EUR/USD Weekly Forecast: Eurozone, US Q3 Gross Domestic Product to set tone

- The United States, Germany and the Eurozone will release preliminary Q3 GDP estimates.

- The US will also publish employment data ahead of the Nonfarm Payrolls report on Friday.

- EUR/USD could retest the year low at 1.0600 in the upcoming days.

The EUR/USD pair fell to an almost four-month low of 1.0760 on Wednesday but managed to recover the 1.0800 mark to set a handful of pips above the level at the end of the week. The US Dollar maintained its positive momentum throughout the first half of the week, led by a dismal market mood, but later lost some ground amid renewed demand for high-yielding stocks following the release of encouraging US macroeconomic data.

The political picture takes its toll

The run to safety can be explained by persistent geopolitical tensions in the Middle East and uncertainty surrounding the looming United States (US) presidential election.

Israel continued military operations in Gaza and Lebanon in its conflict with Hamas and Hezbollah. Attempts to reach a ceasefire, even with the intervention of US Secretary of State Antony Blinkenhave so far been unsuccessful.

Meanwhile, the US election will be held in a little over a week and polls show a tight run between the Democratic candidate, Vice President Kamala Harris, and the Republican one, former President Donald Trump. Market concerns revolve around Trump taking power and erasing at the stroke of a pen all the Federal Reserve’s (Fed) hard work to tame inflation without generating a recession.

European economic trouble extends into Q4

The macroeconomic calendar had little relevance to offer this week, albeit Eurozone figures indicated that the economic setback continued at the beginning of the last quarter of the year.

The Hamburg Commercial Bank (HCOB) reported on Thursday that the German Flash Composite Purchasing Manager Index (PMI) ticked up from September’s seven-month low of 47.5 to 48.4 in October. Manufacturing output in the same period improved to 42.6 from 40.6, while the services index rose from 50.6 to 51.4. Nevertheless, the official report noted that “conditions continued to worsen across Germany’s private sector at the start of the fourth quarter, with businesses reporting further decreases in output and employment amid a backdrop of weak underlying demand.”

In the same period, the Eurozone HCOB Composite PMI ticked marginally higher, printing at 49.7. Manufacturing output improved by more than anticipated, with the index hitting 45.9, still indicating contraction. Additionally, the Services PMI resulted at 51.2, worse than the previous 51.4 and the expected 51.6. Finally, it is worth adding that the employment sub-index deteriorated for its fifth consecutive month and stands at 49.1.

European Central Bank officials hint at more rate cuts in the docket

The International Monetary Fund (IMF) held its annual meeting with the World Bank Group (WBG) and multiple central banks’ officials hit the wires throughout the week. European Central Bank (ECB) policymakers attending the event aligned with the previous week’s decision to trim interest rates and kept shifting the focus from inflation to growth.

ECB President Christine Lagarde made several references to weak PMIs during the press conference following the monetary policy decision, and officials followed her lead. The odds for a 50 basis points (bps) rate cut in December have increased, albeit not sufficiently. Should data continue to show easing inflationary pressures and tepid growth, the odds for such a move will likely increase.

United States growth continues

Data coming from the US was quite encouraging as Initial Jobless Claims rose by 227K in the week ended October 18, much better than the 242K expected. Additionally, the flash US S&P Global October Composite PMI rose to 54.3 after printing at 54.0 final in September. Manufacturing output improved to 47.8 from 47.3 in September, beating the anticipated 47.5. The services index printed at 55.3, up from 55.2 in the previous month and above the 55 forecast.

By the end of the week, the country reported that Durable Goods Orders slid 0.8% on a monthly basis in September, slightly better than the 1% slump expected. Non-defense Capital Goods Orders ex Aircraft in the same period were up 0.5%, better than the 0.1% advance expected. Finally, the October Michigan Consumer Sentiment Index was confirmed at 70.5, better than the 68.9 previously estimated.

Meanwhile, Fed officials flooded the wires but offered no fresh clues on monetary policy. Generally speaking, officials are confident that the economy will dodge a recession and that inflation will continue to ease as they deliver modest rate cuts towards a more neutral interest rate.

Growth in the eye of the storm

The upcoming week will be filled with first-tier releases that could trigger relevant movements in the EUR/USD pair.

Major economies will release the first estimates of their Q3 Gross Domestic Product (GDP) data. Germany will do so on Wednesday, along with the preliminary estimates of the October Harmonized Index of Consumer Prices (HICP). The US and the Eurozone will release their GDP figures later that same day, while the US will also publish the ADP report on private job creation.

The Eurozone will publish the preliminary October HICP estimates on Thursday, while the US will unveil the Fed’s favorite inflation gauge, the September Personal Consumption Expenditures (PCE) Price Index.

Finally, on Friday the US will release the October Nonfarm Payrolls (NFP) report and the October ISM Manufacturing PMI.

