EUR/USD Weekly Forecast: Corrective advance may continue, but the EUR is doomed

- Massive quantitative tightening does little to bring inflation down.

- Europe's green energy plan backfires as Russia continues to reduce supplies

- EUR/USD corrective advance losses steam as economic turmoil remains the same.

The EUR/USD pair started the week on the back foot, falling to a fresh 22-year low of 0.9535, changing course mid-week to post substantial gains and then settling at around the 0.9780 threshold.

Volatility was once again triggered by inflation-related concerns and prospects for a global economic downturn amid central banks’ massive quantitative tightening (QT) effort. As price pressures continue, policymakers from around the world embarked on liquidity-draining processes, which in turn, undermined economic progress.

BOE chimes in

Government bond yields skyrocketed as investors did not see inflation receding anytime soon. US Treasury yields reached multi-year highs on Wednesday, with the 2-year note yield peaking at 4.34% and the 10-year note reaching 4.01%. The higher yields go, the more bonds fall.

The situation is not exclusive to the United States. Last Wednesday, the Bank of England decided to intervene by buying long-dated debt to stabilize financial markets after GBP/USD plummeted to an all-time low of 1.0317. At the same time, the central bank announced it would maintain its QT program but delayed gilts selling until October 31. The decision came after the UK’s new Prime Minister Liz Truss announced a mini-budget that included £45 billion in unfunded tax cuts triggering financial turmoil.

UK Government and BOE measures were evenly criticized, but stocks and bonds plummeted worldwide after the central bank’s decision. US government bond yields shed roughly 20 bps while US indexes fell to fresh 2022 lows. In turn, the overbought dollar began retreating as falling yields impacted on the USD.

Most of the weekly EUR/USD advance could be attributed to this financial turmoil, as there are no reasons to believe the EU is in better shape than the US. In fact, it faces challenges that could mean the steepest economic setback on record. Entrenched inflation in the Union was confirmed by the latest official releases. Germany's Harmonized Consumer Price Index rose by 10.9% YoY in September, while the EU HCPI in the same period hit 10%, multi-decade highs.

European governments caught off guard

Another factor negatively weighing on EU progress is the energy crisis. Since Russia embarked on a war with Ukraine, its gas flows to the Union have decreased by roughly 50%. Energy prices soared as the Old Continent struggled to secure enough gas to cope with the winter. The UK government’s controversial tax-cut is a direct consequence of rising energy prices and the dynamics of the European energy market.

The EU Commission proposed an emergency intervention in Europe's energy markets “to tackle recent dramatic price rises.” The proposal includes the obligation to reduce electricity consumption by at least 5% during selected peak price hours, a temporary revenue cap on non-conventional electricity producers, and a temporary solidarity contribution on excess profits generated from activities in the oil, gas, coal, and refinery sectors.

But such a crisis is not only to blame on Russia but also on the rigged nature of the European wholesale energy market. Additionally, European governments have been forcing a transition from fossil and nuclear energy to renewable resources. Green policies have been at the top of the agenda for a decade now, and nuclear energy has suffered as a consequence, with some countries only now considering bringing them back to life.

Topping it all, policymakers from both shores of the Atlantic insist they will maintain the fast pace of quantitative tightening while surreptitiously menacing with more aggressive measures.

Inflation remains the same

On the data front, German figures were scary. Wholesale food prices were up 19% in September. The IFO survey on Business Climate contracted to 84.3 in the same month, worse than anticipated, while the Gfk Consumer Confidence Survey plunged to -42.5 in October from -36.8 in the previous month. In the EU, the Economic Sentiment Indicator also missed expectations, down to 93.7 in September from 97.3 in August.

US figures were not what we could call encouraging but painted a more resilient picture. Durable Goods Orders were down a modest and better-than-expected 0.2% in August, while the core reading, Nondefense Capital Goods Orders ex-aircraft, improved a whopping 1.3%. Consumer Confidence in the country improved by more than anticipated, according to CB, while the Gross Domestic Product was confirmed to have contracted at an annualized pace of 0.6% in the three months to June.

Finally, the US released the core Consumption Personal Expenditures Price Index which saw a rise of 4.9% YoY in August, more than the 4.7% anticipated by the market. Higher-than-anticipated inflation fueled risk-averse trading, sending stocks down and yields up, helping USD to recover further ahead of the weekly close.

