- Policymakers from the EU and the US pledged to maintain exceptional monetary easing.

- Slow economic progress and pandemic fatigue weighing on investors’ mood.

- EUR/USD long-term bullish stance remains firmly in place.

The EUR/USD pair ends the week where it started, in the 1.2130 price zone, and while it expanded its weekly range, it held within familiar levels. Investors’ attention centred on US Treasury yields, as long-term ones soared to one-year highs. The dollar initially rallied with yields, but the exceptional correlation was short-lived, fading as the days went by.

Central banks aligned

Speculative interest had little to work with, still waiting for fundamental headlines related to a new stimulus package in the US and progress in the battle against the coronavirus. The financial world seems to have entered a new stage of pandemic fatigue, trapped between concerns related to new strains and delayed vaccines’ deliveries, and hopes for an economic comeback in the second half of the year.

Uncertainty is not just a matter of market participants. The US Federal Reserve and the European Central Bank published the minutes of their latest meeting this week, with policymakers from both continents having one same idea: exceptional monetary easing is here to stay, as long as the pandemic keeps taking its toll on economic progress. The news fell short of surprising and had limited effects on currencies.

Encouraging but tricky numbers

Macroeconomic figures were mostly encouraging but still reflecting the struggle. The German ZEW Survey indicated that the Economic Sentiment in the country and the EU improved in February, although the assessment of the current situation plunged. The Union Gross Domestic Product was upwardly revised to -0.6% in Q4, while Consumer Confidence improved to -14.8 in February, still well into negative territory.

The US published an upbeat Retail Sales report. Sales were up a whopping 5.3% in January, while the core reading jumped to 6%. However, the solid numbers are the result of the latest round of $600 stimulus checks in the country. February readings will likely disappoint, as government aid fails to solve the underlying issue. Employment figures disappointed, and as the Fed noted in its Minutes, growth in the sector have been slowing in recent months.

Finally, Markit published the preliminary estimates of its February PMIs. In the Euro area, manufacturing activity continued to improve, but services output fell further into contraction territory, as restrictive measures weighed on the sector. US figures, on the other hand, showed that manufacturing activity slowed modestly but services output surged, with the index up to 58.9 from 58.3.

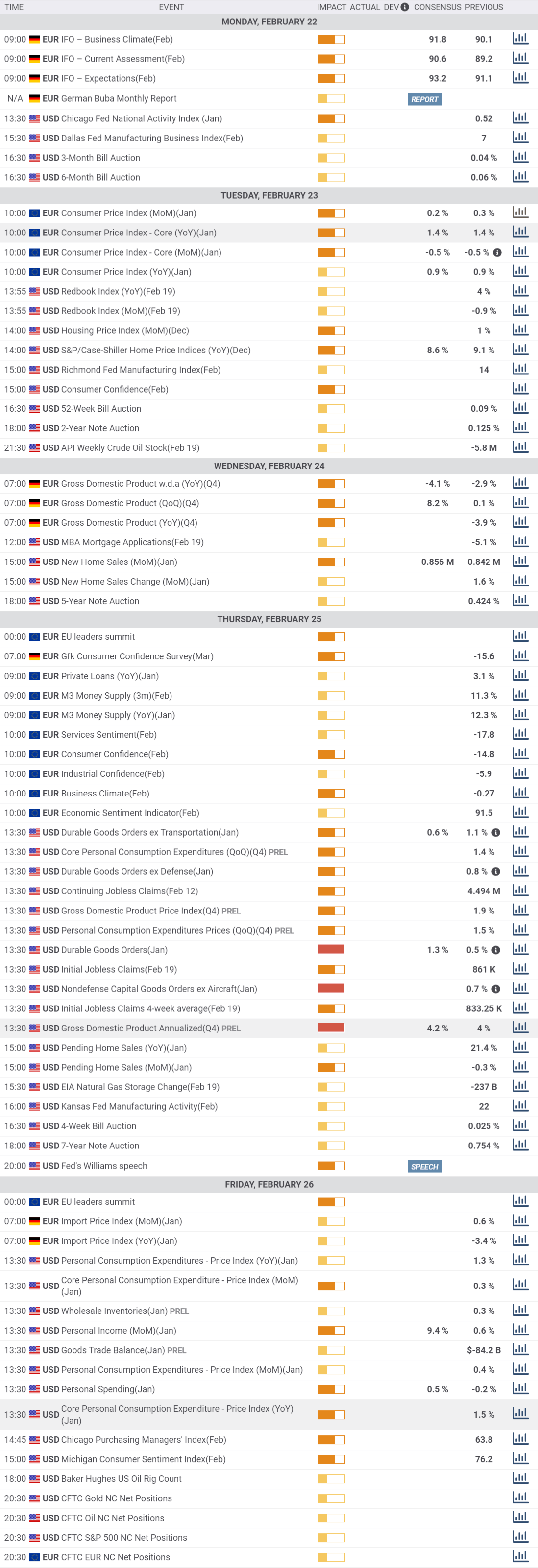

The next week will bring US January Durable Goods Orders, the only relevant first-tier piece of data and a revision of Q4 GDP. Germany will publish the February IFO survey on Business Climate and the final reading of its Q4 GDP, while the EU will post updates on inflation and Consumer Confidence.