EUR/USD technical outlook

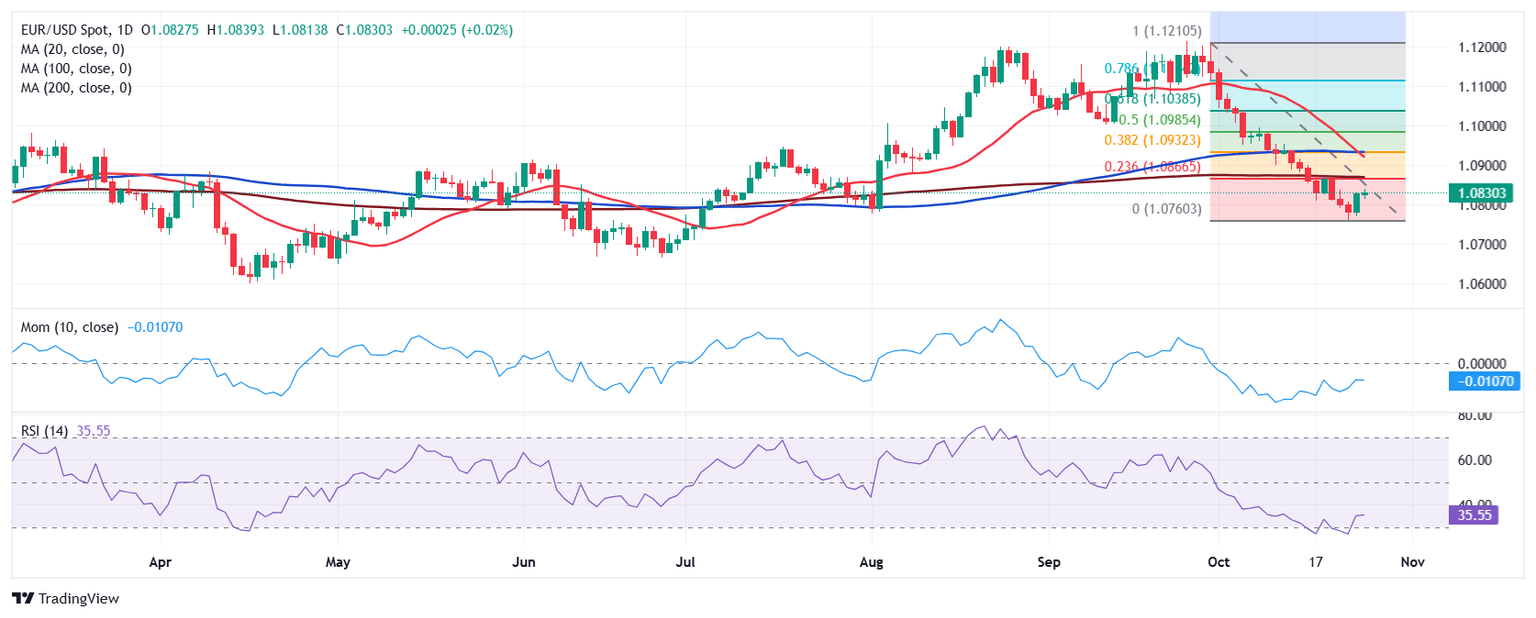

The EUR/USD pair is down for a fourth consecutive week, trading at around 1.0840 as the US session comes to an end. From a technical perspective, the pair is poised to extend its slide in the weekly chart, albeit the downward momentum has receded. Still, EUR/USD has held below its 20 and 200 Simple Moving Averages (SMAs) while battling at around a directionless 100 SMA. In the meantime, technical indicators remain below their midlines, although the Momentum indicator turned flat within neutral levels. As per the Relative Strength Index (RSI) indicator, it maintains its bearish slope at around 43, in line with lower lows ahead.

The daily chart shows EUR/USD corrected oversold conditions, with the advance losing strength. The pair stalled below an immediate resistance level at 1.0865, the 23.6% Fibonacci retracement of the daily slump between 1.1208 and 1.0760. A more relevant one is the 38.2% retracement lying at 1.0930.

Meanwhile, technical indicators have turned flat well below their midlines, reflecting the absence of substantial buying interest. At the same time, a firmly bearish 20 SMA crossed below a flat 100 SMA well above the current level, usually a sign of sellers’ dominance. Finally, the 200 SMA has turned flat, converging with the aforementioned 23.6% Fibonacci retracement and reinforcing it.

The weekly low at 1.0760 provides near-term support en route to the 1.0700 threshold. A break below the latter exposes the year low at 1.0600, with additional losses unlikely in the upcoming days. On the contrary, buying interest could push the pair towards the 1.0930 Fibonacci resistance, with additional gains above it exposing the 1.1000 mark.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Nov 01, 2024 12:30

Frequency: Monthly

Consensus: 140K

Previous: 254K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Economic Indicator

Gross Domestic Product s.a. (YoY)

The Gross Domestic Product (GDP), released by the Eurostat on a quarterly basis, is a measure of the total value of all goods and services produced in the Eurozone during a certain period of time. The GDP and its main aggregates are among the most significant indicators of the state of any economy. The YoY reading compares economic activity in the reference quarter compared with the same quarter a year earlier. Generally speaking, a rise in this indicator is bullish for the Euro (EUR), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 30, 2024 10:00 (Prel)

Frequency: Quarterly

Consensus: 0.8%

Previous: 0.6%

Source: Eurostat

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.