EUR/USD Weekly Forecast: Inflation and growth updates to bring markets back to life

- The United States Consumer Price Index, scheduled for next week, could set the tone for the rest of the month.

- Market participants are not buying worldwide policymakers’ hawkish messages.

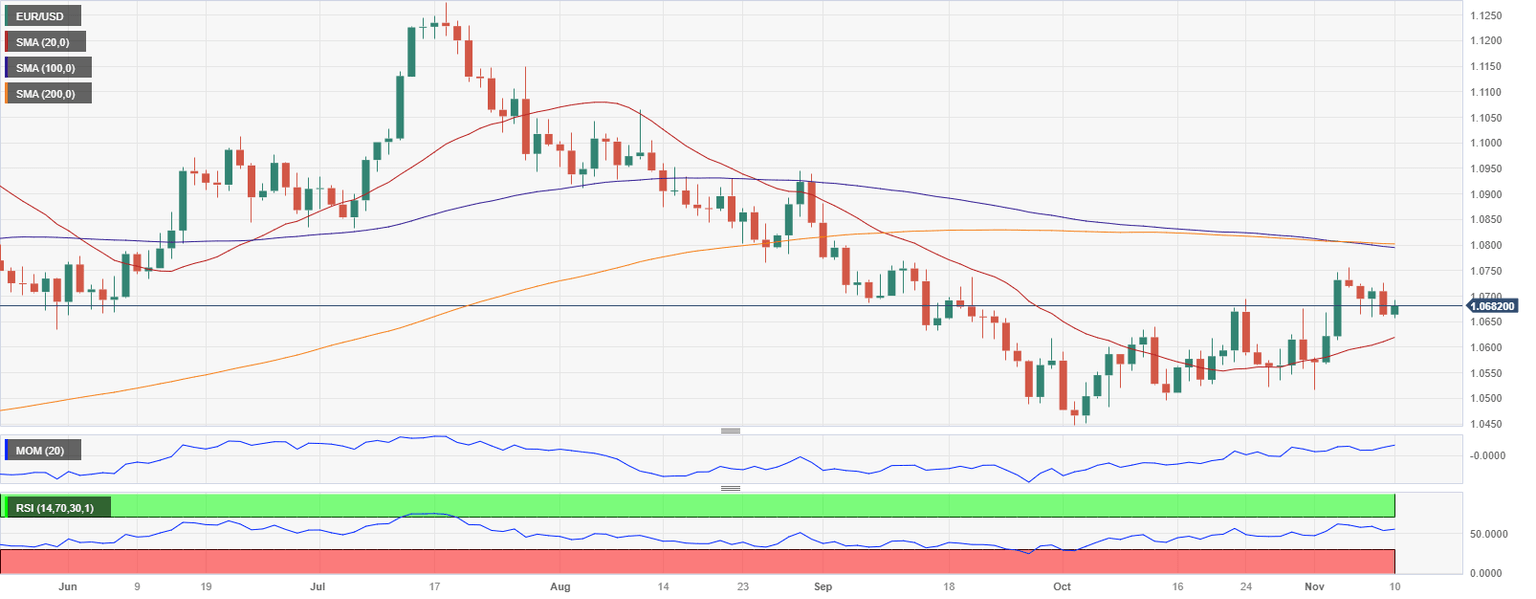

- The EUR/USD pair's long-term perspective shows bears retaining control.

An uneventful week ended with EUR/USD trading marginally lower in the 1.0660 price zone. The pair repeatedly failed to reconquer the 1.0700 threshold as spikes beyond the level quickly attracted sellers, but demand for the US Dollar remained subdued throughout the week.

Central banks spur cautious optimism

Market participants stayed confident central banks are pretty much done with rate hikes despite policymakers warning rate hikes remain on the docket. Speaking on Thursday at the International Monetary Fund (IMF), Federal Reserve (Fed) Chairman Jerome Powell said officials will not hesitate to hike benchmark rates if financial conditions require it.

Across the pond, European Central Bank (ECB) President Christine Lagarde has repeatedly made similar comments, indicating that interest rate hikes remain on the table until price pressures recede toward the central bank’s goal.

But it’s not just the Fed or the ECB. Most worldwide central banks have a couple of consistent lines. One is that they are not done with tightening, and the other is that rates will remain higher for longer, with both aimed to cool down speculation of rate cuts for 2024. Speculative interest, however, does not fully believe so. Investors are betting cuts will come in the second half of 2024 and that hikes are already out of the table amid the risks to economic growth.