EUR/USD technical outlook

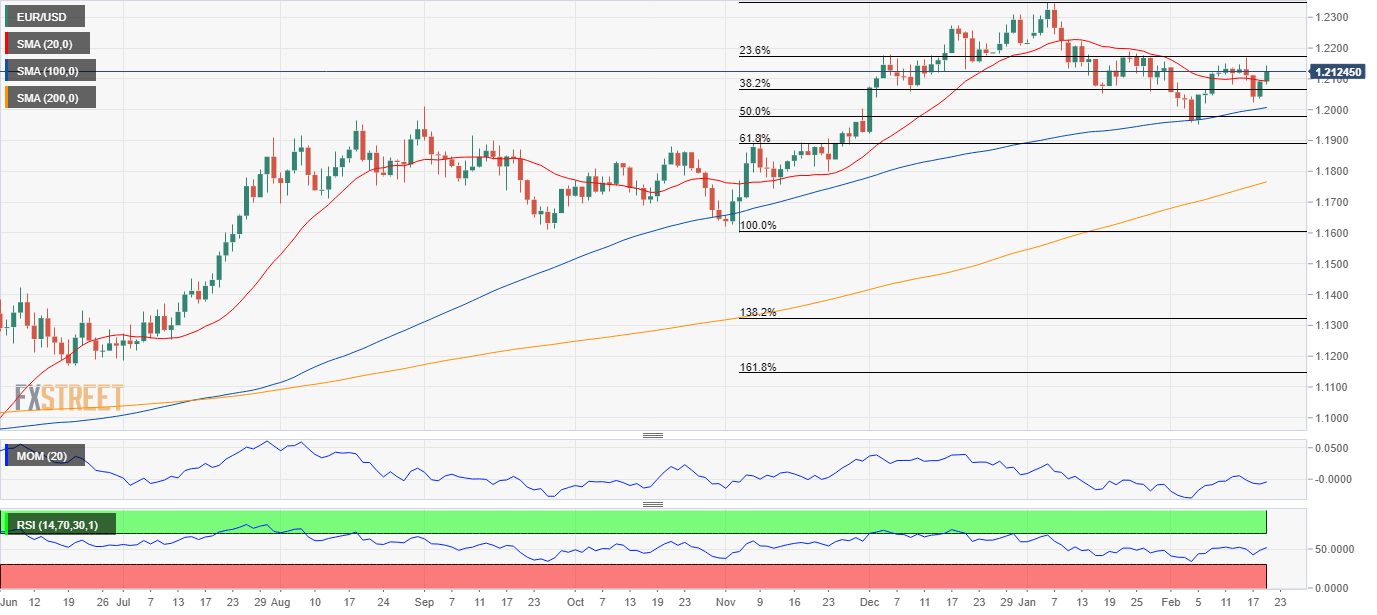

The EUR/USD pair is bullish in the long-term and has room to recover further but needs to clear the 1.2170/80 resistance level. The pair has there the 23.6% retracement of its November/January advance, and it has been meeting sellers around it ever since mid-January. The weekly chart shows that a bullish 20 SMA provided support while extending its advance beyond the longer ones. Technical indicators continue to lack directional strength but hold within positive levels.

In the daily chart, the pair is developing around a directionless 20 SMA, currently above it. The 100 SMA maintains its bullish slope, with buyers surging on approaches to it. Technical indicators have crossed their midlines into positive territory and head higher at fresh one-month highs, reflecting increased buying interest.

Beyond the mentioned 1.2170/80 resistance area, the pair has room to retest January’s high at 1.2349. Gains beyond this last seem unlikely at the time being. Supports are seen at 1.2060 and 1.1970, both Fibonacci levels. A dip towards the latter will likely attract buyers.

EUR/USD sentiment poll

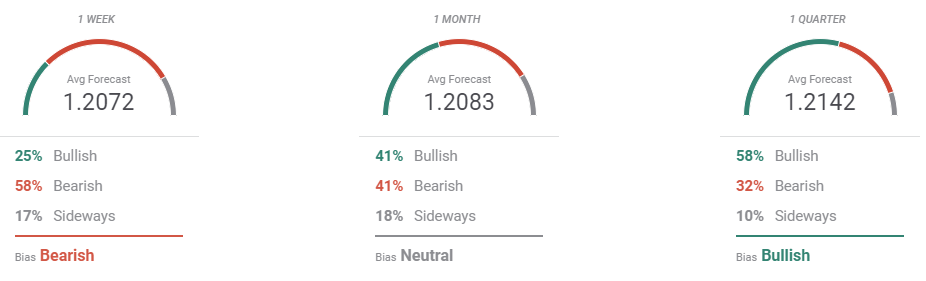

The FXStreet Forecast Poll indicates that speculative interest remains unconvinced. The pair is seen mostly neutral, as bears in the near-term aim for limited declines. The pair is neutral in the monthly view while bulls’ intentions surge in the quarterly perspective. On average, however, the pair is seen in the 1.20/1.21 price zone in the three time-frame under study.

In the Overview chart, the shorter moving average heads higher, somehow contradicting the dominant sentiment. The longer-term moving averages continue to lack directional strength. In general, there are limited chances for a bearish turn-around, as the number of possible targets sub-1.20 is limited.

Related Forecasts:

GBP/USD Weekly Forecast: At critical crossroads, next moves hinge on Boris' reopening, Biden's boost

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.