EUR/USD: The bullish arguments have not disappeared [Video]

![EUR/USD: The bullish arguments have not disappeared [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/forex-market-14546406_XtraLarge.jpg)

EUR/USD

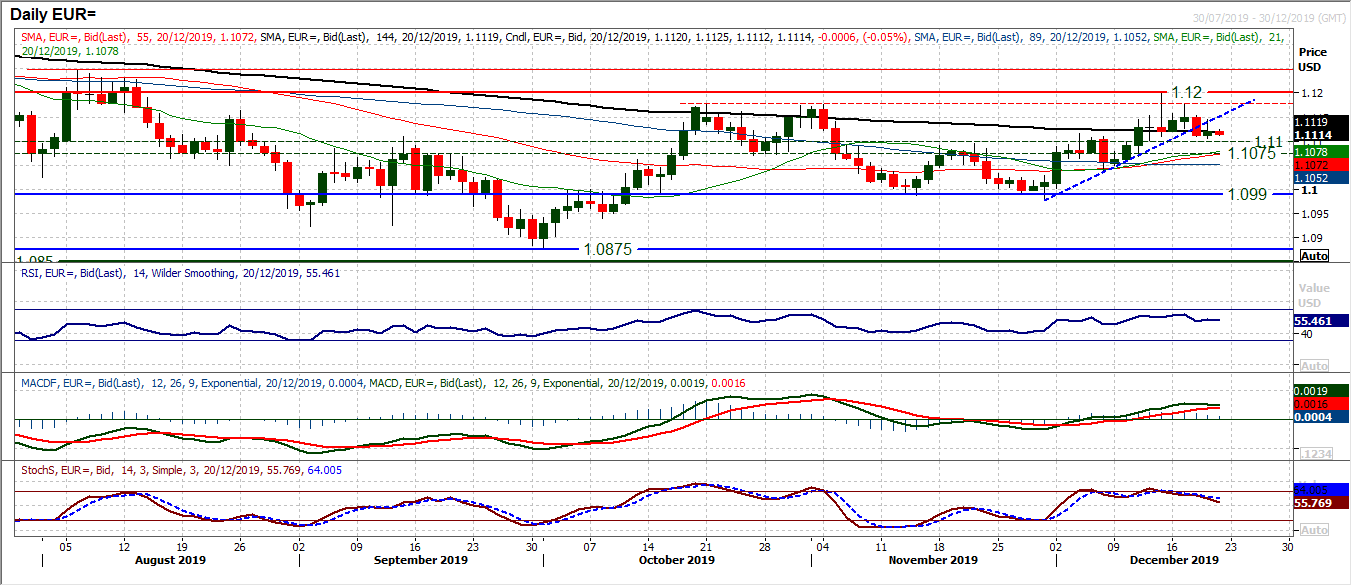

The bullish arguments have not disappeared, but are more muted now. An initial positive reaction to Wednesday’s decisive negative candle was subsequently sold into and only a marginal positive session resulted yesterday. The concern is that there is a growing sense of lower highs forming and pressure is mounting on the support $1.1100/$1.1110. We have seen that the momentum indicators have, at the least, lost their sparkle and are beginning to slip back. However, for now this is still just an unwind, rather than a growing correction. The key will be the response around the $1.1100 mid-range pivot. Pressure is seemingly mounting on the support. The market has been trading within a band $1.0980/$1.1200 for two months now, and a close under $1.1100 would be a signal for another retreat back towards the bottom of the band again. The hourly chart shows that yesterday’s high of $1.1145 is initial resistance now to breach and re-open the $1.1200 high again.

Author

Richard Perry

Independent Analyst