EUR/USD Weekly Forecast: Bulls hesitate as concerns arise

- Federal Reserve Chair Jerome Powell repeated the FOMC’s hawkish message.

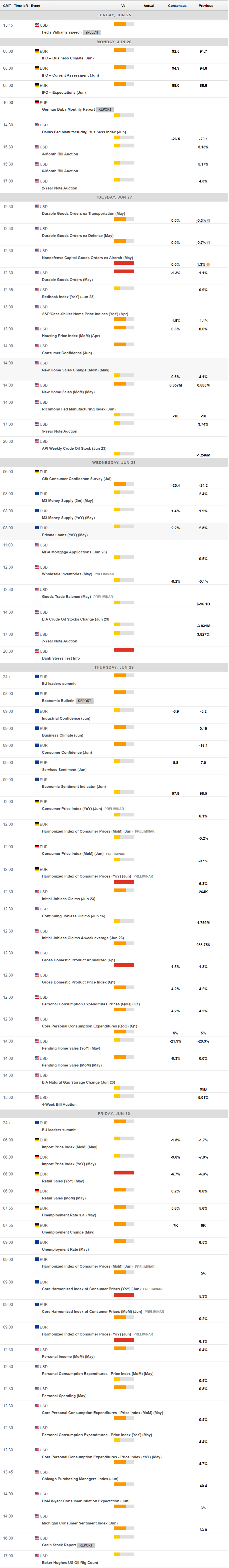

- European inflation and the US Bank Stress Test in the docket next week.

- EUR/USD loses its bullish momentum, although bears remain side-lined.

The EUR/USD pair changed course this past week, ending in the red in the 1.0880 price zone. It briefly traded above the 1.1000 threshold but turned south amid a dismal mood and poor macroeconomic figures reinforcing investors’ concerns.

United States (US) Federal Reserve (Fed) Chairman Jerome Powell pressured the US Dollar mid-week while testifying about the Semi-Annual Monetary Policy Report before Congress.

Powell was hawkish as he reiterated that more interest rates are likely in the months ahead. The latest Federal Open Market Committee (FOMC) dot plot implied at least two hikes in the near term, although market players do not look convinced. Additionally, he described the economy as “still strong” and the labor market as “tight.” Powell also said policymakers see inflation still running high, another sign of additional monetary tightening in the docket, although he clarified they would move forward at a moderate pace. Finally, he added rate cuts are off the table for this year.

Stock markets extended losses as Powell poured cold water on bets the central bank is near the end of the tightening cycle, but the US Dollar did not receive the usual safe-haven attention, with the news barely enough to prevent a steeper decline of the American currency. EUR/USD peaked at 1.1011 on Thursday, ahead of Powell’s second day of testimony before a different congressional commission, turning definitively south after evidence the Fed will maintain the hawkish path.

European setback weighs on sentiment

The market sentiment was further dented by the Bank of England (BoE) as the Monetary Policy Committee (MPC) voted 7-2 to raise the Bank Rate by 50 basis points (bps), doubling the market’s expectations for a 25 bps hike amid stubbornly high inflation.

The Euro accelerated its slump on Friday, following a slew of dismal macroeconomic figures. S&P Global released the preliminary estimates of the June PMIs, which showed Eurozone economic growth slowed at the end of the second quarter. The manufacturing sector remains the weakest, with the German index plummeting to 41 and the Eurozone Services PMI printing at 43.6. Services output held within expansionary territory, although Germany's Services PMI fell to 54.1, its lowest in three months, while the EZ index eased to 52.4, its lowest in five months. On a positive note, the S&P Global report noted that “the slowdown was accompanied by a marked cooling of inflationary pressures.”

Across the pond, news were also concerning. The US S&P Global Manufacturing PMI fell to 46.3 from 48.4 in May, while the Services PMI eased from 54.9 in April to 54.1 but beat the expected 54. Finally, the Composite PMI edged lower, printing at 53. The news maintained the USD bid ahead of the weekly close as Wall Street edged further south.

