Key highlights

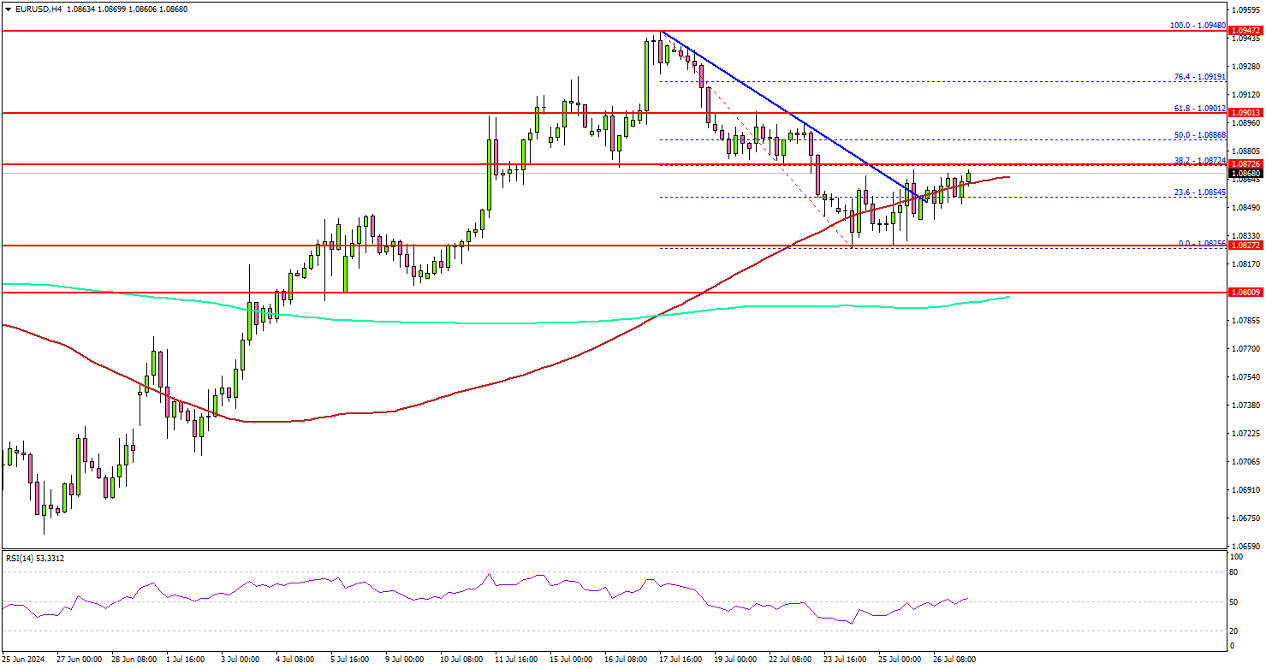

- EUR/USD found support near the 1.0825 zone.

- It cleared a connecting bearish trend line with resistance at 1.0860 on the 4-hour chart.

EUR/USD technical analysis

Looking at the 4-hour chart, the pair tested the 1.0825 support zone and remained stable above the 200 simple moving average (green, 4-hour). A low was formed at 1.0825 and the pair is now rising. There was a move above a connecting bearish trend line with resistance at 1.0860.

The pair climbed above the 100 simple moving average (red, 4-hour). It is now testing the 38.2% