EUR/USD Weekly Forecast: Bulls on pause but still in control

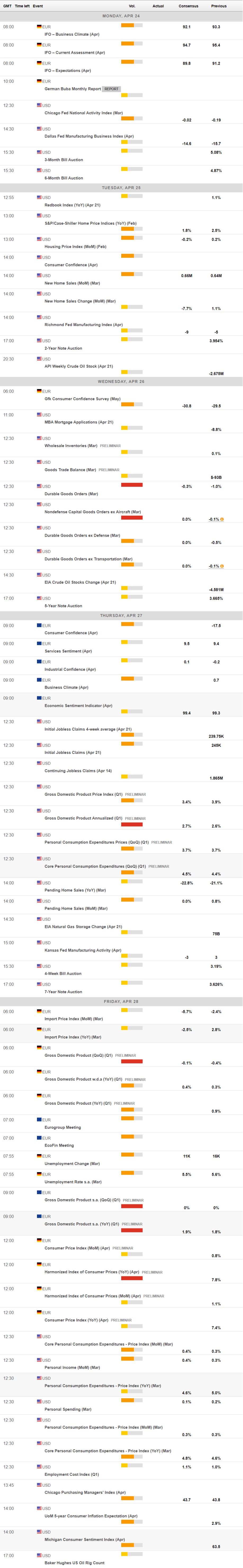

- Cautiousness arises ahead of the European Central Bank and the Federal Reserve meetings.

- Growth-related data hints at an economic downturn ahead of critical GDP figures.

- EUR/USD bullish case on pause, 1.1000 stands in the way.

The EUR/USD pair lost momentum and ended its winning streak, ending the week with modest losses at around 1.0950. The pair fell the most on Monday as the US Dollar extended its fear-inspired gains from the previous Friday. Concerns arose amid tepid United States macroeconomic data and hawkish Federal Reserve (Fed) officials’ comments, which brought a potential recession back to the table. Meanwhile, the Euro was unable to extend gains on self-strength, leaving EUR/USD consolidating within familiar levels throughout the week.

The absence of first-tier data exacerbated range trading as only on Friday, the macroeconomic calendar delivered relevant figures. S&P Global published the final estimates of the April Purchasing Manager Indexes (PMIs) for the Eurozone (EU) and the United States (US).

The EU Composite PMI jumped to 54.4 as the services index was upwardly revised from 54.5 to 56.6. The manufacturing sector remained in contraction territory, as the index printed 45.5, well below the previous estimate of 47.3. Still, the EU recorded the strongest economic growth in eleven months, with the upswing boosted by picking up demand, the strongest job creation in a year, and easing inflation, according to the official report. As for the US report, the Manufacturing PMI improved to 50.4 from 49.2, while the Services PMI printed at 53.7, beating expectations of 51.5.

Gearing up for central banks’ decisions

Additionally, speculative interest turned cautious ahead of the US Federal Reserve (Fed) and the European Central Bank (ECB) monetary policy meetings in two weeks. Policymakers these days fell short of providing fresh clues on what’s next in monetary policy. On the one hand, ECB officials maintained the hawkish bias, although hesitating between a 25 or 50 basis points (bps) rate hike in May. The central bank published the Accounts of its latest meeting on Thursday, and the document showed some members would have preferred that the key interest rates not be raised until financial market worries had abated. However, a large majority agreed to hike rates by 50 bps. The document also showed that policymakers believed that monetary policy “still had some way to go to bring inflation down.”

On the other hand, the Fed's usual hawks claimed more action, but the market does not change its view for a 25 bps rate hike coming up. According to the CME FedWatch tool, odds for such an increase stand at 82%.

Economic growth in the eye of the storm

Meanwhile, the latest released macroeconomic figures confirmed the fears triggered last week by softer-than-anticipated data. Economic Sentiment improved by less than anticipated in April, according to the ZEW survey. On a positive note, the Producer Price Price Index (PPI) in the country rose at a slower-than-anticipated pace in March, up by 7.5% YoY. At the same time, the EU confirmed the March Harmonized Index of Consumer Prices (HICP) rose at an annualized pace of 6.9%.

Across the pond, housing-related data triggered most alarms. The US published March Housing Starts, Building Permits and Existing Home Sales, all of which declined sharply in the month. Additionally, the Philadelphia Fed Manufacturing Survey contracted to -31.2 in April, much worse than anticipated, while Initial Jobless Claims rose by 245K in the week ended April 14.

Economic growth will stay in the eye of the storm next week, as the US and Germany will release the first estimates of their respective Q1 Gross Domestic Product (GDP). The US will also publish March Durable Goods Orders, while Germany will unveil the preliminary estimates of the April HICP. Finally, the US will release the March Personal Consumption Expenditures Price Index (PCE), the Federal Reserve’s favorite inflation measure.

