EUR/USD Weekly Forecast: US Dollar likely to keep rallying versus a battered Euro

- European jitters undermined demand for the Euro, ECB rate cut started weighing.

- US Dollar runs as inflation eases and despite fresh hopes for interest rate cuts.

- EUR/USD not done falling despite trading at its lowest in over a month.

The EUR/USD pair slid below the 1.0700 mark for the first time in over a month on Friday, as the US Dollar surged on the back of risk aversion. The dismal mood prevailed throughout the week, with a short-lived exception on Wednesday when softer-than-anticipated United States (US) inflation brought a breath of fresh air.

European elections and US data leading markets

EUR/USD gapped lower at the opening following the European Parliamentary Elections. Despite the centrist coalition managing to keep a narrow majority, far-right parties won in France, Austria, and Germany, leading to French President Emmanuel Macron calling for a snap parliamentary election in his country. Concerns about far-right parties gaining momentum sent investors away from high-yielding assets and into safe-haven USD.

The mood remained sour until Wednesday when the US Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 3.3% YoY in May after climbing 3.4% in April. The same report showed the CPI remained stable on a monthly basis, easing from the previous 0.3%. Finally, the core readings, which exclude volatile food and energy prices, were also below forecast and eased from the April readings. Financial markets rushed away from the Greenback on renewed hopes that the Federal Reserve (Fed) would move away from monetary tightening. EUR/USD peaked at 1.0851 with the news.

Federal Reserve sees modest progress on inflation

However, optimism did not last. The Federal Open Market Committee (FOMC) announced the decision on monetary policy later on the same Wednesday. Officials decided to leave the benchmark interest rate unchanged in a floating range between 5.25% and 5.50%, as widely anticipated. The FOMC released an updated Summary of Economic Projections (SEP), which showed that policymakers are split on how many rate cuts could come this year. 4 of 19 officials saw no rate cuts in 2024, 7 projected a 25 basis points (bps) rate reduction, while 8 marked down a 50 bps cut in the policy rate.

The document also reflected officials’ concerns about inflation as policymakers upwardly reviewed their view on PCE inflation for this year and the next ones. Growth and the unemployment rate forecasts for 2024 were left unchanged at 2.1% and 4%, respectively.

The US Dollar trimmed part of its CPI-inspired losses with the Fed and turned firmly higher afterwards, despite market participants rushing to price in two rate cuts before year-end.

On Thursday, data showed the US Producer Price Index (PPI) rose 2.2% YoY in May, according to BLS, below the 2.3% increase recorded in April and below the market expectation of 2.5%. The annual core figure rose 2.3%, below the 2.4% expected, while the monthly PPI declined 0.2%. News of easing price pressures at wholesale levels added to speculation the Fed will deliver at least two interest rate cuts in the upcoming months.

Finally, on Friday, the US released the preliminary estimate of the June Michigan Consumer Sentiment Index, which unexpectedly contracted to 65.6 from 69.1 in May, missing expectations of 72.

So, signs of disinflation spurred speculation the Fed would cut rates and still, the US Dollar rallied. Mounting demand for the USD could be partially explained by Wall Street, as despite a mixed performance, the S&P 500 posted record highs pretty much on a daily basis this past week, while Treasury bond yields edged sharply lower. The 10-year note currently offers around 4.20%, its lowest since late in March, while the 2-year note yields roughly 4.70%, a level that was last seen in early April.

The dismal mood among European investors added to US Dollar demand these days amid political turmoil in the Old Continent.

European turmoil hits the Euro

Far-right victory in Europe continued to take its toll on the shared currency. Local share markets spent most of the week in the red, with the focus mostly on France, as Marine Le Pen’s far-right National Rally Party leads surveys by a significant margin. Speculative interest is concerned about changes in fiscal policies, immigration regulations, and climate-change measures that may affect economies should the right parties take over local governments. European bonds lost appeal throughout the week, further weighing on local stocks and the Euro.

Also, it is worth reminding the European Central Bank (ECB) trimmed interest rates a few days before the Fed announced its decision. The decision was clearly Euro bearish, but the currency’s slide was limited ahead of US first-tier events. Once the latter was cleared, selling the shared currency was much easier.

What’s next?

