EUR/USD Weekly Forecast: Corrective decline won’t grant further dollar gains

- USD stronger ahead of the weekly close, although the movement seems corrective.

- Tensions between the US and China and the coronavirus situation to keep the greenback pressured.

- EUR/USD is intrinsically bullish as long as above a critical Fibonacci support level at 1.1636.

The EUR/USD pair is finishing the week little changed below 1.1800, after advancing in the previous six weeks. Investors kept dumping the greenback these days, resulting in the pair surpassing the previous yearly high by a few pips to reach 1.1915, a level that was last seen in May 2018.

The dollar’s weakness was exacerbated this week by the lack of progress in a new US coronavirus aid package. Republicans and Democrats at Congress are still “far apart on some very significant issues,” according to comments from Treasury Secretary Stephen Mnuchin on Thursday, and after the previous stimulus package ended in July.

Stimulus, tensions and coronavirus

Meanwhile, the pandemic continues to take its toll. The US has surpassed the 5 million cases, while the death toll is above 162K. The latest projection shows that this last could hit 300K by December. Things are only modestly better in Europe, that seems to be on the brink of a second wave. Just this week, the number of daily local cases soared above 1,000 in Germany, France and Spain. The increase in contagions came alongside economic reopenings. New lockdowns so far have been focused, but each one of those points for a further delay in economic recovery.

Market players remained concerned about the future of the world’s largest economies, trading on coronavirus-related headlines rather than on macro releases, which report on the past instead of anticipating the future.

Political turmoil was also a major factor these days, and in fact, the main reason the dollar strengthened ahead of the weekly close. Late Friday, news agencies reported that the US administration is considering expanding its action against China, potentially sanctioning Hong Kong leader Carrie Lam. Earlier in the week, US President Trump issued an order banning TikTok and WeChat from operating in the US in 45 days, if they are not sold by parent Chinese companies.

Economic growth kept slowing

Data released these days showed that the situation is worse in the US than in the EU, at least for now. The final versions of Markit Manufacturing PMIs were upwardly revised in the Union and downgraded in the US. The official US ISM Manufacturing PMI came in at 44.3, still indicating contraction in the sector. Services output is also stronger in the Old Continent than in America, according to Markit, although the official US ISM Markit Manufacturing PMI jumped to 58.1.

An upbeat US monthly employment report fell short of saving the greenback. According to the Nonfarm Payroll report, the country added 1.76 million positions in July, while the unemployment rate shrank to 10.2%. The underemployment rate improved from 18% to 16.5%, while the Labor Force Participation Rate increased to 61.4%. Anyway, most US data released these days, included employment one, suggest that the economy continued slowing in July.

During the upcoming days, Germany and the US will publish July inflation figures, although the macroeconomic calendar will remain quite light until Friday. In the last trading day of the week, the EU will publish a revision of Q2 GDP, while the US will unveil July Retail Sales and the preliminary August Michigan Consumer Sentiment Index.

EUR/USD technical outlook

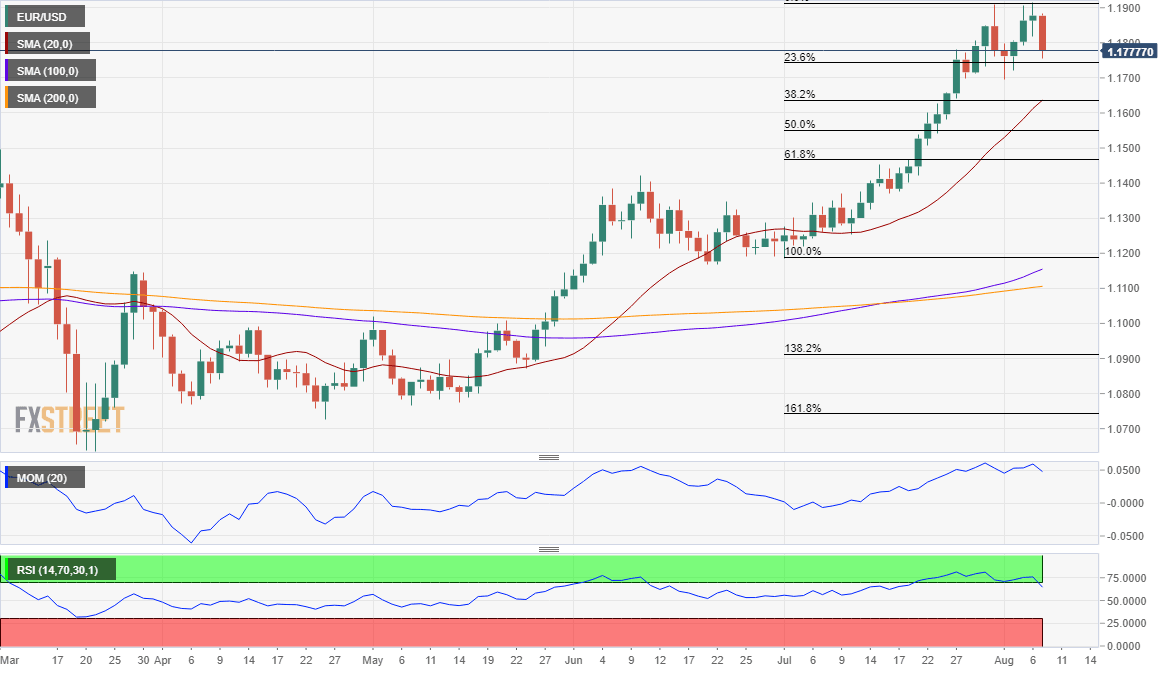

Despite holding on to gains, the EUR/USD pair is losing its bullish momentum. The weekly chart shows that the pair is holding above the 23.6% retracement of its July/August rally at 1.1740, the immediate support.

In the mentioned time-frame, the pair is far above all of its moving averages, with the 20 SMA advancing but still below the larger ones. Technical indicators, in the meantime, are barely retreating from overbought territory. The next Fibonacci support comes at 1.1636, the level that should give up for the dollar to turn bullish.

In the daily chart, the ongoing decline could also be considered corrective. A sharply bullish 20 SMA converges with the 38.2% retracement of the latest rally at 1.1636 while developing over 500 pips above the larger ones. Technical indicators, in the meantime, retreat from overbought readings, but remain well above their midlines.

Resistances, from the current level, come at 1.1830 and 1.1915, with a break above this last exposing the 1.2000 threshold.

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that investors expect dollar’s weakness to continue in the short-term, as the sentiment towards the pair is bullish in the weekly view, seen on average at 1.1848. A steep corrective decline is expected afterwards, as the bears become a majority in the monthly and quarterly views, with the pair seen at 1.17 and 1.16 respectively.

In the Overview chart, however, moving averages suggest that the bullish trend is still strong. The weekly and quarterly medias head north, while the monthly one is just flat. In general, the risk remains skewed to the upside as possible targets below the 1.1600 are quite scarce in all the time-frame under study.

Related Forecasts:

Bitcoin Weekly Forecast: BTC hit the pause button before a decisive breakthrough

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.