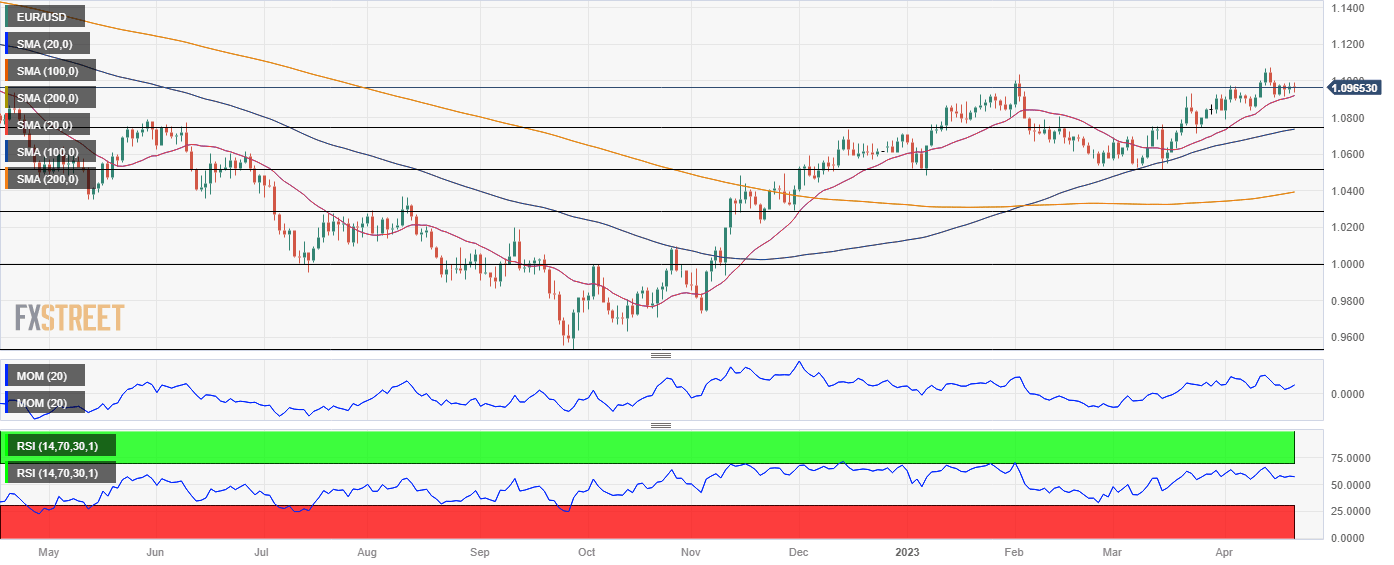

EUR/USD technical outlook

The EUR/USD pair has lost momentum, but chances of a U-turn are still quite limited. This past week’s behavior seems consolidative in the middle of a bullish trend as investors gear up to break the 1.1000 psychological threshold. Furthermore, the pair ends the week trading at the upper end of its latest range, suggesting buyers are unwilling to give up.

Technical readings in the weekly chart reflect the aforementioned described situation. EUR/USD is holding just above a bearish 100 Simple Moving Average (SMA), while the 20 SMA maintains its bullish slope below it. The latter currently converges with the 61.8% Fibonacci retracement of the 2022 yearly decline at 1.0745, reinforcing the strong static support level. At the same time, technical indicators hold within positive levels, although turning lower. The Momentum indicator is dangerously close to its 100 level, but the Relative Strength Index (RSI) indicator currently stands at 65, barely retreating from overbought readings.

The technical picture is pretty similar in the daily chart. Technical indicators ease within positive levels, reflecting lessening buying interest, although falling short of suggesting sellers have taken control. Meanwhile, EUR/USD keeps developing above bullish moving averages, with the 20 SMA providing near-term support at around 1.0920 and advancing above the longer ones.

A clear break above 1.1000 will favor a bullish continuation, initially towards 1.1060. Once above the latter, the rally should continue towards the 1.1120 price zone en route to the 1.1200 figure. Support remains in the 1.0880/910 area, with room for a test of 1.0745 if the region gives up.

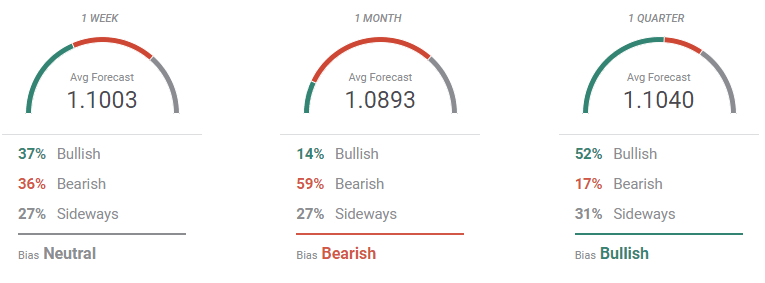

EUR/USD Sentiment poll

The FXStreet Forecast Poll suggest EUR/USD will extend its consolidative phase next week. The pair is seen at around 1.1000, with an equal number or bullish and bearish bets. Bears dominate the monthly perspective, as 59% of the polled experts believe the pair will trade at lower levels. On average, is seen at 1.0893. Still, the decline seems corrective and in the quarterly view, bulls re-take control, represented by 52% of experts and with an average target of 1.1040.

The Overview chart shows that the near-term moving average turned modestly lower, although the longer ones extended their advances into fresh multi-month highs. More relevantly, speculative interest continued to lift the potential base of the future range. In the monthly view, the pair is not seen below 1.0600, while for the three-month perspective, the base stands now at 1.0500.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.