EUR/USD Weekly Forecast: EU encouraging inflation not enough to save the EUR

- United States employment-related data takes centre stage ahead of the NFP release.

- Inflation data in the Eurozone was a breath of fresh air in anotherwise concerning scenario.

- EUR/USD surged towards 1.0600, but selling interest still leads.

The EUR/USD pair ended a three-week losing streak, recovering towards 1.0600 before finally finding sellers. The US Dollar (USD) gapped lower at the weekly opening after reaching fresh 2024 highs against its European rival, with EUR/USD bottoming at 1.0332 on November 22.

Trump, tariffs and inflation

The week started with headlines indicating that United States (US) president-elect Donald Trump picked billionaire Scott Bessent to serve as the next secretary of the Department of the Treasury. “Unlike in past Administrations, we will ensure that no Americans will be left behind in the next and Greatest Economic Boom, and Scott will lead that effort for me and the Great People of the United States of America,” Trump noted.

Bessent resulted in a breath of fresh air, as in a recent interview he supported a more gradual approach to tariffs. Nevertheless, Trump brought back concerns to the table mid-week, as he threatened to impose a 25% tariff on Mexican and Canadian goods and services and up to 60% on Chinese imports.

Tariffs pose a threat to inflation in times when the Federal Reserve (Fed) is close to claiming victory on price pressures and decided to shift its tightening monetary policy cycle into an easing one.

Meanwhile, investors welcomed headlines indicating a 60-day cease-fire agreement between Israel and Hezbollah. Israel Prime Minister Benjamin Netanyahu declared that the country's government will consider the agreement previously approved by the Israeli military cabinet. Netanyahu, however, added any attempts by Hezbollah to rearm would be considered a violation of the treaty, in which case Israel would respond.

European Central Bank concerned about growth

Across the pond, a more hawkish stance from European Central Bank (ECB) Executive Board member Isabel Schnabel underpinned the Euro in the near term. Schnabel said the ECB is getting closer to neutral territory, estimating the neutral rate at 2% to 3%. Furthermore, she warned about growth risks related to fresh US tariffs under Trump’s administration, urging her colleagues to take a gradual interest rate cut path.

Also, the central bank released the annual Financial Stability Review report, which noted that the Eurozone could face a debt crisis if it did not boost growth, lower public debt and fix policy uncertainty.

Other than that, European inflation data was pretty encouraging. Germany reported that the Harmonized Index of Consumer Prices (HICP) rose 2.4% in the year to November, below the 2.6% anticipated and according to preliminary estimates. The monthly figure came in at -0.7%, much lower than the 0.4% posted in October. The Eurozone HICP rose 2.3% year-over-year (YoY) and slid 0.3% in the month. Finally, the core HICP rose 2.8% YoY in November, slightly higher than the 2.7% increase from October, albeit in line with the market’s forecast.

It is worth adding that Consumer Confidence in the EU deteriorated to -13.7 in November from -12.4 in the previous month, albeit the Economic Sentiment Indicator improved to 95.8 in the same month from 95.7 previously.

The US published on Wednesday the second estimate of the Q3 Gross Domestic Product (GDP), which was confirmed at 2.8% as previously calculated . Initial Jobless Claims for the week ended November 22 improved to 213K from the previous 215K, also beating expectations of 217K.

Durable Goods Orders, in the meantime, rose a modest 0.2% in October, worse than the 0.5% advance anticipated but better than the -0.4% posted in September. Finally, the October Personal Consumption Expenditures (PCE) Price Index rose 0.2% MoM and 2.3% YoY as expected. The core annual figure increased by 2.8% YoY, also meeting the market’s forecast.

Financial markets went into hibernation on Thursday, as US markets closed amid the Thanksgiving holiday, which also meant an early close on Friday.

US employment under scrutiny

The upcoming week will bring multiple relevant macroeconomic figures, starting on Monday with the US November ISM Manufacturing Purchasing Manager Index (PMI) and the S&P Global Manufacturing PMIs from both economies. The S&P Services and Composite PMIs will be out on Wednesday when the EU releases the October Producer Price Index (PPI) and the US will publish the November ADP Employment Change report and the official ISM Services PMI for the same month.

The Eurozone will publish Retail Sales on Thursday, while the week will end with the release of the US Nonfarm Payrolls report and the preliminary estimate of the December Michigan Consumer Sentiment Index.

US employment figures will gather most of the attention, as a tight labor market was among the main reasons inflation took so long to recede. On the one hand, the Fed seeks to keep unemployment under control, yet on the other, it needs to address the weakness in the sector to tackle price pressures.

