EUR/USD Weekly Forecast: Inflation figures to confirm or deny Fed’s and ECB’s stances

- The United States Federal Reserve and the European Central Bank delivered but failed to impress.

- Policymakers repeated the banking systems are sound and resilient, but speculative interest needs to be convinced.

- EUR/USD consolidative phase near year highs hints at higher highs ahead.

The EUR/USD pair ends the week with modest losses around the 1.1000 figure after flirting with the 1.1100 level for a second consecutive week. Lots of water ran under the bridge this week, and generally speaking, the US Dollar remained on the back foot, gaining traction on Friday, while the Euro was the one single major currency that could not take advantage of it.

Conservative Federal Reserve hits the US Dollar

The Greenback fell the most on Wednesday following the United States Federal Reserve (Fed) monetary policy announcement. As widely anticipated, the Fed hiked rates by 25 basis points (bps) to 5-5.25% and opened the door for a pause in tightening, as it dropped from the accompanying statement the wording saying “the Committee anticipates that some additional policy firming may be appropriate.”

The central bank shifted to a data-dependent approach to determine future rate decisions, noting policymakers are prepared to adjust the stance of monetary policy as appropriate if risks emerge.

Chairman Jerome Powell’s message, however, leaned to hawkish. He kick-started his press conference by saying that the Fed is focused on achieving maximum employment and an inflation rate of 2%. Additionally, he noted that a rate cut was not on the table, although market participants rushed to price in an on-hold stance for June and July, and a potential rate cut in September.

About the labor market, Powell was quite conservative, saying that it remains too tight, with some modest signs of weakness emerging. He was optimistic it could continue softening and help to avoid a recession. A soft landing is not off the table.

Finally, Powell noted that the banking system is sound and resilient, although financial markets had difficulty believing him.

On Thursday, rumors that Western Alliance Bank was considering a potential sale pushed its stock down over 50%, although bank authorities later denied it. Also, First Horizon stock plummeted 40% after agreeing to terminate the TD Bank merger, while another regional bank, PacWest Bank, confirmed on Thursday it’s looking for a financial lifeline. Bank stocks recovered some ground on Friday, as concerns temporarily cooled down.

Hawkish Christine Lagarde failed to boost the Euro

The European Central Bank (ECB) monetary policy announcement took place on Thursday, and also in line with the market expectations, the central bank delivered a 25 bps rates hike. President Christine Lagarde said that some policymakers preferred a 50 bps movement, but it is clear that the banking system vulnerabilities made them opt-out of the most conservative stance. She also said that the European banking system was sound and resilient and offered some hawkish comments that fell short of boosting the Euro.

The ECB statement showed that “underlying price pressures remain strong” and that “the past rate increases are being transmitted forcefully to euro area financing and monetary conditions, while the lags and strength of transmission to the real economy remain uncertain.”

Lagarde noted that an on-hold stance was never on the table and that, given that inflation remains too high, there’s much to be done. By the end of the event, market players rushed to discount at least two or three more rate hikes.

Employment and profit-taking help US Dollar in the near term

Data-wise, it is worth mentioning that the preliminary estimate of the Eurozone (EU) April inflation rose by more than anticipated. The Harmonized Index of Consumer Prices (HICP) increased at an annualized pace of 7%, higher than the previous 6.9%. Also, Retail Sales contracted sharply in Germany and the EU in March, down 2.4%% and 1.2%, respectively.

Finally, on Friday, the US published the April Nonfarm Payrolls report, further boosting the Greenback and pushing EUR/USD below 1.1000. The country added 253K new job positions, much better than the 179K expected. Additionally, the Unemployment Rate contracted to 3.4%, while the Labor Force Participation Rate increased to 62.6%. Finally, Average Hourly Earnings were up 0.5% MoM and 4.4% YoY, above market expectations.

The US Dollar ran with the news, on the back of profit-taking on Euro-longs and higher US Treasury yields. However, the positive tone of equities and perspectives of central banks’ future actions limited gains to the near term.