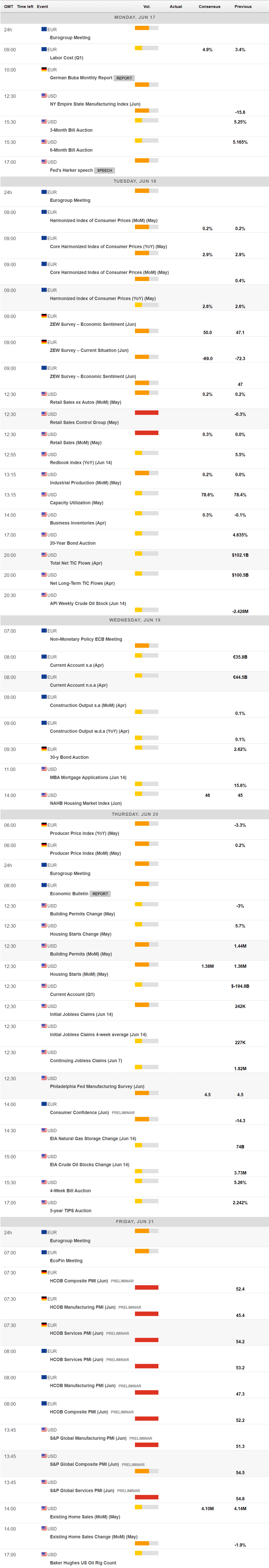

The firmer USD and the battered Euro do not show signs of changing curse in the upcoming days. Fundamentally, the upcoming week will be a lighter one. The Eurozone will release the final estimate of the May Harmonized Index of Consumer Prices (HICP), expected to be confirmed at 2.6% YoY. Germany will unveil the June ZEW survey on Economic Sentiment and the May PPI. As for the US, the focus will be on May Retail Sales. Finally, on Friday, the Hamburg Commercial Bank (HCOB) and S&P Global will release the preliminary estimates of their June Manufacturing Purchasing Managers Index (PMI) for major economies.

But beyond macroeconomic data, sentiment will remain as the top market lead. Despite potential interest rate cuts coming in the US, hopes that America will avoid a recession and jitters elsewhere will likely maintain the USD on the winning side.

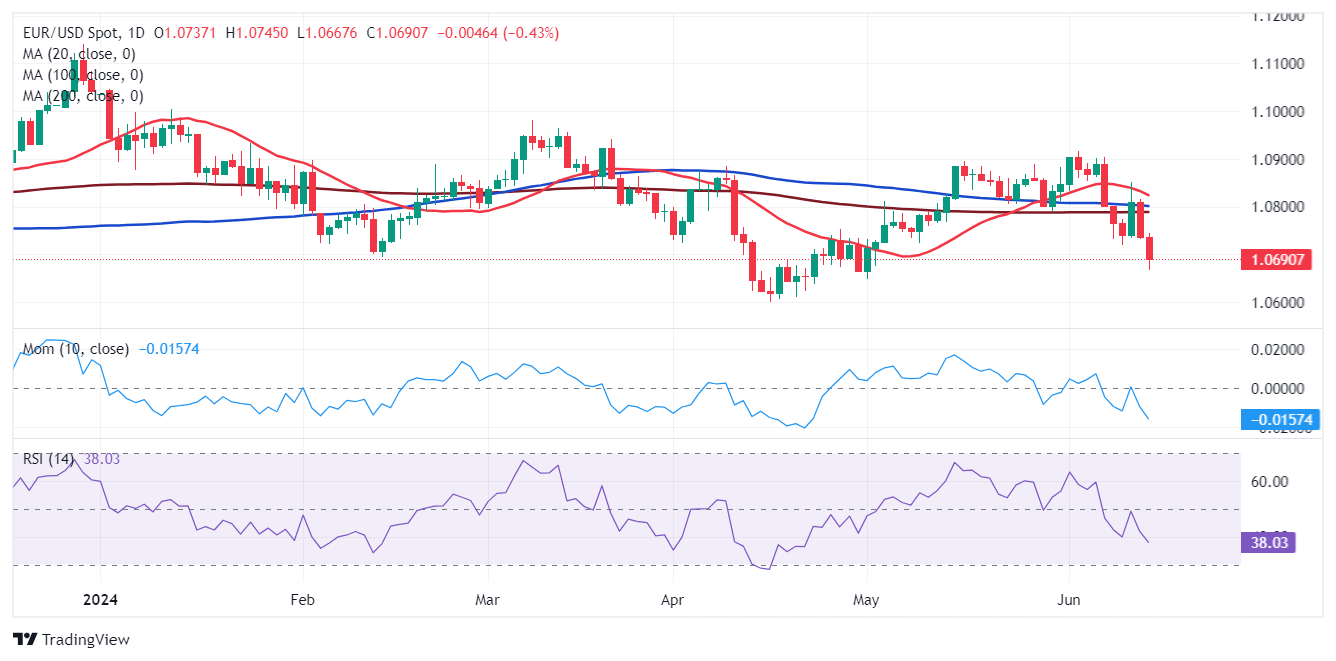

EUR/USD technical outlook

The EUR/USD pair maintains the bearish bias sub-1.0700 ahead of the weekly close, trading at its lowest since May 1. The weekly chart shows the selling momentum is strong, and anticipates additional losses in the upcoming days. A failed attempt to overcome a marginally bearish 20 Simple Moving Average (SMA) resulted in the pair plummeting towards the 100 SMA, providing dynamic support in the 1.0650 price zone. EUR/USD has held above the latter since last October, which means a clear break below it will likely discourage bulls.

At the same time, technical indicators have left neutral territory and turned sharply lower, maintaining the downward momentum within negative levels. Finally, the 200 SMA grinds modestly higer at around 1.1100, too far away to be relevant.

According to technical readings in the daily chart, the bearish case is even firmer. EUR/USD plummeted below all its moving averages, with the 20 SMA gaining downward momentum above the longer ones, which remain directionless. Meanwhile, technical indicators head south almost vertically and approach oversold readings without signs of downward exhaustion.

Below the 1.0650 support area, EUR/USD could fall towards the 1.0600 region, where the pair bottomed this year. Once below the latter, the next relevant support area comes at 1.0520. Should the pair bounce, the immediate resistance level comes at 1.0710 en route to the 1.0770 price zone. Gains beyond the latter are quite unlikely, yet this week’s top at 1.0851 is the next level to watch.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.