EUR/USD technical outlook

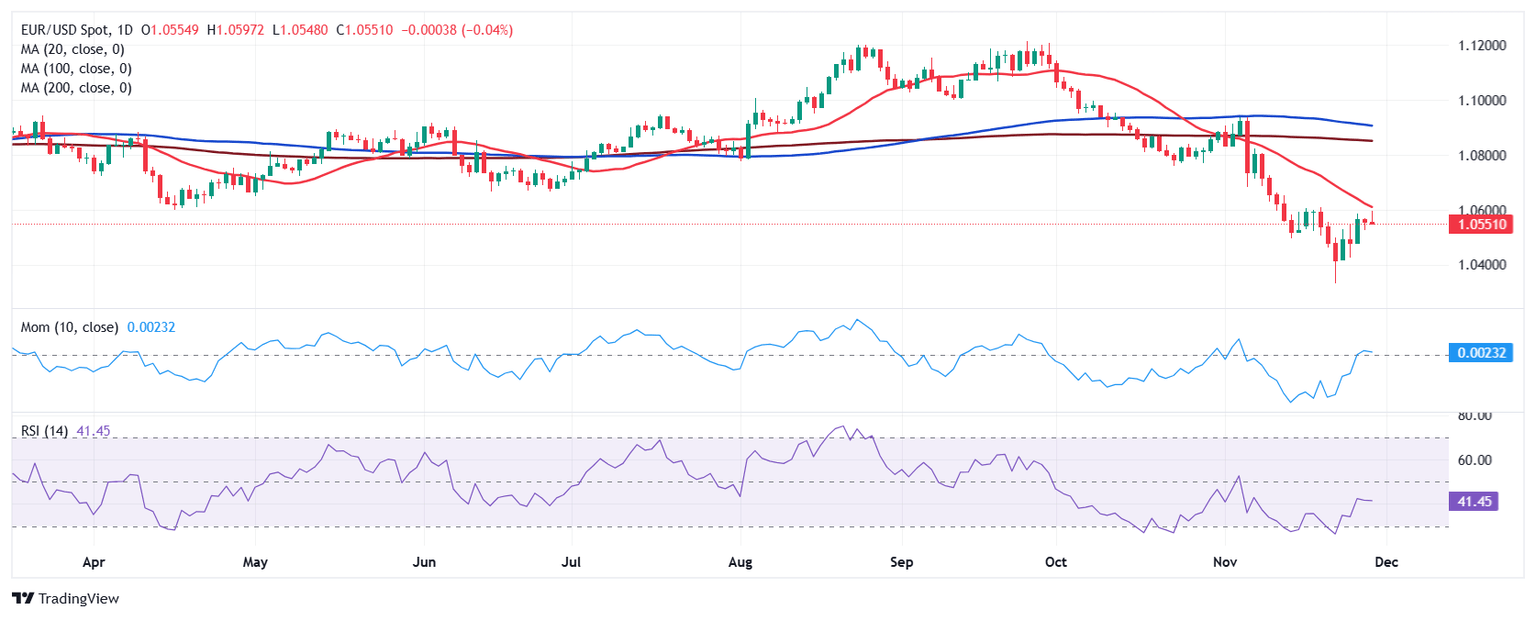

The EUR/USD pair hovers around 1.0550 and the weekly chart shows it posted a higher low yet held below the previous weekly top at 1.0609, suggesting unconvinced buyers. The same chart shows technical indicators are bouncing just modestly from oversold readings, lacking enough upward strength to support another leg north. Finally, the pair keeps developing below all its moving averages, with the 20 Simple Moving Average (SMA) gaining downward traction between the 100 and 200 SMAs. All in one, it seems profit-taking helped EUR/USD these last few days, yet the bearish risk remains in place.

According to the daily chart, the EUR/USD corrective advance may well be over. The Momentum indicator keeps heading higher, although below its midline, while the Relative Strength Index (RSI) indicator has lost directional strength and turned flat at around 41. Even further, the intraday peak was set just below a firmly bearish 20 SMA, which keeps sliding below marginally bearish 100 and 200 SMAs.

A slide below the 1.0500 threshold will open the door for another leg south. The next support level comes at 1.0440, the October 2023 low, en route to 1.0400. A break below the latter should be followed by a retest of the year low in the 1.0330 price zone.

Beyond the 1.0610 price zone, EUR/USD could extend its corrective advance towards 1.0700 without hurting the long-term bearish perspective. Gains beyond the latter, however, will likely spook sellers and encourage buyers, pushing the pair towards the 1.0780/1.0800 region.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Dec 06, 2024 13:30

Frequency: Monthly

Consensus: 183K

Previous: 12K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.