EU inflation and the US Bank Stress Test

Coming up next, Germany and the Eurozone will release the preliminary estimates of their respective June Harmonized Index of Consumer Prices (HICP), while the US will publish May Durable Goods Orders and the final assessment of the Q1 Gross Domestic Product (GDP). More relevantly, the Federal Reserve System will unveil the results of the Bank Stress Test. The latter could take its toll on the upcoming central bank’s decision, as Fed officials have affirmed the banking system remains strong and healthy ever since the crisis that unfolded last March. FOMC’s decision to become dovish was partially explained by fears additional tightening would unwind financial chaos. So, if the Bank Stress Test actually informs an upbeat scenario, the Fed would have clearance to continue with monetary tightening.

EUR/USD technical outlook

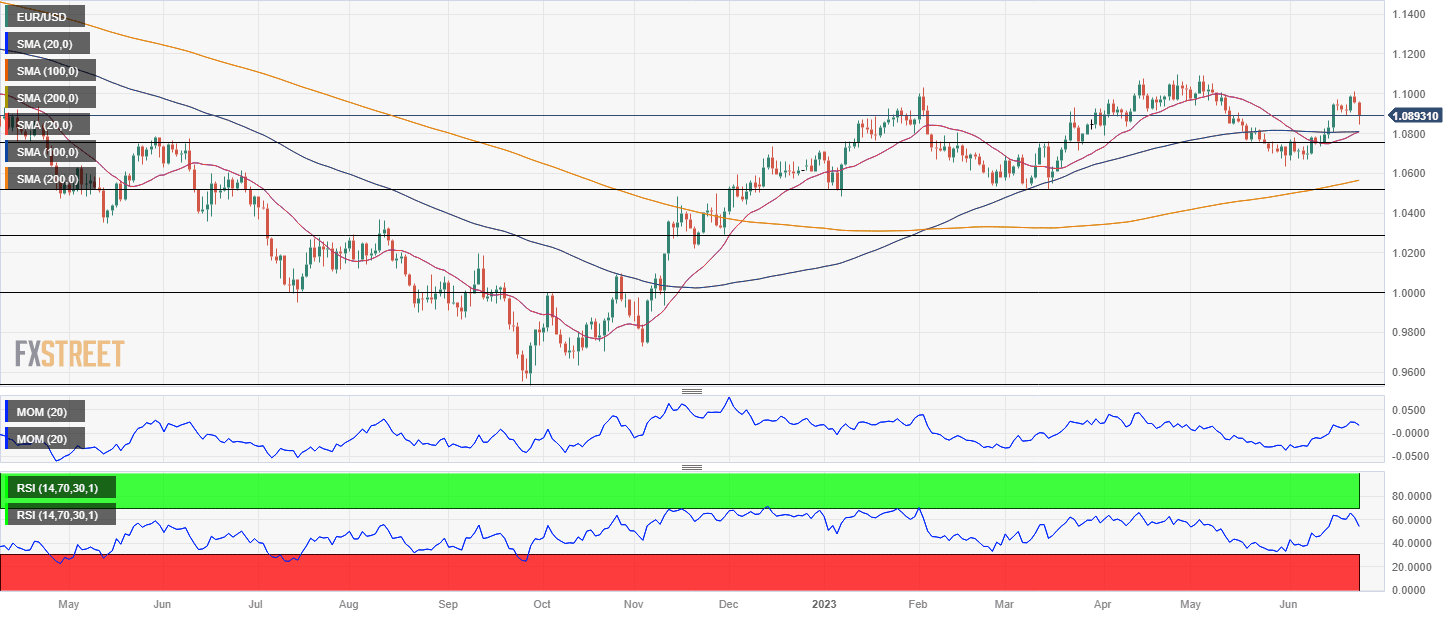

The EUR/USD pair has lost its bullish momentum, but technical readings are far from suggesting an upcoming decline. The weekly chart shows that Friday’s slide to 1.0843 met buyers at a directionless 100 Simple Moving Average (SMA), while the 20 SMA remains flat below the longer one. At the same time, technical indicators have turned south, but without enough strength to confirm another leg lower and still holding well above their midlines.

Furthermore, EUR/USD develops far above the 61.8% Fibonacci retracement of its 2022 yearly decline at 1.0745. As long as the level holds, there’s room for a test of the upper end of the range at 1.1494, the February monthly high.

