EUR/USD Weekly Forecast: Focus returns to inflation

- United States employment figures indicate a persistently tight labor market.

- Weaker European economic growth undermines demand for the Euro.

- EUR/USD aims to resume its long-term advance and finally beat 1.1000 resistance.

The EUR/USD pair saw little action for a second consecutive week, settling around the 1.0940 mark. The US Dollar benefited from a souring market mood, while the absence of relevant European data kept the Euro in check.

A couple of factors undermined the mood, starting with mounting tensions between China and the United States (US), as the former decided to limit exports of metals critical for the chip industry. Western nations saw such a move as retaliation from Beijing for Western restrictions on the industry.

Additionally, growth-related figures were weaker than anticipated, reviving concerns about recessions among major economies. The fact that central banks are not yet done with monetary exacerbated fears, which ended up in stock market sell-offs.

S&P Global downwardly revised most of its June PMIs for the Eurozone and the US, with an unexpected setback in the services sector which anyway remains the best performer. The economic slowdown is steeper in the Old Continent, as most data missed expectations. On a positive note, the EU reported the Producer Price Index (PPI) shrank to -1.5% YoY in May, below the -1.3% anticipated.

Resilient US labor market

In the US, the focus was on labor’s strength. The country published Challenger Job Cuts, which showed that US-based employers announced 40,709 cuts in June, down 49% from the 80,089 cuts announced in May. Additionally, the ADP Survey on private jobs creation printed at 497K, more than doubling the market expectations and well above the previous 267K, while Initial Jobless Claims for the week ended June 30 rose by 248K, slightly above the 245K expected.

Finally on Friday, the US released the Nonfarm Payrolls (NFP) report, which showed that the country added just 209K new jobs in June, missing expectations and initially triggering optimism. The US Dollar fell as equities gained, although the enthusiasm cooled a bit as the rest of the report was not encouraging. The Unemployment Rate declined to 3.6%, as expected, but wages were higher than anticipated. Average Hourly Earnings rose 0.4% MoM and 4.4% YoY, spelling trouble in the inflation front and hence, backing the Federal Reserve’s (Fed) case for additional tightening. Thus, the possibility of a recession remains alive and kicking.

The EUR/USD pair jumped to 1.0930 as an immediate reaction to the encouraging headline but returned to trade below the 1.0900 threshold afterwards.

Employment done, inflation coming up next

The focus shifts to price pressures next week, as major economies will report inflation data. Germany will release the final estimates of the Harmonized Index of Consumer Prices (HICP) for June, previously estimated at 6.8% YoY. On Wednesday, the US will publish the June Consumer Price Index (CPI), foreseen up by 3.6% YoY. The monthly increase is anticipated to be 0.2%, slightly above May’s figure. Additionally, the country will unveil the June Producer Price Index (PPI) and the preliminary estimate of the July Michigan Consumer Sentiment Index, previously at 64.4.

EUR/USD technical outlook

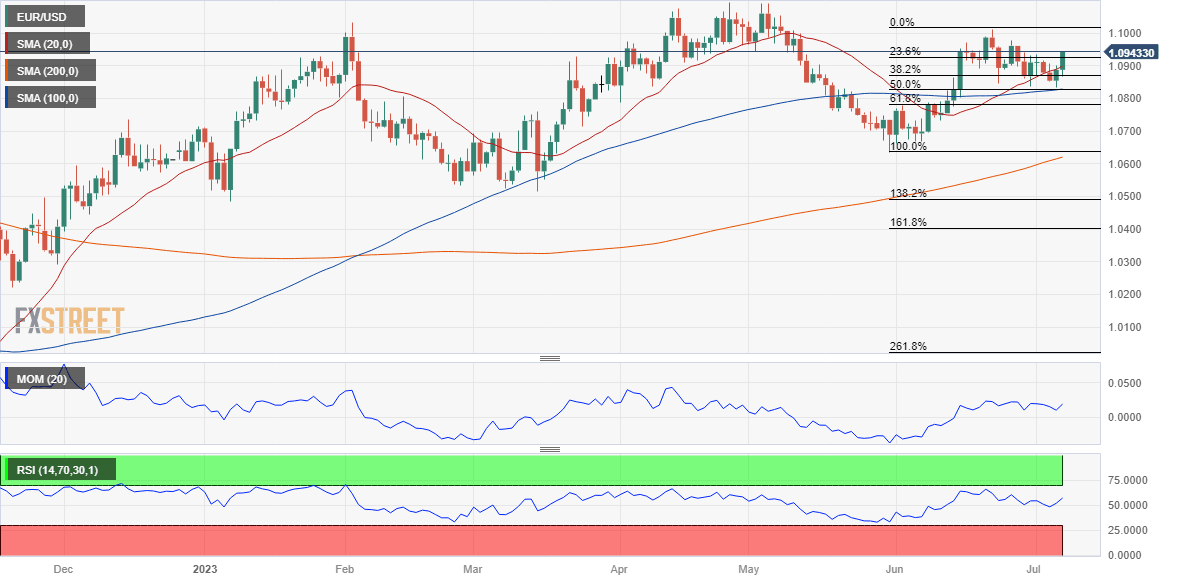

The EUR/USD pair is stuck around the 1.0900 level for a second consecutive week, losing its upward strength but far from turning bearish. The pair trades just below the 23.6% Fibonacci retracement of the 1.0634/1.1011 run at 1.0921, while buyers surged on an approach to the 50% retracement at 1.0820.

Technical readings in the weekly chart maintain bulls’ hopes alive, as the pair is developing above its 20 and 100 Simple Moving Averages (SMA), with the shorter gaining upward traction. The mentioned SMAs converge with the aforementioned support at 1.0820. At the same time, the 200 SMA remains directionless, far above the current level, providing no clues. The Momentum indicator keeps easing within positive levels, reflecting the absence of upward strength rather than anticipating a slide. Finally, the Relative Strength Index (RSI) indicator consolidates at around 58, limiting the chances of an upcoming decline.

The daily chart offers a neutral-to-bullish stance. The pair is currently recovering above a bullish 20 SMA after meeting buyers around a flat 100 SMA. The latter converges with the 38.2% retracement of the mentioned Fibonacci rally at 1.0865. Technical indicators recovered their bullish poise, although the Momentum is struggling to overcome its 100 level, while the RSI aims north at around 54, suggesting bulls are not yet fully convinced.

The pair still needs to clear the 1.0930/50 region, and once above it, the psychological barrier at 1.1000 comes next. On the downside, the aforementioned Fibonacci levels are the ones to take care of, with a break below 1.0820 opening the door for a test of 1.0745, the 61.8% retracement of the 2022 yearly slump.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, EUR/USD could be under pressure in the near term, but regain its bullish poise in the longer run. Most experts are bearish in the weekly outlook, with the pair seen on average at 1.0949. The outlook is neutral in the monthly view, while bulls soar to 86% in the quarterly view, with the pair seen then averaging 1.1149.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.