EUR/USD Weekly Forecast: Bulls turn cautious ahead of Federal Reserve’s decision

- Macroeconomic data imbalances may end up benefiting the US Dollar.

- European tepid growth may soon take its toll on the Euro.

- EUR/USD maintains the bullish bias in the daily chart despite absent weekly progress.

The EUR/USD pair edged lower in the fourth week of July, trading marginally lower in the 1.0850 region ahead of the close. The US Dollar started the week on a strong footing, but the momentum faded following the release of United States (US) first-tier data that helped improve the market’s mood.

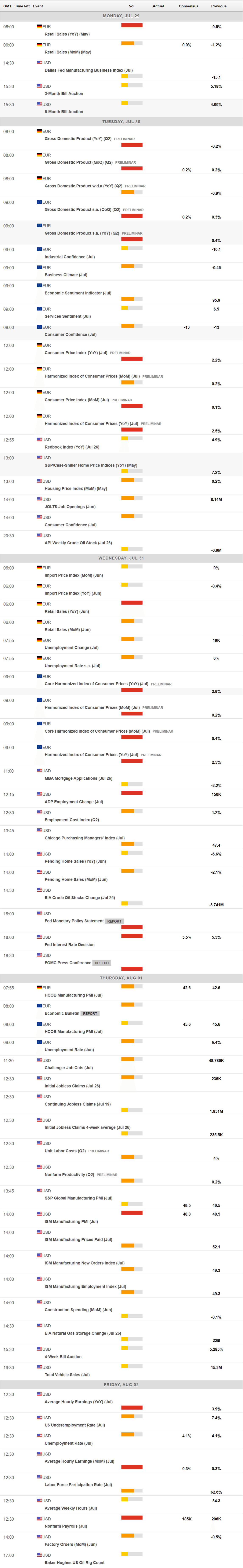

Tepid European data

At the same time, Euro buyers had little to cheer. EUR/USD bullish potential was limited by tepid European data reflecting the elevated risk of a recession. According to the Hamburg Commercial Bank (HBOC), the private sector stood near stagnation at the beginning of the third quarter, as the flash Purchasing Managers Indexes (PMIs) came in worse than anticipated. Manufacturing output shrank in July, resulting in the Composite PMI falling to 50.1 from 50.9 in June, its lowest in five months.

Furthermore, the German private sector economy “slipped back into contraction at the start of the third quarter, weighed down by a worsening performance across the country’s manufacturing sector,” the report showed.

The European Central Bank (ECB) is well aware of the situation and trimmed rates despite persistent inflationary pressures. In fact, European policymakers are likely to deliver a second interest rate cut in September, fearing an unmanageable recession. Of course, this would never be said out loud.

United States may dodge even a soft landing

Across the pond, macroeconomic data was far more encouraging. The S&P Global flash PMI data showed business activity growth in the United States (US) edged up to its fastest for 27 months in July, with the services sector still outperforming the manufacturing one.

Furthermore, the preliminary estimate of the Q2 Gross Domestic Product (GDP) showed that the economy grew at an annualized pace of 2.8%, much better than the 2% expected and the previous 1.4%. At the same time, the quarterly core Personal Consumption Expenditures Price Index rose 2.9% QoQ, easing from the 3.7% posted in the first quarter, yet above expectations of 2.7%. Furthermore, the GDP Price Index rose 2.3% in the same period, below the market expectation of 2.6%.

Finally on Friday, the US reported the June core PCE Price Index, which rose 0.2% MoM, above the 0.1% anticipated. The annual reading remained unchanged at 2.6%, also surpassing expectations. Nevertheless, the news fell short of affecting the odds of an interest rate cut in September.

The Federal Reserve (Fed) will take center stage next week as the central bank announces its decision on monetary policy. Interest rates are widely anticipated to remain unchanged, although investors hope policymakers will pave the way towards a September announcement.

The United States will also publish the July Nonfarm Payrolls report on Friday and the official ISM Manufacturing PMI for the same month.

The European macroeconomic calendar will include the preliminary estimates of the German and the Eurozone Q2 GDP and inflation data for the same month.

