EUR/USD Weekly Forecast: All eyes on Jackson Hole and chief Powell

- The Delta variant and Fed’s tapering spurred demand for the greenback.

- Eyes turn to the Jackson Hole Symposium as investors are eager for additional clues.

- EUR/USD is technically bearish and could approach the 1.1500 figure next week.

The EUR/USD pair trades at its lowest since November 2020 in the 1.1670 price zone, as concerns fueled demand for American currency. The FX board rests on two legs these days: higher chances of US tapering and the spread of the coronavirus Delta variant.

US policymakers escalate tapering talks

The Federal Reserve published the Minutes of its latest FOMC meeting, which showed that policymakers are ready to discuss the timing of tapering in the upcoming meeting. This time, however, hints suggested that retrieving monetary support will be faster than previously anticipated.

“Looking ahead, most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace of asset purchases this year,” the document reads, although some participants would like to wait until next year. On the other hand, policymakers highlighted that reducing financial facilities does not mean an immediate rate hike, also noted that the employment sector had not achieved the “substantial further progress” required to hike.

Stocks were sharply down as speculative interest believes that the current rally to record highs is more linked to the heaping load of financial support than to economic progress. Wall Street was sharply down this week, trimming all of its August gains. Meanwhile, resurgent demand for government bonds sent yields down to fresh weekly lows.

Delta variant slowing economic comeback

At the same time, concerns related to the Covid-19 Delta variant undermined investors’ confidence. The US reported over 154K new cases in the last 24 hours and 967 deaths. At this point, more than 98% of US residents now live in an area with a “high” or “substantial” risk of coronavirus community transmission, while roughly 56% of the US population is fully vaccinated against covid. Fears that it may further delay the economic comeback fueled stocks´ decline to the benefit of the greenback.

The Delta variant is also dominant in Europe, according to the WHO, but the spread has not yet run out of control, as the region accelerates its pace of vaccination. Still, the pandemic future developments are still uncertain, adding additional weight to financial markets.

Fresh growth hints in the docket

Meanwhile, US data reflected the slowing pace of recovery. Retail Sales fell by 1.1% MoM in July, while regional manufacturing indexes came in below expectations. The most encouraging news came from the employment sector, as Initial Jobless Claims for the week ended August 13 contracted to 348K, beating the market’s expectations. On the other hand, the EU confirmed the Gross Domestic Product at 2% in the second quarter of the year and annual inflation at 2.2% in July.

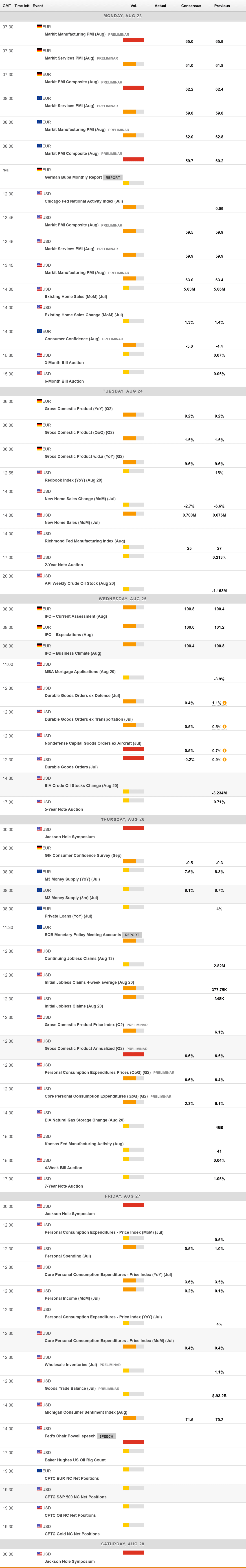

The upcoming week will start with the August preliminary estimates of Markit PMIs for the EU and the US, which would likely reflect the downbeat ruling sentiment. Germany will release its Q2 GDP estimate, foreseen at 1.5%, the IFO Business Climate, and GFK Consumer Confidence, while the US will release July Durable Goods Orders, which are expected to have contracted by 0.4%.

The main event of the week will be the Jackson Hole Symposium starting on Thursday. The annual meeting, meant to discuss important economic issues that affect economies worldwide, usually sees the presence of multiple central bank heads and market participants follow the event in the hopes of getting fresh clues on the future of economic policies. Bank of England governor Andrew Bailey and European Central Bank President Christine Lagarde are not attending the conference this year due to coronavirus restrictions. Federal Reserve chief Jerome Powell will speak on Friday, with the market’s attention focused on this specific event.

