EUR/USD to push for higher timeframe resistances?

ECB Hikes for a Seventh Consecutive Meeting

The EUR/USD currency pair was widely talked about on Thursday and for a good reason. The European Central Bank (ECB) hiked all three benchmark rates by 25 basis points. The main refinancing rate increased from 3.5% to 3.75%; the deposit facility rate increased from 3.0% to 3.25%, and the marginal lending rate increased from 3.75% to 4.0%. This marks the seventh consecutive rate increase since mid-2022. As of writing, markets are pricing in the possibility of about another two rate hikes before the ECB looks to perhaps hit the pause button.

In her post-announcement presser, Christine Lagarde—the President of the ECB—also communicated the possibility of additional rate hikes to combat inflation. Euro area headline inflation slightly increased to 7.0% in April (from March’s 6.9%), essentially snapping a five-month period of slowing price increases. Note that the current inflation rate remains more than three times higher than the central bank’s target.

EUR/USD Technical View

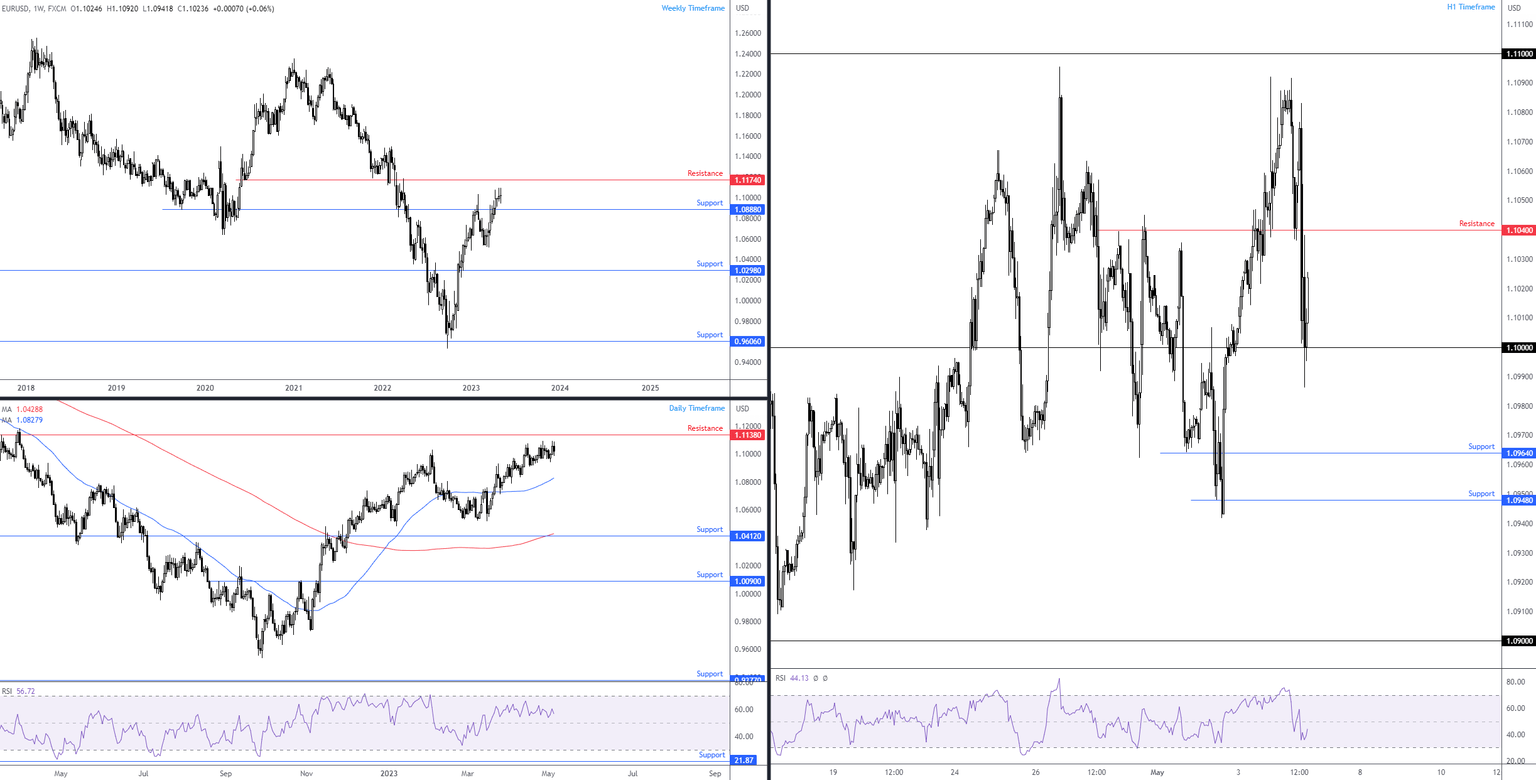

The EUR/USD aggressively explored lower levels following the rate announcement. Leaving the underside of $1.11 unchallenged, downside pressure led H1 price action into a floor of bids around the $1.10 psychological figure. I am sure most would agree that the H1 chart is a bit of a mess; although we are rebounding from $1.10, the trend is not greatly defined in the short term (longer term, it is clear we have been heading higher since September 2022). H1 resistance is at $1.1040, with a break of here perhaps approaching the $1.11ish neighbourhood.

Looking at price action on the bigger picture, we can see that upside momentum has decreased considerably since the pair retested the upper edge of the 50-day simple moving average on 24 March on the daily scale. The lack of momentum is visible through price structure: highs are weakening, and the Relative Strength Index (RSI) has been topping out during that time, hovering nearby the overbought threshold and threatening to touch gloves with the 50.00 centreline. To the upside on the daily timeframe, resistance calls for attention at $1.1138. At the same time, if sellers make a stand, given the lack of support, we could drop as far south as the 50-day SMA, currently fluctuating around $1.0828.

From the weekly timeframe, I see the current candle is on track to finish in the shape of a doji indecision candle. However, this may not be meaningful in light of the candle forming pretty much within the limits of the previous week’s range between $1.1096 and $1.0962. Resistance warrants attention at around $1.1174 and support can be seen at $1.0888.

Ultimately, chart studies suggest buyers will put in an appearance and aim at the higher timeframe resistances between $1.1174 (weekly) and $1.1138 (daily). This could see H1 price continue to defend $1.10 and target H1 resistance at $1.1040 (and possibly higher), though slipping under the round number could also be on the cards to shake hands with H1 supports at $1.0948 and $1.0964.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,