62.4% from 62.3% previously, also beating market expectations.

As an immediate result, Fed swaps pared bets on a potential rate cut in 2023, and the US Dollar soared while Wall Street rotated south.

German macroeconomic data released these days should ring alarms. The preliminary estimate of the 2022 Q4 Gross Domestic Product (GDP) showed the economy contracted by 0.2% in the three months to December, while the annualized growth was 0.5%, missing the 1.1% anticipated by market players. Additionally, the country reported Retail Sales fell 5.3% MoM in December. An economic setback is still on the table, despite other figures reporting an improvement in the general situation.

S&P Global published the final estimates of its January PMIs, upwardly revising most of them. The recovery in business output is firmer in the services sector, as the German and EU indexes came in above 50.

Eurozone inflation-related figures were mixed. On the one hand, the EU Harmonized Index of Consumer Prices (HICP) rose by 8.5% YoY in January and according to preliminary estimates. However, Germany delayed the release of its own HICP for the same period, and the EU used an estimate for the country. On the other hand, the Eurozone Producer Price Index (PPI) rose by more than anticipated in December, up by 24.6% YoY.

Beyond the employment report, the US published the January ISM Manufacturing PMI, which fell by more than anticipated to 47.4. The ISM Services PMI, on the other hand, surged to 55.2, much better than the 50.4 expected.

The upcoming week will be a lighter one in terms of macroeconomic data. The EU will publish January Retail Sales on Monday, while Germany will finally unveil the preliminary estimate of the Harmonized Index of Consumer Prices (HICP) for the same month. Finally, next Friday, the US will disclose the preliminary estimate of the February Michigan Consumer Sentiment Index.

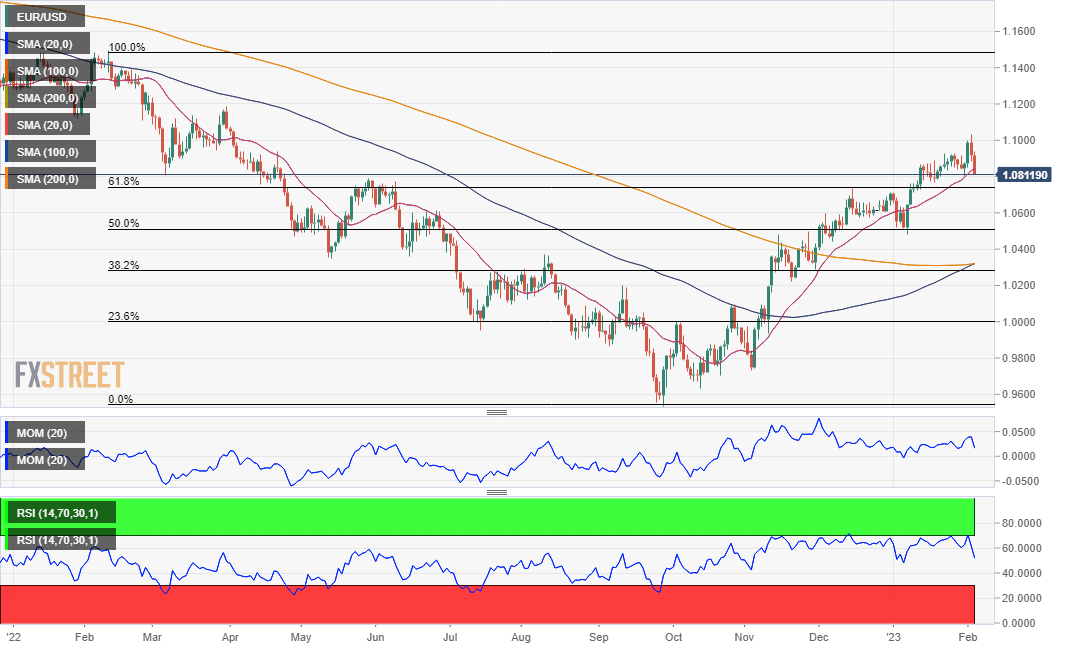

EUR/USD technical outlook

The EUR/USD pair is ending a second consecutive week unchanged. The overall long-term perspective continues to favor the upside, as the pair developed above a critical Fibonacci resistance level, the 61.8% retracement of its 2022 slump at 1.0745.

Technical readings in the weekly chart indicate the pair is overbought but are still short of suggesting upward exhaustion.

EUR/USD still develops far above a bullish 20 Simple Moving Average (SMA), which currently advances above the 38.2% retracement of the 2022 slide at 1.0280. At the same time, the 100 SMA extended its decline below the 200 SMA while above the current level, providing relevant dynamic resistance a handful of pips above the aforementioned multi-month high. Technical indicators remain around overbought levels, with the Momentum easing just modestly but the Relative Strength Index (RSI) heading marginally higher at around 67.

According to the daily chart, EUR/USD could extend its latest slide, although further confirmations are needed. The pair is currently battling with a bullish 20 SMA, so far holding above it. At the same time, the 100 SMA is about to cross above the 200 SMA, both in the 1.0310/20 price zone. Technical indicators, however, extended their declines within positive levels and are nearing their midlines.

The pair needs to recover the 1.0900 figure to be able to extend gains towards the weekly high at 1.1034. Beyond the latter, the 1.1100 price zone comes as the next potential target. On the other hand, a daily close below 1.0745 will discourage buyers and could trigger a downward corrective extension, initially towards 1.0640 and later to 1.0515, the 50% retracement of the 2022 slump.

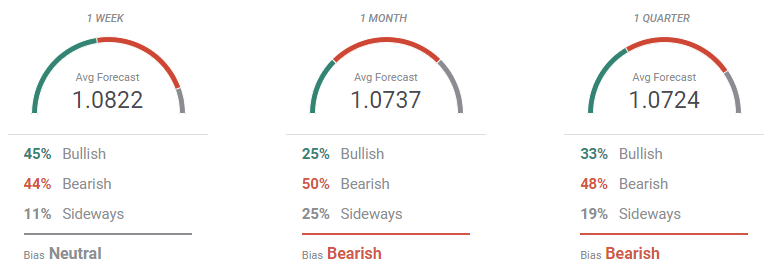

EUR/USD sentiment poll

The FXStreet Forecast Poll suggests the EUR/USD pair will extend its consolidative phase next week. The number of experts betting for higher targets pretty much equals that of those betting for a slide. On average, the pair is seen at 1.0822. On the longer-term perspectives, bears are a majority, although the average target keeps raising, a sign of mounting buying interest. In the monthly and quarterly views, the pair is seen on average, holding above 1.0700.

The Overview chart has suffered quite a change as most big banks updated their views. The weekly moving average has lost directional strength but holds at its highest since last June. The monthly and weekly indicators, however, have ticked north, as the largest accumulation of potential targets comes above the current level. For the monthly view, the 1.1000 area seems critical, while the 1.1200/1.1400 area comes at sight by the end of the quarter.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.