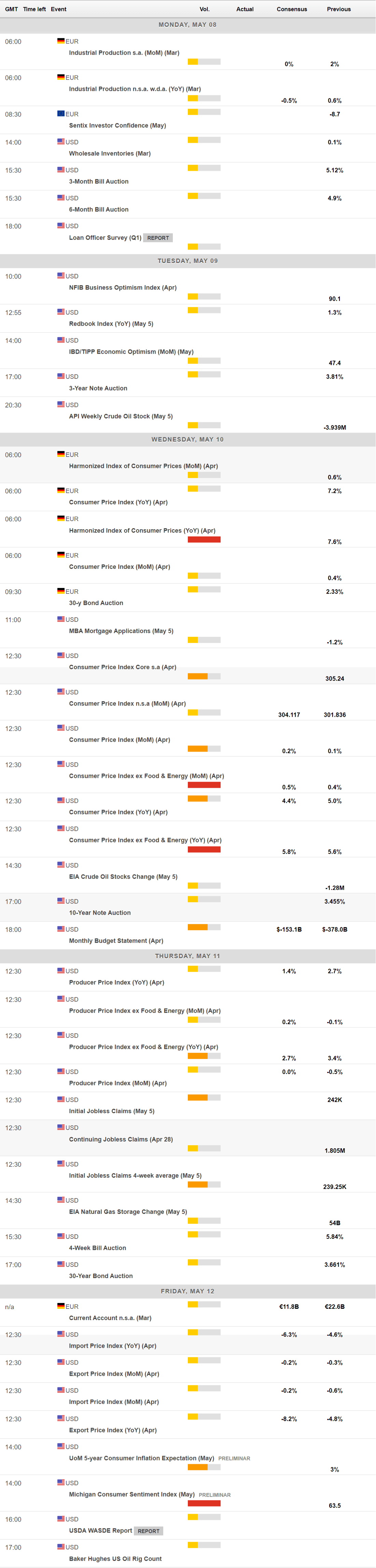

The upcoming week will feature first-tier inflation figures. Germany will release the final estimate of its April Harmonized Index of Consumer Prices (HICP), previously estimated at 7.6% YoY. On Wednesday, the United States will publish the April Consumer Price Index (CPI), foreseen up by 4.4%, easing from 5% in March. The core CPI, on the contrary, is expected at 5.8% in the same period, increasing from the previous 5.6%. The US will also unveil the April Producer Price Index (PPI), foreseen at 1.4% YoY. Finally, on Friday, the country will release the preliminary estimate of the May Michigan Consumer Sentiment Index.