The daily chart offers a similar picture as technical indicators ease from their recent highs, maintaining bearish slopes within positive levels. At the same time, EUR/USD changes hands well above all its moving averages, with the 20 SMA aiming to cross above the 100 SMA, both converging at around 1.0800. The latter is now a critical support area, as buyers will likely give up if the pair breaks below it. The aforementioned Fibonacci level at 1.0745 is a line in the sand for the current trend, with US Dollar bulls taking over once below it.

Near-term resistance can be found at 1.0930/50, followed by the 1.1000 psychological threshold. The pair would need to extend its advance beyond 1.1040 to become attractive to bulls, aiming then for the 1.1180 region. Not likely at the time being, yet if the pair breaks above the latter, 1.1230 comes as the next potential target.

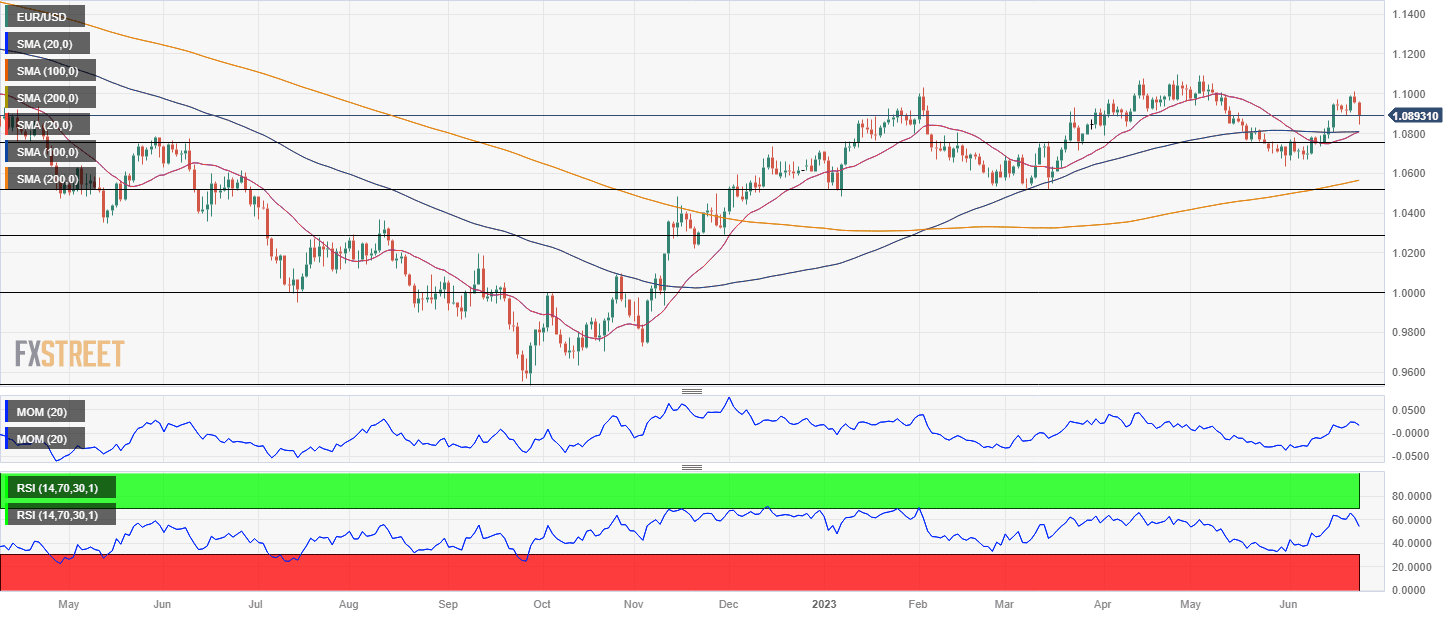

EUR/USD sentiment poll

EUR/USD sentiment poll

The FXStreet Forecast Poll shows that market players are doubting EUR/USD could extend its advance. The pair is neutral in the weekly perspective, seen on average around the current level. Bulls account for 50% of the polled experts in the monthly view, with the pair seen above the 1.0900 mark, gaining further room in the long-term, as in the quarterly perspective buyers are at 69%. The average target is up to 1.1037.

The Overview chart reflects the growing cautious mood. The three moving averages have lost their upward strength and turned marginally lower, not enough to confirm a slide. In the monthly view most targets accumulate in the 1.0900/1.1200 area, while in the quarterly perspective, the congestion is in the same range.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.