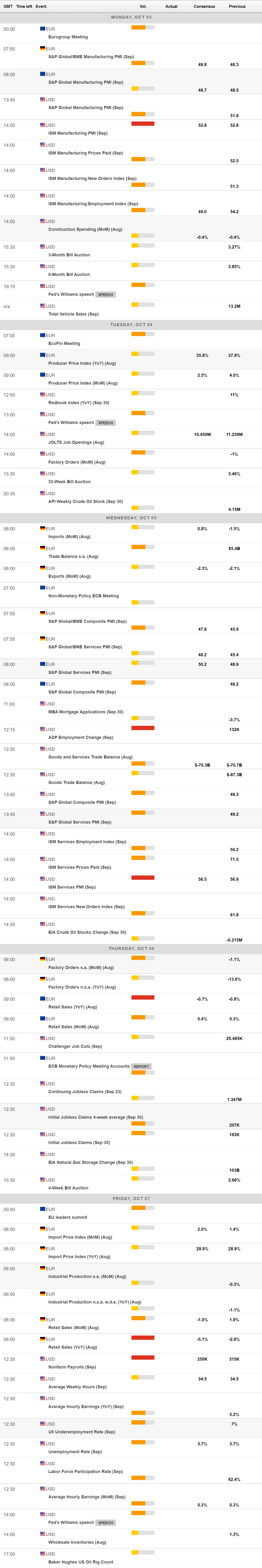

Next on Monday, S&P Global will release the final estimates of the September Manufacturing PMIs for the EU and the US, while the latter will publish the official ISM index, foreseen at 52.8, and unchanged from August. On Wednesday, it will be the turn of the ISM Services PMI, expected to have declined to 56.5.

Germany and the EU will publish their respective August Retail Sales data, while the US will close the week publishing the September Nonfarm Payrolls report. The country is expected to have added 250K new jobs in the month, while the Unemployment Rate is foreseen steady at 3.7%.

EUR/USD technical outlook

The EUR/USD pair hit 0.9853 before retreating on Friday. It ends up way below the 38.2% retracement of the 1.0197/0.9535 slide, at around 0.9790. The 23.6% Fibonacci retracement provides support at 0.9685.

Technical readings in the weekly chart show that EUR/USD has barely begun correcting extreme oversold conditions. Indicators remain at extreme levels with the RSI at 29, but losing bearish strength and are mostly flat. Meanwhile, the 20 SMA maintains its firmly bearish slope far above the current level, running parallel with a descending trend line coming from this year’s high at 1.1494. The trend line will provide resistance at around 1.0070 in the upcoming days.

Bears never lost control, according to the daily chart. The pair held throughout the week below a bearish 20 SMA, currently at around 0.9890. The longer moving averages kept heading south far above the shorter one. Meanwhile, technical indicators corrected extreme oversold conditions before resuming their declines within negative levels. They head into the weekend with a strong downward momentum that hints at further declines.

A break below the aforementioned 0.9685 level should confirm the bearish case, with the pair finding support later at 0.9600 and 0.9535. If the latter gives way, 0.9400 is the next probable bearish target. On the other hand, if the pair manages to run past 0.9870, chances are of another corrective advance towards the 1.0030/70 price zone.

EUR/USD sentiment poll

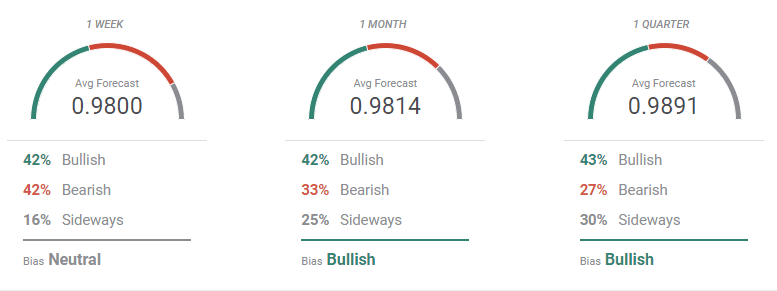

The FXStreet Forecast Poll for the EUR/USD pair hints at an extension of the bullish correction, with the pair anyway seen trading below parity for the rest of the year. The near-term outlook is neutral, as bulls and bears are equally 42%. Bulls take the lead in the monthly and quarterly views but remain below 50% of the polled experts. On average, the pair is barely seen above 0.9800 in the next few weeks while approaching the 0.9900 level in the three-month view.

The Overview chart shows that the near-term moving average has lost its bearish strength and turned flat, but also that the longer ones maintain their bearish slopes. Dismissing some wild bets, the pair is seen on average between 0.9500 and 1.0400 in the upcoming months.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.