EUR/USD Weekly Forecast: Euro vulnerable after ECB and stronger US data

- The US Dollar strengthened on the back of positive US economic data, next week's jobs report in focus.

- The Euro had a mixed performance as the ECB opened the door to a potential pause in September.

- For now, the EUR/USD is holding above an uptrend line and the 20-week SMA.

The EUR/USD dropped for the second week in a row on the back of a strong US Dollar across the board. The key event of the week was not the Federal Reserve (Fed) meeting nor the European Central Bank (ECB) decision; it was a series of US economic data that surpassed expectations and showed the economy remains resilient despite the monetary tightening implemented by the Fed. The pair extended its bearish correction from one-year highs and dropped below 1.1000. The main trend is still up, but momentum continues to fade in the face of a firm Dollar.

EZ outlook deteriorates, central banks hike rates, and US data surpasses expectations

The US Dollar outperformed, boosted by US economic data, which surpassed expectations, leaving room for more rate hikes if the Federal Reserve desires them. During the second quarter, growth accelerated to an annual rate of 2.4%, above the expected 1.8%. Private consumer momentum lost steam, but companies increased investment.

Other economic reports also came in stronger than expected, including the preliminary S&P Global PMI Manufacturing (not the PMI Service, which fell more than expected), Durable Goods Orders, and Initial Jobless Claims. Against this backdrop, recession calls for the second half of the year have practically disappeared.

The story across the Atlantic was different, and the data added evidence of a deterioration in the economic outlook. The Eurozone PMIs came in weaker than expected, with the manufacturing sector diving deeper in negative territory and activity in the service sector slowing. The ECB Bank Lending Survey showed lending demand continues to soften. German GDP stagnated during the second quarter, after contracting by 0.3% in the first. On the inflation front, preliminary numbers from France, Spain, and Germany showed the annual rates slowing down. However, the German CPI inflation remains well above the ECB target.

The Fed and the ECB raised interest rates by 25 basis points. Federal Reserve Chair Jerome Powell offered no surprises and delivered as expected. It looked like a final rate hike; however, robust US data still keeps the door open to more tightening from the Fed. The impact of the meeting was limited. On the contrary, the not-so-big surprise from the ECB was that it dropped its forward guidance, possibly pointing to a pause in September. This outcome responds more to the economic outlook than the advance in the fight against inflation.

US jobs data takes center stage

After a busy week, the focus turns back to economic data, with inflation and employment numbers taking center stage. Also, markets will start listening again to central bank officials. However, those comments could have a minor impact, taking into account that there is a long way to go until the next “live” meetings from the ECB on September 14 and the FOMC on September 19-20. Prior to those meetings, there will be plenty of data to assess, not only July figures but also August.

The process from ECB officials to analyze what to do at the next meeting starts on Monday with Eurozone inflation and growth data. The preliminary estimate of Q2 GDP is due, as well as the July preliminary Consumer Price Index (CPI). No major surprises are expected from inflation figures, as Spain, France, and Germany have already reported.

On Tuesday, the final Manufacturing PMI from the Eurozone and the German Unemployment Rate will be released. Later in the day, the final US PMI and the Manufacturing ISM are due, together with the JOLTS Job Openings for June. This latter will be the first one in a round of crucial employment reports from the US during the week.

The only game in town on Wednesday will be the ADP Employment report in the US. Last month, data surprised with a 497,000 positive change in private employment that triggered market action; but at the same time, it showed a greater difference with Nonfarm Payrolls. So this number could have a limited impact, with a slowdown expected.

On Thursday, the final reading of the Services PMIs will be featured. Eurostat will also release the Producer Price Index (PPI) for June. The Bank of England (BoE) will announce its decision and could have an impact on markets. In the US, it will be a busy day, with the focus on the weekly Jobless Claims report and the preliminary Q2 Unit Labor Cost. Those numbers will be scrutinized to see the health of the labor market and wage inflation. Later in the day, will be the turn of the ISM Service PMI and Factory Orders.

The Eurozone will report June Retail Sales on Friday before the highlight of the week, which is the US official employment report. Nonfarm Payrolls are expected to have risen by around 180,000 in July, and the Unemployment rate is seen staying unchanged at 3.6%. If these figures reflect that the labor market remains strong, they could boost the US Dollar further.

