- The US Federal Reserve announced the beginning of the end of the pandemic financial support.

- The upcoming week will bring fresh inflation figures for the US and the EU.

- EUR/USD steadily approaches 1.1500 and is poised to lose the level.

A tumultuous week ended with the EUR/USD pair trading at fresh 2021 lows near the 1.1500 figure. The American dollar stands victorious across the FX board after the US Federal Reserve delivered as expected. The US Central Bank kept interest rates unchanged at 0.25%, as expected, and announced the reduction of its asset purchases by $15 billion per month. The Fed will begin tapering its $120 billion pandemic-related program later in November with reductions in Treasuries purchases by $10 bln and mortgage-backed securities by $5 bln.

Heating inflation not moving policymakers

The announcement did not surprise investors, as in their previous meeting, US policymakers noted that the economy has made progress toward the central bank’s goals, adding that if “progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted.”

On inflation, Federal Reserve Chair Jerome Powell & Co said they still believe high inflation will be transitory, although Powell noted that supply chain issues would likely extend well into next year, which means inflation will also remain high.

Powell denied the Fed is behind the curve on inflation and noted it is hard to forecast in the current pandemic environment. However, the annual inflation rate in the US hit a 13-year high of 5.4% in September, while core PCE prices, Fed’s favorite measure, held steady at 3.6% YoY for a third straight month in September. Somehow, it seems to be stabilising, but at too high levels.

The central bank’s head preached patience. He said he would not want to surprise markets by changing the taper strategy, opposite to the statement that noted that they could adjust the strategy as needed. His conservative stance put some pressure on the greenback while boosting Wall Street, although the dollar’s decline was short-lived.

The US Federal Reserve is not the only central bank blaming bottlenecks in the supply chain for spurring price pressure and bumpy growth. What most central banks have in common is that they expect that flowing supplies will make inflation ease, despite the fact that they are not certain about it.

The European Central Bank President Christine Lagarde said on Thursday that it is very unlikely that the ECB would raise interest rates in 2022, despite the Consumer Price Index EU running at a 13-year high of 3.4%, according to September estimates.

Lagarde said that the outlook for inflation over the medium term remains subdued, and thus the conditions for a rate hike “are very unlikely to be satisfied next year."

US employment, the weak leg?

Back to the US and chief Powell, who said that “if you look back to 3-6-9 month average, job creation is between 550,000-600,000 if we can get back on that path we would be making good progress.” Job creation was well above that average in June and July but fell in August and September, with the country adding just 194K new positions in the latter. Additionally, the JOLTS Job Opening showed that openings were down to 10.4 million in August, while the quits rate soared to 2.9%.

The October Nonfarm Payroll report showed that the country added 531K new jobs in October, beating expectations and in line with Powell’s comfort levels. The Unemployment Rate declined to 4.6%, while the Participation Rate held steady at 61.6%. The report had a limited impact on the dollar, which retained its dominance and reached a fresh yearly high against the shared currency.

At the same time, the US posted some encouraging growth-related reports. The October ISM Manufacturing PMI contracted to 60.8 from 61.1, although better than anticipated. The official services index jumped to 66.7, much better than the previous 61.9 and beating the market’s expectations. Additionally, September Factory Orders advanced 0.2% MoM.

On the other hand, European data was mostly discouraging. German Retail Sales were down 2.5% MoM in September, while Factory Orders in the same month posted a modest 1.3% advance. Finally, Industrial Production in the same period contracted 1.1%. In the EU, the Producer Price Index jumped to 16.0% YoY in September, hinting at mounting inflationary pressures.

