EUR/USD

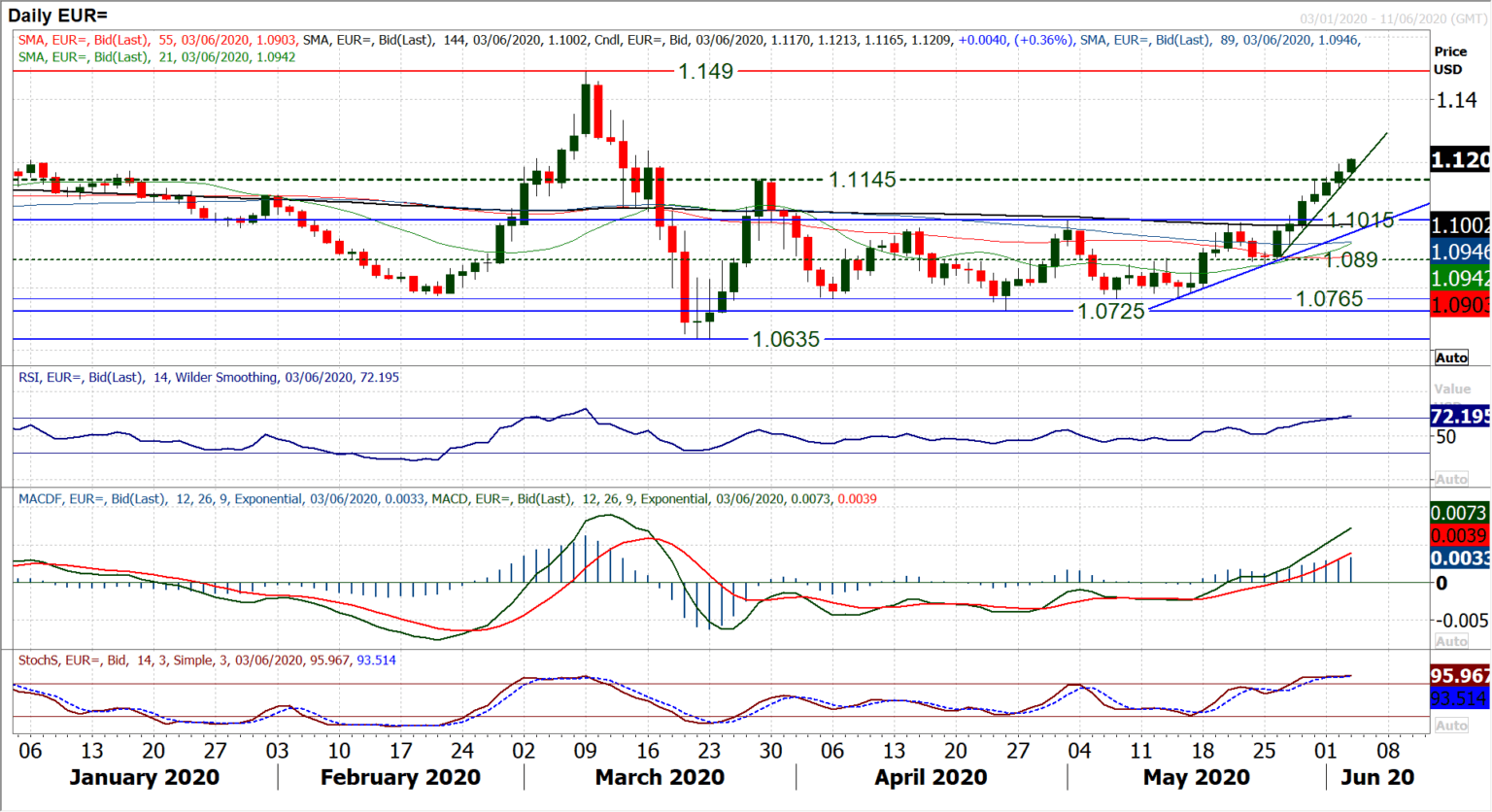

With the run of decisive positive closes higher on EUR/USD the bull run continues. The move has now decisively broken though the resistance of the late March high at $1.1145 to continue the impressive rally of the past three weeks. The original breakout above $1.1015 implied a move towards $1.1250 and this is still on the cards the way the market is moving. Momentum indicators are certainly with the breakout, with the RSI into the 70s, Stochastics strong and MACD lines accelerating higher above neutral. We still believe that the near term outlook is stretched though, as historically the RSI tends to struggle around the 70 mark and this is a warning for the current run. However, the strength of momentum and configuration of daily candlesticks (which have solid and strong positive real bodies) reflects the strength of the buying pressure. So drawing in a sharp uptrend which rises around $1.1160 today, this should be watched for potential reversal signs. It would only need a negative candle/close for this mini trend to be breached and warn of a corrective slip. For now though as the market again pushes higher, we are still happy to sit long. We are just cautious for profit-taking (especially with the ECB announcement on Thursday). We are also watching for the potential negative divergences on hourly chart (MACD especially), whilst hourly RSI below 40 would also be a warning. Initial support band $1.1080/$1.1145.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD looks at the RBA for near-term direction

AUD/USD resumed its rebound and briefly surpassed the 0.6600 barrier on the back of the renewed and marked resurgence of the downward bias in the US Dollar. Investors, in the meantime, expect the RBA to keep its rates unchanged on Tuesday.

EUR/USD: Price action hinges on the US election and the Fed

EUR/USD managed to trespass the key 1.0900 hurdle and print new highs following the Greenback’s offered stance as investors warmed up for the US election and the FOMC event later in the week.

Gold trades around $2,730

Gold price is on the defensive below $2,750 in European trading on Monday, erasing the early gains. The downside, however, appears elusive amid the US presidential election risks and the ongoing Middle East geopolitical tensions.

Ethereum Price Forecast: ETH struggles below $2,500 amid State of Michigan pension fund investment in ETH ETF

Ethereum (ETH) is trading near $2,420, down about 1% on Monday, but could bounce off a key descending trendline close to the $2,258 historically high demand zone.

US presidential election outcome: What could it mean for the US Dollar? Premium

The US Dollar has regained lost momentum against its six major rivals at the beginning of the final quarter of 2024, as tensions mount ahead of the highly anticipated United States Presidential election due on November 5.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.