EUR/USD Weekly Forecast: Between a rock and a hard place, the Fed will decide on monetary policy

- The European Central Bank proceeded with the planned 50 bps hike despite financial turmoil.

- The United States Federal Reserve will announce its decision next Wednesday.

- EUR/USD extended its consolidative phase for a fourth week in a row, awaits fresh banking-related clues.

Financial markets were on a bumpy road this week amid concerns about the banking sector's health. The EUR/USD pair traded between 1.0515 and 1.0759 to settle above the 1.0600 mark, marginally lower from Monday’s opening.

A banking catastrophe in the makes

The week started with market players aiming to stay positive after United States President Joe Biden stepped in to rescue depositors of Silicon Valley Bank (SVB) and Signature Bank to prevent a larger financial crisis. After SVB collapsed, American regulators shuttered SB on March 12 to avoid an escalation of the banking crisis.

The situation seemed contained although speculative interest stepped back to rethink future monetary policies. The US banking crisis could be partially explained by the US Federal Reserve (Fed) and the monetary policies adopted due to the coronavirus pandemic. Massive liquidity in the first year was followed by aggressive tightening starting in early 2022, with the US interest rate benchmark jumping from 0% to 5% in less than a year. Government bonds lost value, and borrowing costs increased as a result of the Fed’s policies, affecting banks’ capitals.

However, the market mood soured again mid-week as Credit Suisse Group AG shares plummeted over 30% before trading was halted. The European bank sector collapsed amid contagion fears, and it was not until the Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) announced late Wednesday that Credit Suisse met the capital requirements imposed on banks and that they would provide liquidity if necessary. Credit Suisse tumbled after its top shareholder, Saudi National Bank Chairman Ammar Al Khudairy, ruled out providing financial assistance to the company.

Finally on Thursday, several major US banks injected $30 billion in deposits into First Republic Bank (FRC.N), also suffering from liquidity issues amid depositors rushing to take their savings out of the institution.

The contingency is far from over, and markets will hear more about capital issues in the upcoming days.

European Central Bank delivered

Despite the banking turmoil, the European Central Bank (ECB) hiked its benchmark rates by 50 basis points (bps). The accompanying statement showed that policymakers projected inflation will average 4.6% in 2023, while growth is expected to accelerate to 1.6% in both 2024 and 2025. The statement included a line noting that "the new ECB staff macroeconomic projections were finalised in early March before the recent emergence of financial market tensions."

President Christine Lagarde delivered a speech following the ECB decision and started it by saying that European banks are resilient. She added that policymakers are closely watching “current market tensions,” adding they stand ready to respond as necessary to preserve price stability and financial stability in the euro area.

Lagarde also said that there was no trade-off between price and financial stability after hiking rates despite the banking sector turmoil, clearly remarking the central bank’s focus remains on addressing the price stability issue. EUR/USD struggled to find direction as investors tried to make something out of her words, hovering around the 1.0600 level after the dust settled.

The battle to remain optimistic resumed on Friday but failed miserably after SVB officially announced bankruptcy, while First Republic shares are down sharply, dragging stock markets lower.

Federal Reserve coming up next

The United States Federal Reserve will announce its monetary policy decision next Wednesday. Financial markets were anticipating a 50 bps rate hike before the banking crisis unfolded amid hawkish testimony from Chair Jerome Powell. However, at the time of writing, the CME FedWatch Tool shows odds for 25 bps at 76%, while chances of a 50 bps are now out of the table. Will the Fed remain aggressive or turn cautious to prevent steeper chaos.

It could be a lose-lose scenario for the American central bank as if US policymakers opt for a 50 bps hike, they would add pressure on already stressed financial institutions. Yet if they go for a more discrete move, they will be telling markets they are worried and could also fuel the crisis while dealing with high inflationary pressures for longer.

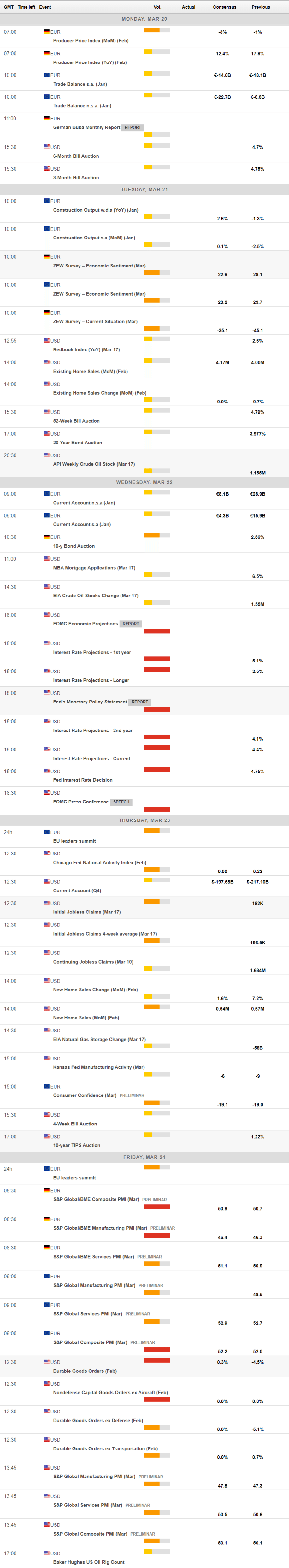

Beyond the Fed’s decision, the macroeconomic calendar will include the preliminary March S&P Global PMIs estimates, which measure business health across major economies. The US will also release February Durable Goods Orders seen up by 0.3% MoM.