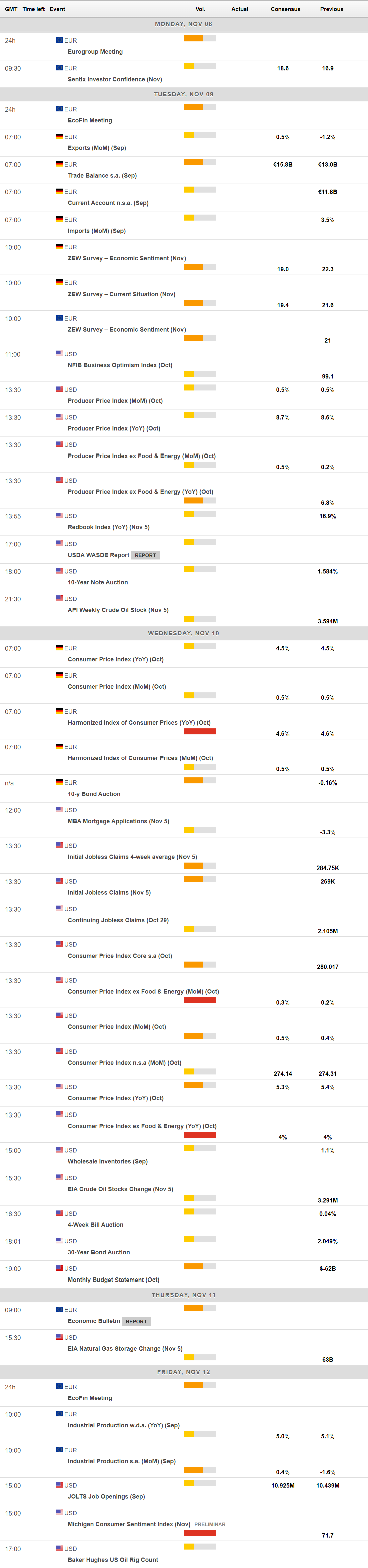

During the upcoming week, the EU, Germany and the US will publish the final estimates of October inflation figures. There won’t be much more to cover, in terms of macroeconomic data, although it is worth noting that Germany will release the November ZEW Survey, while next Friday, the US will unveil the preliminary estimate of the November Michigan Consumer Sentiment Index, previously at 71.7.

EUR/USD technical outlook

The EUR/USD pair is down for a second consecutive week and trading at its lowest since July 2020. The weekly chart shows that it has broken below its 200 SMA, which stands below the shorter ones. At the same time, technical indicators have extended their declines within negative levels, hinting at lower lows ahead.

According to the daily chart, the pair is also set to extend its decline. After spending the week around a flat 20 SMA, it finally moved below it on Thursday, extending its decline ahead of the weekly close. Meanwhile, technical indicators head firmly lower within negative levels, reflecting strong selling interest.

The main support area is now at around 1.1460/70. The level should attract buyers at least on a first attempt to break below it. If the price zone gives way, the pair would likely extend its slump to the 1.1400/20 region.

The pair would need to recover above 1.1520 first, and 1.1615 later to shrug off the negative stance, but sellers will likely reject advances if the rally extends towards a stronger resistance level at 1.1670.

EUR/USD sentiment poll

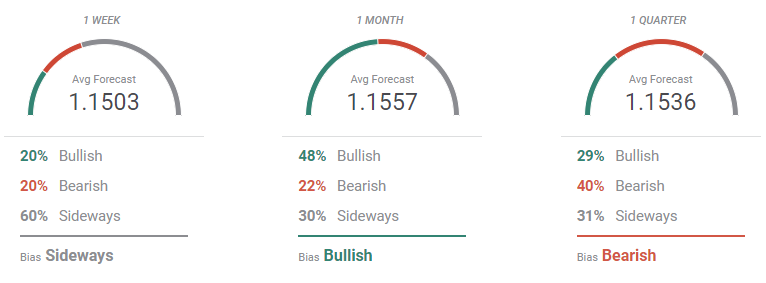

The FXStreet Forecast Poll shows that the market is expecting the bearish breakout to extend in the upcoming days. The weekly view is actually neutral, as most market participants see the pair stuck around 1.15. The monthly perspective is mildly bullish, while the quarterly one shows that bears are a majority. Worth noting that, on average, the pair is expected to remain below the 1.1600 threshold.

According to the Overview chart, the pair is set to extend its decline as the three moving averages offer bearish slopes. Most targets accumulate below the current level in the weekly and quarterly view, although there’s a neutral range of possible targets in the monthly perspective. Lower lows are expected in the three-month view, with most possible targets accumulating in the 1.13/1.16 area.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD rose to fresh highs around 1.1240

EUR/USD maintained its bullish momentum on Thursday, climbing to the 1.1240 region as the US Dollar accelerated its decline amid growing concerns about the economic fallout from Trump's tariffs.

GBP/USD picks up pace, challenges 1.3000

GBP/USD made significant gains, edging just pips shy of the psychological 1.3000 barrier. The advance came amid trade war jitters and a sharp sell-off in the Greenback following the announcement of 145% US tariffs on China.

Gold flirts with record peaks near $3,175, Dollar tumbles

Gold continued its record-setting rally on fresh tariff-related headlines, surging past the $3,170 mark per troy ounce after the White House confirmed new tariffs, sparking another round of US Dollar selling.

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.