Tepid economic progress

Policymakers have good reasons to keep an eye on growth. The United States (US) economy has indeed proven resilient, but it’s not out of the woods yet. On the other hand, the European one has yet to confirm a bottom. The latest S&P Global Producer Manager Indexes (PMIs) demonstrated that business activity stood in contraction territory at the beginning of the last quarter of the year. Services output was confirmed at 48.2 for Germany and 46.5 for the Euro Zone. The Composite PMI for the latter printed at 46.5 in October, well below the 50 mark that indicates expansion.

Furthermore, the latest Gross Domestic Product (GDP) update showed growth was weaker than expected in Q3, declining 0.1% from the previous quarter, while the annualised rate slowed sharply.

On a positive note, the EU reported the Producer Price Index (PPI) fell 12.4% YoY in September, while Germany confirmed the Harmonized Index of Consumer Prices at 3% YoY in October.

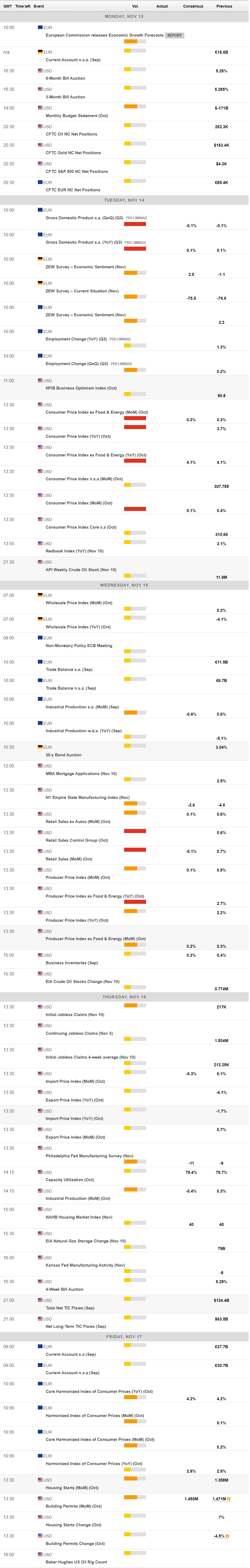

Answers coming next week

Market participants could have clearer clues on central banks’ future actions next week, as the macroeconomic calendar includes plenty of first-tier events. The EU will release the second estimate of Q3 GDP, expected to give a reading at -0.1% QoQ on Tuesday, while Germany will unveil the November ZEW Survey on Economic Sentiment. Later in the day, the US will publish the October Consumer Price Index (CPI). The inflation rate is seen at 3.3% YoY, down from the previous 3.7%, while core annual inflation is expected to be confirmed at 4.1%, slightly above the September reading of 4%.

The US will release October Retail Sales and the Producer Price Index for the same month on Wednesday. Finally on Friday, the EU will unveil the final estimate of the October HICP.

Softer-than-anticipated inflation-related figures should confirm the market’s belief that central banks are done with rate hikes, boosting optimism and, therefore, demand for high-yielding assets. On the contrary, investors could fear monetary tightening may return and rush into safety.

EUR/USD technical outlook

The EUR/USD pair held within a well-limited range and posted a higher high and a higher low on a weekly basis, although there are no other signs of a potential bullish run. In the mentioned time frame, the pair is stuck around a mildly bearish 100 Simple Moving Average (SMA), while the 20 SMA offers a firm downward slope above the weekly peak of 1.0755. Technical indicators, in the meantime, have lost their positive momentum and turned marginally lower within negative levels, suggesting bears hold the grip.

The daily chart for EUR/USD shows the pair developing above a bullish 20-day SMA, providing dynamic support at 1.0620, while the longer moving averages head marginally lower above the current level, converging around the 1.0800 mark. Finally, the Momentum indicator heads sharply lower, just above its 100 line, while the Relative Strength Index (RSI) indicator consolidates at around 55, reflecting the absence of buying interest.

Support could be found at the 1.0640 price zone, while a break through 1.0600 exposes the 1.0520 area. Below the latter, the pair could retest the year low at 1.0447.

The pair needs to run past the 1.0755 weekly high to test bears’ determination around the 1.0800 threshold. Gains beyond the latter are still unclear, although the next relevant resistance area comes around 1.0860.

EUR/USD sentiment poll

The FXStreet Forecast Poll suggests EUR/USD may attract some buyers next week but will likely resume its decline afterwards. The pair is seen averaging 1.0705 in the near term, pretty much holding ground but sliding towards 1.0618 in the monthly perspective. Bears account for 58% on the latter but decline to 36% in the quarterly view, with the pair then seen averaging 1.0675. Despite the US Dollar's inability to run higher, speculative interest seems unwilling to let it go.

The Overview chart offers a neutral-to-bearish perspective in the medium term. The monthly moving average is flat, while the quarterly one heads firmly lower at fresh multi-month lows. Curious, there is a clear accumulation of potential targets in the 1.0800/1.1000 region, although bets below 1.0400 have increased compared to the previous week.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.