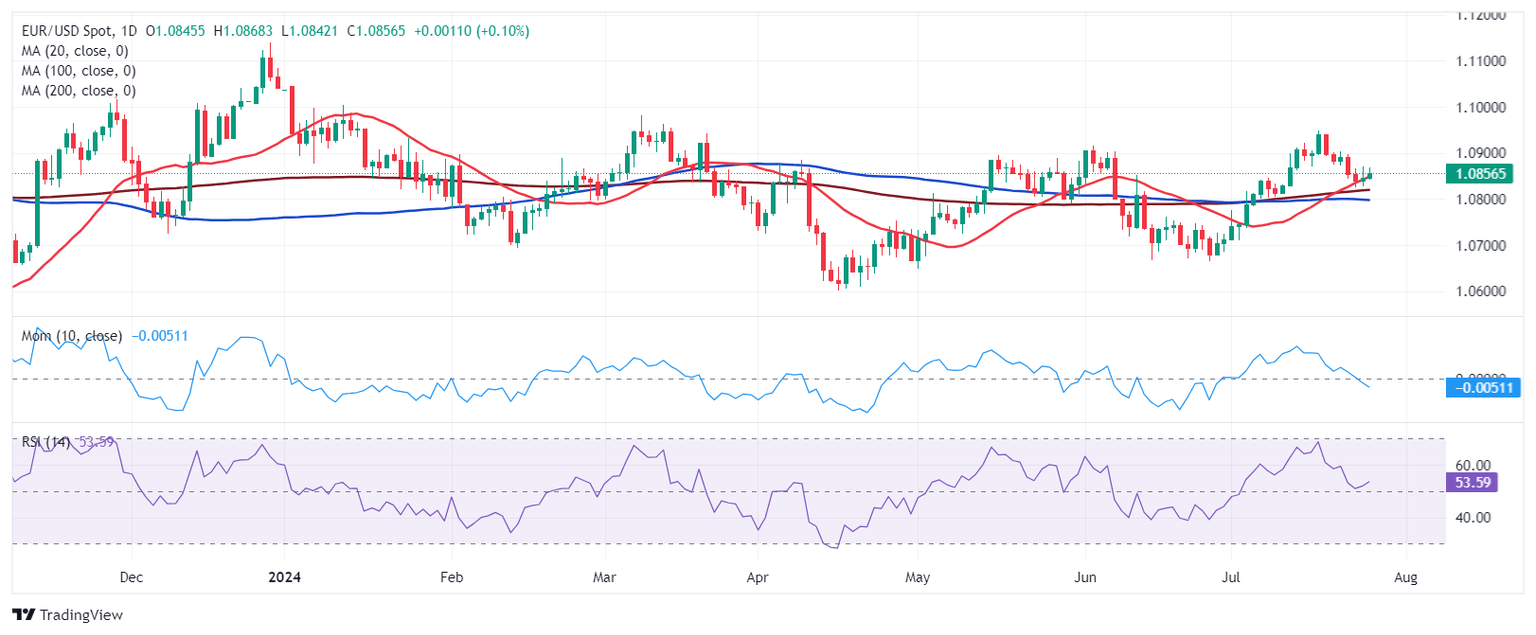

EUR/USD technical outlook

The weekly chart for EUR/USD shows the pair has made little progress. It retains a neutral-to-bullish stance, as technical indicators have lost their directional strength but hold within positive levels. At the same time, directionless 20 and 100 Simple Moving Averages (SMAs) stand below the current level, with the shorter one providing dynamic support at around 1.0790. The 200 SMA, in the meantime, provides dynamic resistance at around 1.1080.

Bulls can build hope based on the daily chart. Technical indicators bounced from around their midlines after correcting the overbought conditions reached mid-July, offering modest upward slopes. At the same time, a bullish 20 SMA has provided dynamic support, with the pair recovering pretty fast on slides below it. Furthermore, the latest keeps advancing above the longer ones, supporting the case of another leg higher.

As long as the pair holds above the 1.0800 level, the odds for a bearish extension remain limited. A break below it, however, exposes the 1.0740 area en route to 1.0660. Should the latter give up, the year low at 1.0600 comes next. The main resistance level is 1.0947, the monthly high, followed by the 1.1000 mark. Gains beyond the latter should result in EUR/USD testing 1.1080, followed by the 1.1140 price zone.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Next release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Consensus: 185K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.