- Overheating inflation and slowing economic growth are still the main market drivers.

- The European Central Bank and the US Federal Reserve will meet in the upcoming weeks.

- EUR/USD is losing bullish potential in the wider perspective, beware of a break below 1.0626.

The EUR/USD pair peaked at 1.0786 mid-week, its highest level for May, but finished it pretty much unchanged in the 1.0720/30 price zone. Much of the pair’s direction was directly linked to government bond yields’ behavior, affected by inflation and growth-related fears.

“Recession” sounded louder than usual as JP Morgan CEO Jamie Dimon warned about an economic “hurricane” on the horizon amid Fed’s tightening and the Russia-Ukraine war.

US Federal Reserve: To pause, or not to pause

Starting June 1, the US Federal Reserve began trimming its massive balance sheet of almost $9 trillion by up to $95 billion per month. Materially, nothing would happen until June 15, when $15 billion of Treasuries mature without reinvestment, and while the effects of such a move may take some time to become evident, it is clear that market players are already pricing it in. Alongside rate hikes, these actions are meant to cool down record inflationary pressures resulting from the pandemic economic disruption. The American central bank will announce its next monetary policy decision also on June 15.

As of lately, speculation has arisen about a potential pause in rate hikes in September to assess the effects of the ongoing monetary policy on the economy. However, the idea has been cooled down by a couple of Fed officials. Federal Reserve Vice-Chair Lael Brainard said that the central bank would hardly pause its current rate-hiking cycle amid record inflation levels. Cleveland’s Loretta Mester said that inflation has not yet peaked and that it’s too early to discuss a potential pause in the tightening path.

Hopes that inflation may have peaked had helped Wall Street to recover some ground after the selling spiral that took place between March and May, but stocks are back in the red for this week. With lingering price pressures and the central bank draining easy money, there’s only one way for high-yielding assets.

Still, the greenback failed to take full advantage of the risk-off scenario, hurt by tepid local data mostly related to employment. The ADP survey showed that the private sector added just 128K new positions in May. The Nonfarm Payrolls report was more encouraging, as the economy created 390K new jobs, while the unemployment rate remained steady at 3.6%. However, several companies, Tesla included, announced they are considering cutting staff to cape with the upcoming economic setback. The news overshadowed the encouraging NFP headline.

European turmoil has just begun

Across the pond, things are no better. The EU approved the sixth package of sanctions on Russia, which includes an embargo on crude oil imports that would represent 90% of oil imports by the end of 2022, with an exemption to pipeline deliveries. Also, three Russian credit institutions were removed from the SWITF system, Sberbank, Credit Bank of Moscow, and Russian Agricultural Bank. At the same time, EU inflation soared to a record high of 8.1% YoY in May, according to preliminary estimates.

The Ukraine war and the subsequent sanctions imposed by the western world are fueling price pressures and the economic downturn, affecting mostly, but not exclusively, Europe.

The European Central Bank will meet next week, but little surprises are expected. Policymakers have announced they will end their assets purchase program in the third quarter of the year and have been paving the way for a rate hike of 50 bps as soon as possible. Markets are now looking at July as the potential date for the first move. If that’s the case, the EU rate will be at 0.5%, while the US one will be at 2%. Such imbalance is one more reason for EUR/USD to remain subdued.