EUR/USD technical outlook

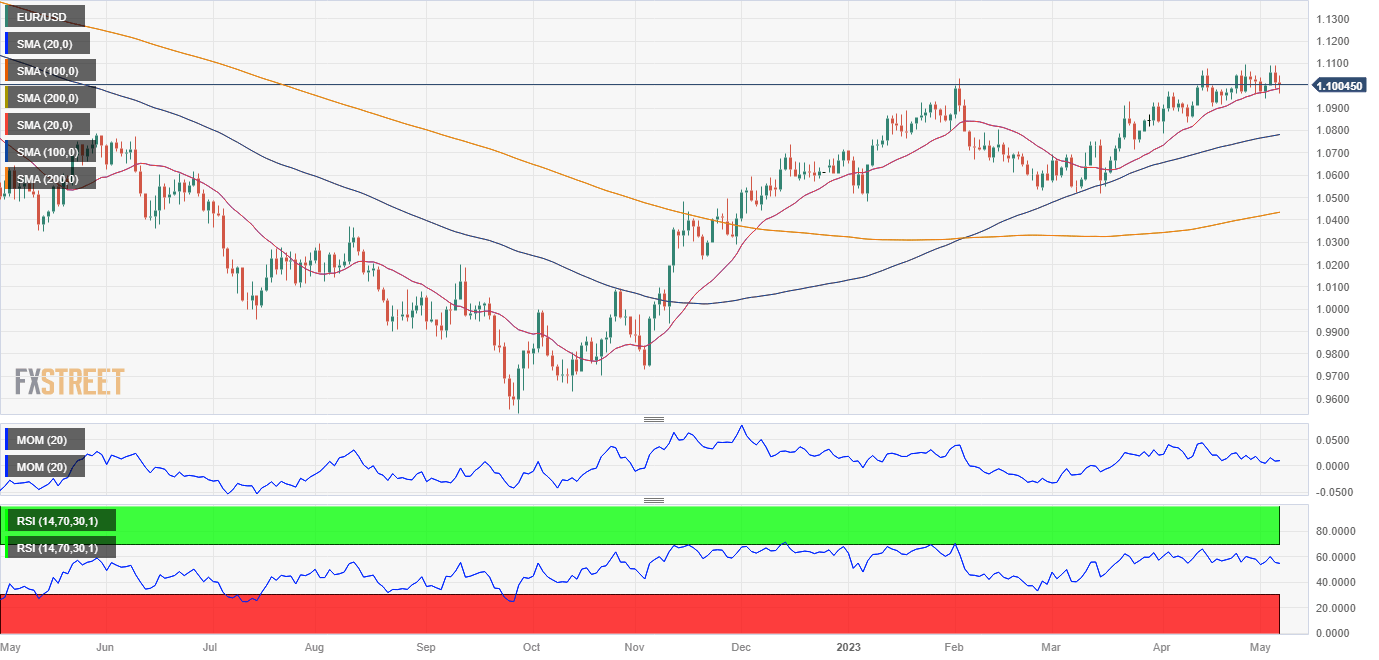

The EUR/USD pair is little changed for a third consecutive week, with the consolidation taking place at one-year highs. The weekly chart shows the pair has continued to lose momentum, but at the same time, chances of a new-born bearish trend remain out of the picture. The pair stays above a bearish 100 Simple Moving Average (SMA), currently around 1.0910, while the 20 SMA keeps heading firmly north, well below it. At the same time, the Momentum indicator eases towards its midline, currently within neutral levels, while the Relative Strength Index (RSI) indicator remains near overbought readings with a modest downward slope.

Technical readings in the daily chart offer a neutral stance. The pair is struggling around its 20 SMA, which maintains its bullish slope above also bullish longer ones. Meanwhile, the Momentum indicator is modestly recovering from around its 100 level, still lacking enough strength to confirm a firmer recovery. Finally, the RSI indicator eases within positive levels, reflecting the latest decline rather than hinting at a bearish continuation.

The pair can find support at 1.0940, while below the latter, the next relevant level to watch is 1.0830. Additional losses seem unlikely, although the next support level is 1.0745, the 61.8% Fibonacci retracement of the 2022 yearly slump.

Resistance can be found in the 1.1040 area ahead of the 1.1100 figure. Once the latter is cleared, 1.1160 comes next.

EUR/USD Sentiment Poll

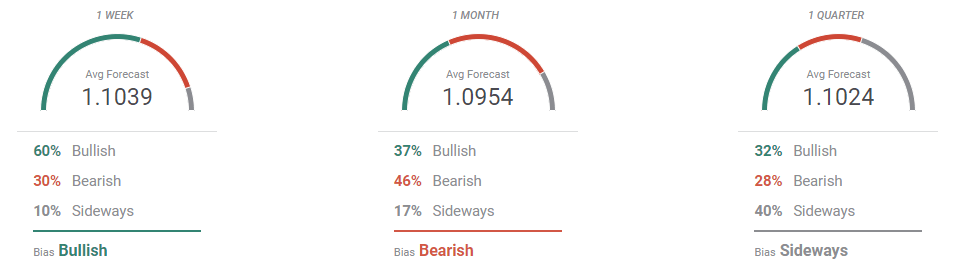

According to the FXStreet Forecast Poll, the EUR/USD pair will likely extend its consolidative phase next week, although most polled experts aim for slightly higher levels. The pair is likely to remain within the 1.0900/1.1100 area, with just one outsider betting for 1.1200. Overall, bulls dominate the scene as 60% of the polled experts are looking for higher levels in the near term. The outlook turns bearish in the monthly perspective, with buyers declining to 37% and bears surging to 46%. Still, the pair is seen on average at 1.0954. Finally, the pair is seen neutral in the quarterly view and averaging 1.1024.

The Overview chart shows that buyers have paused, but did not yet give up. The moving averages are neutral in the three time-frame under study, extending their consolidative stance. At the same time, it shows that losses below the 1.0800 threshold are hardly seen, while chances of an advance towards 1.1200 and beyond continue to increase.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.