EUR/USD Weekly Forecast: Inflation updates could shake financial boards

- United States' dismal macroeconomic figures brought back recession-related concerns.

- Tepid growth figures spell global trouble and weigh on the market’s optimism.

- EUR/USD maintains its bullish stance, but the positive momentum fades.

The EUR/USD pair trades at around 1.0910 on Friday, up for a third consecutive week. Financial markets put banking concerns aside amid the lack of fresh headlines on the matter, which anyway remains latent in the background. Instead, the focus is on economic growth and, once again, speculation on whether central banks have gone too far with monetary tightening or if they have room to squeeze it a bit more.

There have been no big comments from policymakers, but macroeconomic data has triggered some alarms as the economic setback continues among major economies. The final readings of the March S&P Global Manufacturing PMIs were confirmed below 50, the line that separates expansion from contraction. European figures were upwardly revised, with the German index confirmed at 44.7 and the Eurozone one at 47.3. The United States one, on the other hand, was downwardly revised to 49.2. At the same time, the Services PMIs remained within expansion territory in the EU and the US but were downwardly revised.

Investors were quite disappointed with United States macroeconomic figures, which suggested the economy is heading into a recession. The official ISM PMIs declined in March when compared to February, and as a result were worse than anticipated.

Good news or bad news?

Worse, employment-related figures showed that the labor sector has started loosening, which may be good news for the US Federal Reserve (Fed), as it means easing inflationary pressure from that side. Yet at the same time, it means higher chances of an economic slowdown while falling short of affecting the current central banks’ dovish stance.

JOLTS Job Openings fell below 10 million in February for the first time in almost two years, as the number of job openings declined in most sectors. Furthermore, the ADP survey showed the private sector added just 145K new jobs in March, missing expectations. Finally, the March Nonfarm Payrolls report posted a headline of 236K, slightly below the 240K expected. However, the participation rate increased to 62.6% while the unemployment rate declined by 3.5%, further signaling a loosening market. Wage growth was below expected, confirming easing inflationary pressures.

Inflation coming up next

Next Wednesday, the US will publish the March Consumer Price Index (CPI), foreseen at 6.1% YoY, higher than the previous 6%. The core reading is expected to remain steady at 5.5%. On Thursday, Germany will publish the Harmonized Index of Consumer Prices (HICP) for the same month, previously estimated at 7.8% YoY.

Additionally, the Eurozone and the United States will publish March Retail Sales, while the latter will also release the Producer Price Index (PPI) for the same month and the preliminary estimate of the April Michigan Consumer Sentiment Index.

EUR/USD technical outlook

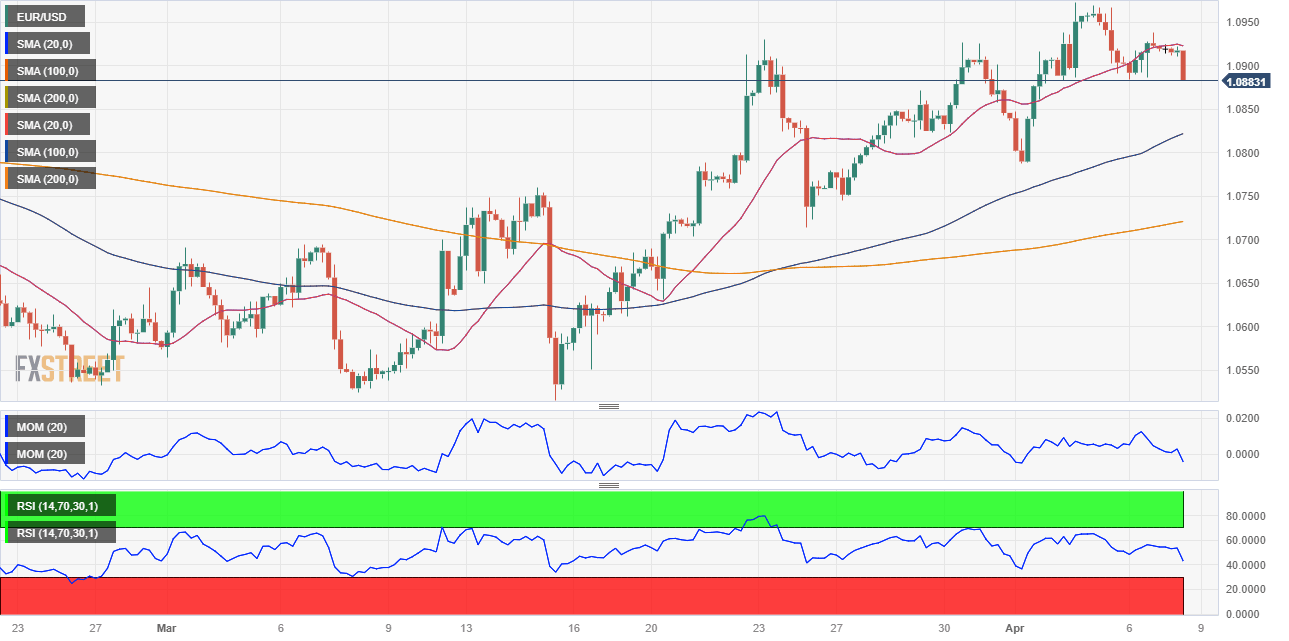

The weekly chart for the EUR/USD pair shows it remains on the bullish side, although the bullish potential has receded. The Momentum indicator is flat, just above its 100 level, although the Relative Strength Index (RSI) indicator maintains its upward slope near overbought readings. At the same time, a bearish 100 Simple Moving Average (SMA) caps the upside at around the mentioned weekly high, while a firmly bullish 20 SMA leads the way higher by heading firmly up far below the current level.

The technical picture is similar on the daily chart. EUR/USD holds well above bullish moving averages, with the 20 SMA providing dynamic support at around 1.0800. Technical indicators, however, ease from fresh multi-week tops achieved mid-week, but with limited downward strength and well above their midlines.

The EUR/USD pair now faces resistance at around the 1.1000 mark, with gains beyond it exposing the 1.1060 area initially en route to the 1.1120/40 price zone. Below the 1.0800 threshold, the pair could extend its slide towards 1.0745, the 61.8% retracement of the 2022 yearly decline.

EUR/USD Sentiment poll

The FXStreet Forecast Poll suggest EUR/USD will extend its consolidative phase but end up breaking higher. The weekly perspective is neutral, while bears dominate the monthly view. Nevertheless, the pair is seen averaging 1.0833, barely below the current price zone. Bulls take over the quarterly estimate, with 42% of the polled experts looking for an advance and only 21% expecting declines. EUR/USD is then expected to trade around the 1.1000 threshold.

The Overview chart is aligned with the bullish case as moving averages extended their advances, although with uneven strength. What seems more notorious is that in the quarterly perspective, the most potential targets accumulate between 1.0900 and 1.1300, while higher lows are now expected in all the time frames under study.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.