EUR/USD technical outlook

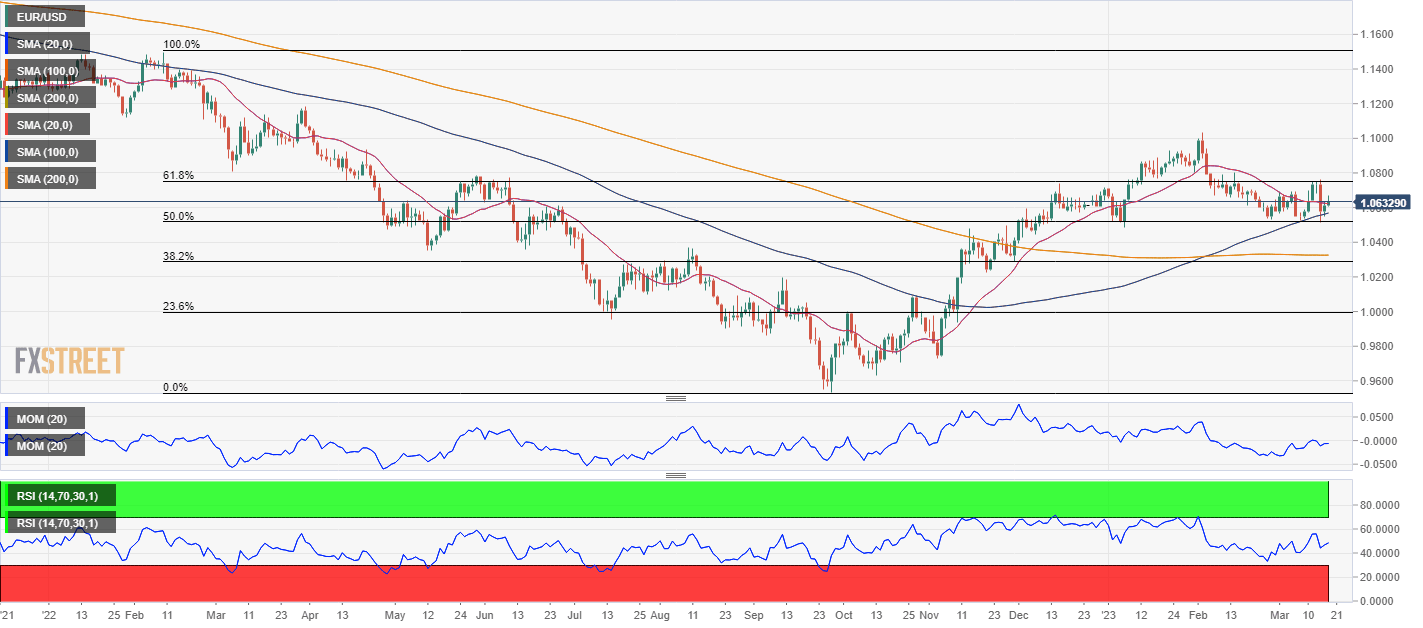

Despite a volatile trading range, EUR/USD held within Fibonacci levels for a fourth consecutive week. The weekly low was set just at the 50% retracement of the 2022 yearly slide at 1.0515, while sellers surged around 1.0745, the 61.8% retracement of the same decline. The pair currently trades mid-way between such levels, and one would need to give up for a clearer directional movement.

The weekly chart shows that the retracement lost momentum, with technical indicators stabilizing within positive levels. The pair is also ending the week above a bullish 20 Simple Moving Average, currently providing dynamic support at around 1.0590. The 100 SMA, on the other hand, gains downward traction well above the current level and widens the distance with the 200 SMA.

The daily chart also suggests that the pair is still seeking direction. The Momentum indicator seesaws around its midline, while the RSI aims north but at around 48. Meanwhile, a bullish 100 SMA provides support at 1.0560, but the pair is currently struggling to overcome a mildly bearish 20 SMA. The absence of directional strength is evident, and market participants can only hope the Fed’s announcement will end the tie.

Immediate support comes at around 1.0590, followed by the aforementioned Fibonacci level at 1.0515. A break below the latter should trigger a more relevant decline, initially towards the 1.0400 region. Bears will likely keep defending the 1.0740/50 region, although large stops are probably building just above the area. If those get triggered, the 1.0820/40 area comes into sight.

EUR/USD sentiment poll

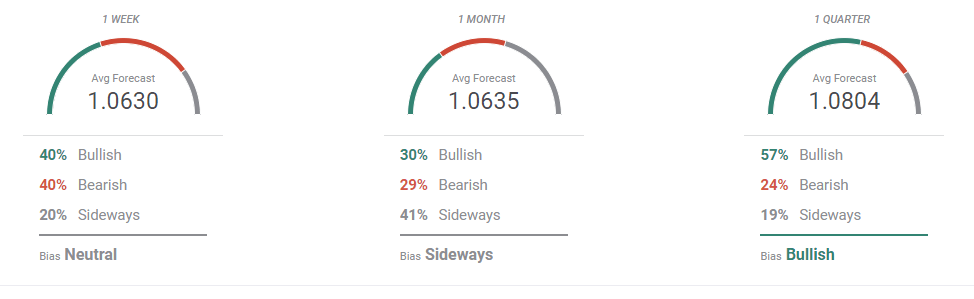

The FXStreet Forecast Poll reflects investors’ neutral stance in EUR/USD. The pair is seen hovering around the current level in the weekly and monthly perspectives, with no significant difference between bulls and bears. In the wider perspective, bulls take control, as 57% of the polled experts bet for higher targets, with the pair seen on average at 1.0804.

The Overview chart shows that the weekly and monthly moving averages are flat, although the longer ones gain bullish strength, heading north above 1.0800. Most potential targets accumulate at around 1.0900, while possible lows are at higher levels than the previous week´s one.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.