EUR/USD under pressure: Resistance levels hold firm

Key highlights

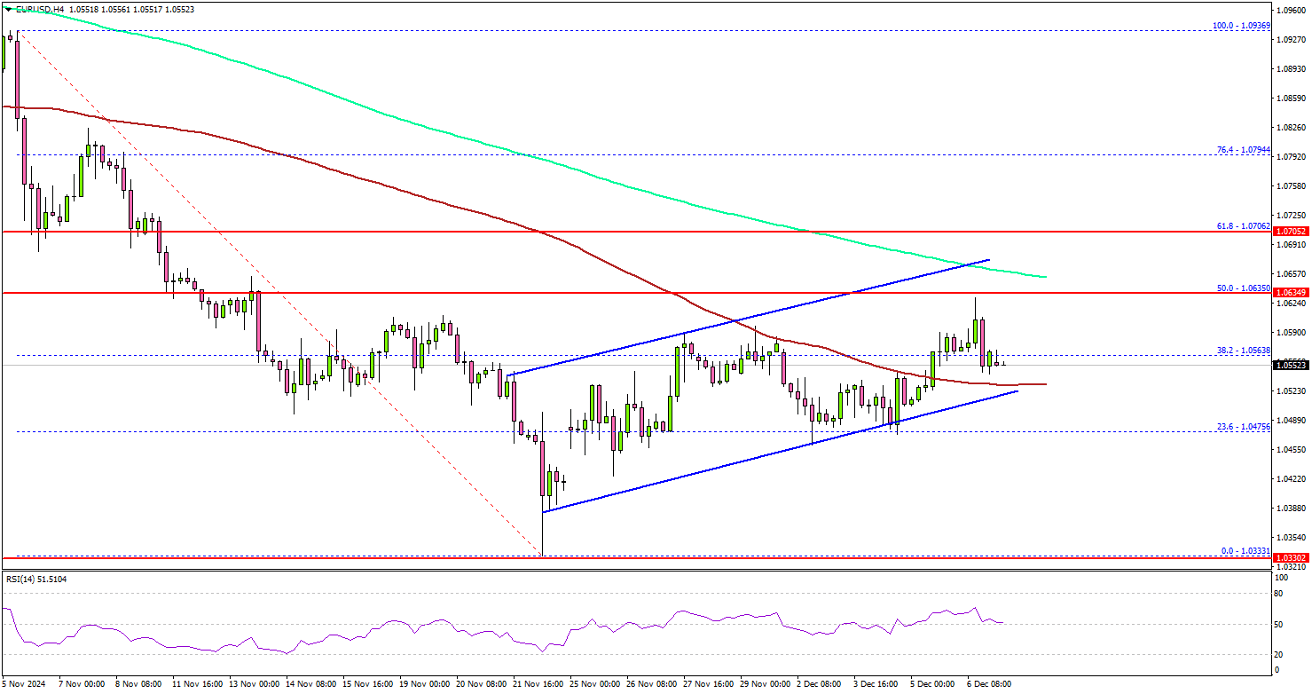

- EUR/USD started a recovery wave above the 1.0520 resistance zone.

- A key rising channel is forming with support near 1.0500 on the 4-hour chart.

EUR/USD technical analysis

Looking at the 4-hour chart, the pair surpassed the 38.2% Fib retracement level of the downward move from the 1.0936 swing high to the 1.0333 low. The pair recovered above the 1.0600 resistance level and the 100 simple moving average (red, 4-hour).

On the upside, the pair could face resistance near the 1.0635 level. It is close to the 50% Fib retracement level of the downward move from the 1.0936 swing high to the 1.0333 low.

The first major resistance is near the 1.0665 level and the 200 simple moving average (green, 4-hour). A close above the 1.0665 level could set the tone for another increase. The next major resistance could be the 1.0800 level, above which the price could climb higher toward the 1.0880 resistance. On the downside, immediate support sits near the 1.0520 level. The next key support sits near the 1.0450 level. Any more losses could send the pair toward the 1.0420 level.

Author

Aayush Jindal

TitanFX

I have spent over six years as a financial markets contributor and observer, and possess strong technical analytical skills. I am a software engineer by profession, loves blogging and observing financial markets.