If Eurozone economic figures point to deterioration in the economic outlook, the Euro could suffer further against the US Dollar. Growth divergence could become a key factor, replacing the potential for monetary policy divergence. Of course, this divergence in the economic momentum also needs US employment data due next week to show a still-tight labor market. A risk factor for the currency pair is US wage data. A significant increase in wages could trigger expectations of another rate hike from the Fed, boosting the US Dollar sharply. However, no such surprise is expected after the 1% increase during the second quarter of the Employment Cost Index, below the 1.1% of market consensus.

EUR/USD technical outlook

The weekly chart shows that the trend in EUR/USD is still up, with the price holding above the 20-week Simple Moving Average (SMA). However, the Relative Strength Index (RSI) and Momentum indicator are moving south, suggesting that the current weakness might translate into next week. A deeper correction from the one-year high reached last week near 1.1300 needs to be limited to the 1.0890/1.0900 area, where an uptrend line and the 20-SMA converge.

A weekly close below the 1.0890 zone would clear the way for more losses. Also, a daily close below this level would be dangerous as the 55-day and 100-day SMAs are located in this area. The 200-day SMA is far below around 1.0730. If EUR/USD manages to remain above 1.0900, it could keep the bias to the upside on the weekly chart. A clear close above the 1.1200 mark would point towards fresh cycle highs.

Bearish pressure will likely persist at the beginning of the week, with another test of 1.0950 likely. Lower levels could expose 1.0900, and an approach to that area could trigger volatility, particularly if it breaks lower. The 20-day SMA stands at 1.1060, and if the Euro manages to rise above it, it could recover momentum and strength to rise to the next relevant resistance seen at the 1.1150 area.

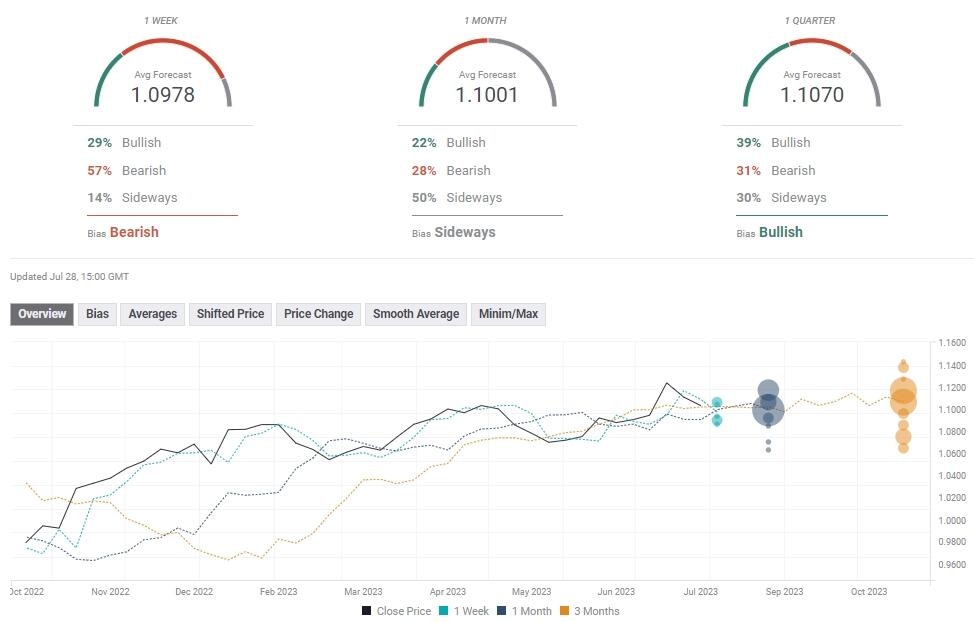

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that market players expect the EUR/USD to trade sideways, with the average forecast below recent highs and moving not far from 1.1000 over the next few weeks. In the short term, they have a bearish perspective, with the average forecast around 1.0970. For the end of the quarter, most of the experts see the EUR/USD moving higher, with a few forecasting a price above 1.1300.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.

-638261551099785788.png&w=1536&q=95)