EUR/USD Weekly Forecast: How far can the dollar go?

- Out-of-control inflation, slowing growth, and Russia combined to put markets in panic mode.

- Central bankers from around the world are mounting the tightening path.

- EUR/USD is extremely oversold in the long term, but it still has room to fall.

The EUR/USD pair finally left its consolidative phase, breaking lower and falling to a multi-year low of 1.0348. It closed the week a handful of pips above the level, with sellers now adding shorts on spikes beyond the 1.0400 figure.

The perfect storm

The collapse took place on Thursday, following the release of US inflation figures the day before. The Consumer Price Index rose by 8.3% YoY in April, above the market’s forecast of 8.1%. The core reading hit 6.2%, also higher than the 6% expected, reflecting broad-based inflationary pressures that would be hard to tame.

Also, more and more central bankers from around the world joined the tightening train. Multiple European Central Bank officials stated that they would be comfortable hiking rates right after finishing the massive bond-buying program known as APP in July. Across the pond, US Federal Reserve chief Jerome Powell repeated that the central bank is likely to raise rates by 50 bps in its next two meetings.

The Fed is two steps ahead of its major counterparts, but several central banks are running before the Fed and also announcing upcoming tighter monetary policies. The only exception is the Bank of Japan, as Governor Haruhiko Kuroda said they would maintain their dovish guidance and not hesitate to take additional easing steps.

Finally, tensions between Russia and western nations fueled the risk-averse mood. Finland has announced it would drop its neutral stance and apply to join NATO, while Sweden is considering a similar move. Moscow threatened to retaliate if Finland joins the organization.

Russian Deputy Chairman Dmitry Medvedev warned that military assistance for Ukraine risks creating a conflict between Russia and NATO. Meanwhile, Ukraine has announced it would suspend Gazprom gas transit on its territory. European Commission President Ursula von der Leyen said Russia was the “most direct threat” to the international order.

Market’s implications

So, we have out of control inflation, slowing growth, and central banks draining massive liquidity introduced to cope with the pandemic. By the way, it is worth noting that the latter is not yet over, and cases are back on the rise, anticipating a new wave and triggering measures that would add to the global burden.

It seems logical that speculative interest began retreating, particularly from high-yielding, volatile assets such as equities and cryptos. And in fact, stocks´ decline seems a mere correction. Take a look at this Dow Jones Industrial Average monthly chart:

The index is currently hovering around the 23.6% retracement of its March 2020/January 2022 rally. Even further, if we take out the early 2020 decline triggered by the pandemic, the index has been rallying since March 2009. The DJIA needs to shed 2,000 points more to reach the 23.6% retracement of the 2009/2022 run. It would need to lose 5,000 points more to pierce the 38.2% retracement and actually be at risk of entering a long-term bearish market.

The greenback is largely overbought in the near term, and a corrective decline is not on the table. Nevertheless, the overall scenario favors the continued dollar’s strength.

Investors’ confidence on the back foot

Data released these days showed that sentiment plunged. The May EU Sentix Investor Confidence fell to -22.5, while the German ZEW Survey for the same month offered a similar picture, noting that the economic setback will likely continue. Also, the US preliminary May Michigan Consumer Sentiment Index plunged to 59.1, its lowest in over a decade.

Regarding inflation, Germany confirmed the annual CPI at 7.8% YoY in April. The EU Producer Price Index rose to 11% YoY in the same month, both signaling that overheating prices are not exclusive to the US.

During the upcoming week, the focus will be on the EU's second estimate of the Q1 Gross Domestic Product, foreseen at 0.2% QoQ, while the US will publish April Retail Sales, expected to have risen by 0.7% MoM.

EUR/USD technical outlook

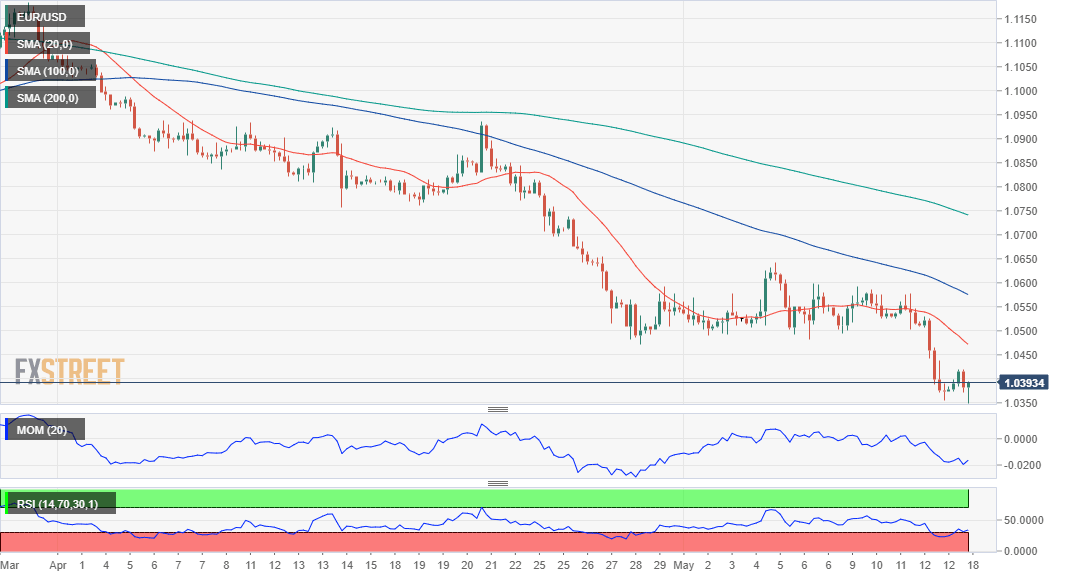

The EUR/USD pair is extremely oversold after falling for six consecutive weeks. Technical readings in the wider perspective reflect a strong bearish momentum that would likely favor additional declines in the upcoming weeks. Nevertheless, a corrective advance or at least another consolidative phase is on the cards and would help to enhance the dominant trend.

The daily chart shows that the pair is developing well below firmly bearish moving averages, in line with the latest collapse. However, technical indicators have begun giving signs of bearish exhaustion. The RSI indicator is now flat at around 26, while the Momentum indicator aims marginally higher from a multi-week low.

The main bearish target and the immediate support level is 1.0339, the low from January 2017. The pair bottomed at 1.0334 in January 2003, reinforcing the level’s strength and making more relevant a potential breakout. Once below the latter should see the pair approaching the 1.0200 figure, and traders start jawboning about parity.

A relevant resistance level comes at 1.0470, the former 2022 low. A recovery beyond it could see the pair extending its corrective advance towards the 1.0600 region, where sellers will likely resurge.

EUR/USD sentiment poll

The FXStreet Forecast Poll hints at another leg lower before a bullish correction. 70% of the polled experts expect EUR/USD to extend its decline next week with the pair seen on average at 1.0380. However, bears decrease to just 17% in the monthly view, while bulls jump to 83%, with the pair expected to recover towards the 1.0600 region. A few experts see it as high as 1.1000, although the percentage is small. In the quarterly perspective, bulls are still a majority, but the pair is still seen stuck at 1.0600.

The Overview chart shows that the three moving averages maintain their firmly bearish slopes. The potential targets’ range is quite limited in the weekly and monthly perspectives but widens in the longer view to 1.00/1.12. Still, the largest accumulation of possible targets is below the 1.0600 figure, in line with the dominant bearish trend.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.