EUR/USD technical outlook

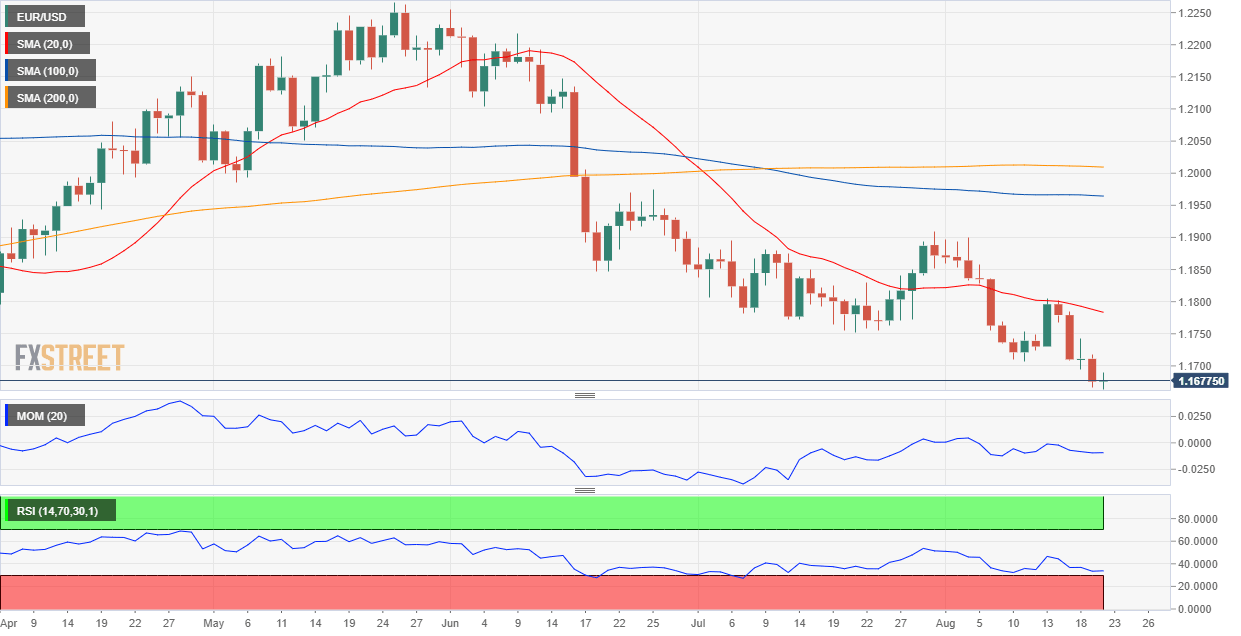

The EUR/USD pair consolidates losses, finishing the week a handful of pips above its yearly low. The long-term technical picture is bearish, with an immediate bearish target at 1.1602, the low from November 2020. The weekly chart shows that the pair accelerated its slump below its 20 SMA, while the 100 and 200 SMAs converge around 1.1560, the next relevant support area. Technical indicators head firmly lower within negative levels, still far from oversold readings.

On a daily basis, the risk is also skewed to the downside, with technical indicators barely losing their bearish momentum near oversold readings. The same chart shows that a bearish 20 SMA capped advances at the beginning of the week, with selling interest accelerating afterward.

The pair could approach the 1.1500 level in the upcoming days, mainly if it ends a day below the mentioned 1.1560 price zone. To the upside, resistance is located at 1.1735 and 1.1790, with approaches to the latter probably attracting selling interest.

EUR/USD sentiment poll

According to the FXStreet Forecast Poll, the EUR/USD pair is poised to extend its decline in the near term, seen on average at 1.1650. 67% of the polled experts are bearish on the weekly perspective, although the number decreases drastically to 14% in the monthly view. Bulls are quite a majority in the monthly and quarterly views, with the pair foreseen on average around 1.1800.

The Overview chart, however, keeps signalling bearish strength. The three moving averages maintain their bearish slopes, with the longer one barely losing strength downward. In the longer perspective, most targets accumulate at around or below the current level, with lower lows in the 1.14/1.15 area now likely.

Related Forecasts:

USD/JPY Weekly Forecast: US dollar remains the king of the safety-trade

GBP/USD Weekly Forecast: More pain for the pound? Delta, data and future Fed moves all eyed

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.