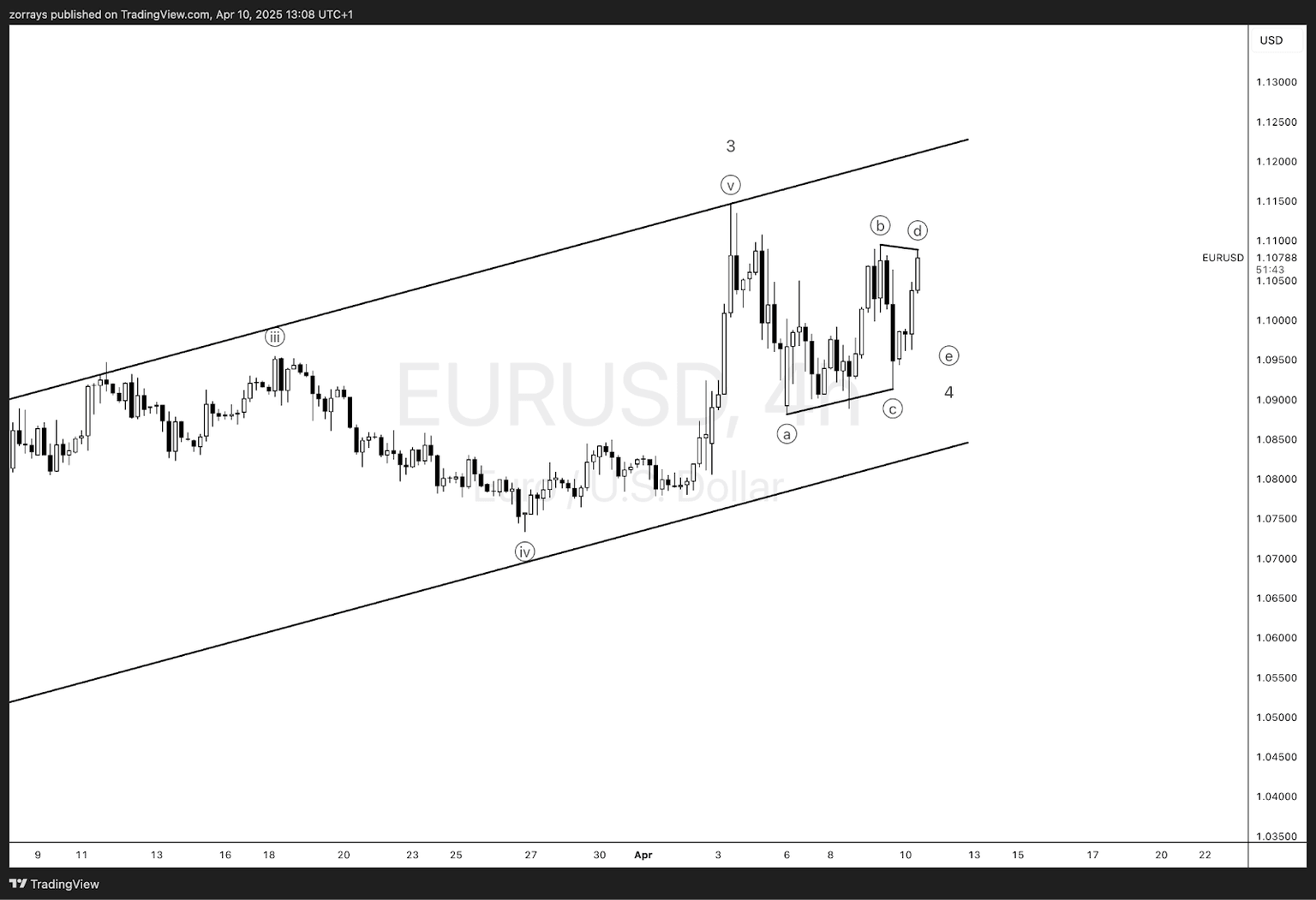

EUR/USD technical analysis: Navigating wave four consolidation

Fundamental overview

The EUR/USD pair has recently experienced significant volatility, primarily influenced by escalating trade tensions between the United States and the European Union. On April 3, 2025, former U.S. President Donald Trump announced sweeping global tariffs, including a 20% tariff on EU imports, which led to a sharp decline in global markets. In retaliation, the European Union proposed countermeasures, further intensifying the trade dispute . These developments have heightened concerns about global economic growth, prompting central banks to consider policy adjustments to mitigate potential downturns.

Technical analysis

Currently, EUR/USD is in the midst of a corrective phase, identified as Wave 4 in Elliott Wave terms. This phase is characterized by sideways price action, indicative of market indecision and consolidation. The formation appears to be developing into a contracting triangle pattern, a common structure during Wave 4 corrections.

In this context, Wave ((b)) serves as a critical level within the triangle formation. A decisive break below this level would suggest that the corrective phase has concluded, signaling the onset of Wave 5. Wave 5 typically resumes the direction of the primary trend preceding Wave 4, implying a potential downward movement in this scenario.

Key levels to monitor

-

Support at wave ((b)): A break below this level could indicate the end of the Wave 4 consolidation and the beginning of Wave 5.

-

Resistance at upper triangle boundary: A move above this boundary would challenge the current triangle pattern, potentially altering the wave count and suggesting a different market dynamic.

Conclusion

The EUR/USD pair is currently navigating a complex corrective phase, with the formation of a contracting triangle indicative of market consolidation. Traders should closely monitor the Wave ((b)) level, as a break below this point may signal the transition into Wave 5 and a resumption of the prior downtrend. Given the prevailing market volatility and ongoing geopolitical developments, maintaining vigilance and employ

Author

Zorrays Junaid

Alchemy Markets

Zorrays Junaid has extensive combined experience in the financial markets as a portfolio manager and trading coach. More recently, he is an Analyst with Alchemy Markets, and has contributed to DailyFX and Elliott Wave Forecast in the past.