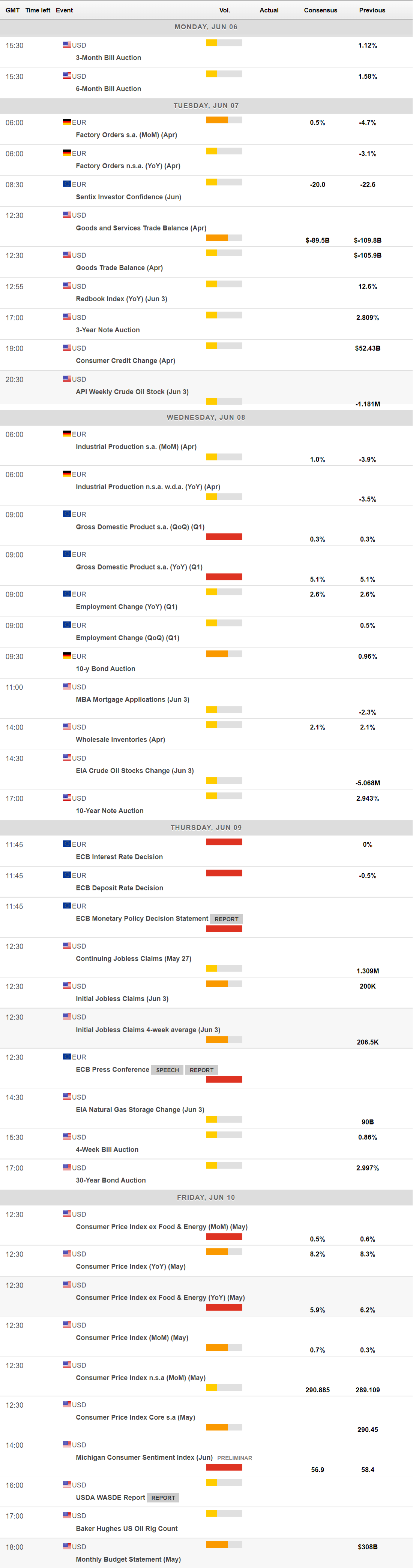

Next week’s macroeconomic calendar will include the second estimate of the EU Q1 Gross Domestic Product, foreseen steady at 0.3%, and the May US Consumer Price Index, expected at 8.2% YoY, slightly below the previous 8.3%.

EUR/USD technical outlook

The EUR/USD pair is trading just below the 50% retracement of its latest slide, measured between 1.1186 and 1.0348 at 1.0770. The weekly chart shows that the pair keeps developing well below all of its moving averages, with the 20 SMA maintaining its bearish slope below the longer ones. Technical indicators, in the meantime, have corrected oversold conditions but lost their bullish strength within negative levels and are currently flat. Overall, the bullish potential remains limited, although the trend may gather momentum if the pair breaks above the 61.8% retracement at 1.0855. Steady gains above the latter could mean an extension towards the critical 1.1000 figure.

Technical readings in the daily chart suggest upward exhaustion. The pair is still developing above a bullish 20 SMA, but technical indicators are easing, with the Momentum pulling back from around overbought levels. At the same time, the 100 and 200 SMAs head firmly south, well above the current level. The weekly low at 1.0626 provides relevant support, with a break below it exposing the 1.0500 threshold.

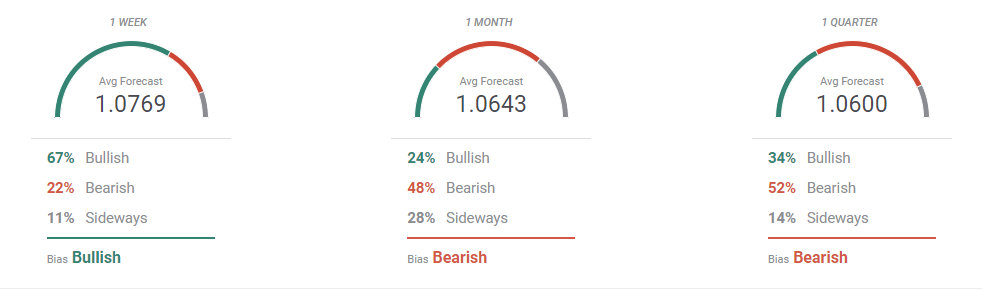

EUR/USD sentiment poll

The sentiment around EUR/USD and according to the FXStreet Forecast Poll is bullish in the near term, but bearish in the wider perspective. 67% of the polled experts expect the pair to trade at higher than current levels, with an average one-week target at 1.0769. Bears take the lead in the monthly view, aiming for 1.0643 while retaining control on a quarterly basis when the pair is seen averaging 1.0600.

The Overview chart suggests that buyers are losing steam. The weekly and monthly moving averages have lost their upward strength and turned flat, while the longer one retains a mildly bearish slope. The same chart shows that gains beyond 1.1000 are unlikely in the foreseeable future, while, on the other hand, the number of those betting for lower lows for the year keeps increasing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Tuesday for some insight into the interest rate outlook.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold price bulls seem non-committed around $2,620 amid mixed cues

Gold price struggles to capitalize on last week's goodish bounce from a one-month low and oscillates in a range during the Asian session on Monday. Geopolitical risks and trade war fears support the safe-haven XAU/USD. Meanwhile, the Fed's hawkish shift acts as a tailwind for the elevated US bond yields and a bullish USD, capping the non-yielding yellow metal.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.