EUR/USD: there could be a near term rally building on the euro [Video]

![EUR/USD: there could be a near term rally building on the euro [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/photo-of-the-american-and-euro-banknotes-57153806_XtraLarge.jpg)

EUR/USD

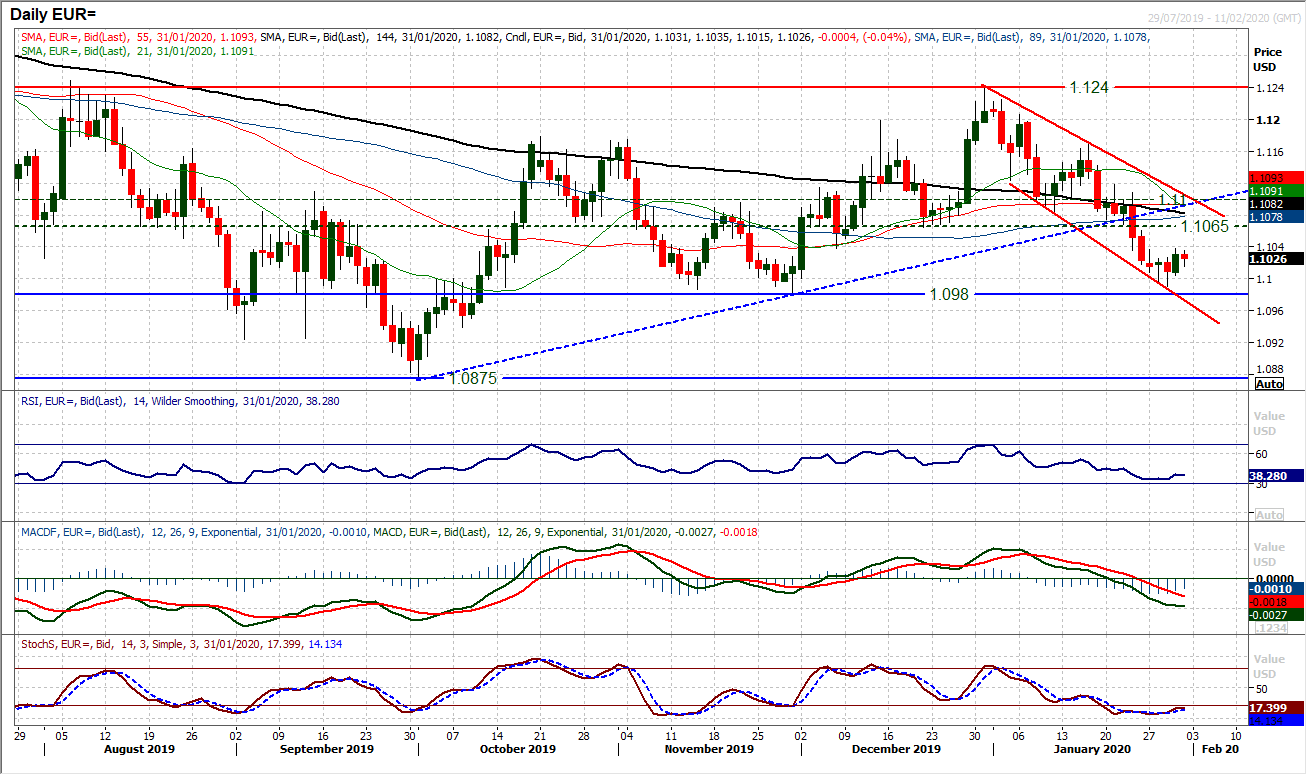

We have been wondering in recent days whether there could be a near term rally building on the euro. Yesterday’s bull candle (which added around +25 pips) was the most positively configured one day candle for almost four weeks. Importantly, after putting pressure on $1.1000 repeatedly in recent sessions, this move has now started to pull away from the $1.0980/$1.1000 support area. The move is building small improvements in daily momentum indicators, with a tick higher on RSI and Stochastics, but it is on the hourly chart where the improvement can really be seen. Hourly RSI is building above 40 and taking a stronger configuration, whilst hourly MACD lines are consistently above neutral. A first lower high (at $1.1027) was broken yesterday, but the move needs to break above resistance at $1.1035/$1.1040 for confirmation of the near term improvement. Despite all this though, it is important not to lose sight of the multi-week downtrend channel that is still the dominant chart pattern of the moment. Overhead supply really does begin to weigh above $1.1065 and this rally could still be short-lived. Trading higher against the downtrend is a risky strategy and we have to be eyeing the next opportunity to sell.

Author

Richard Perry

Independent Analyst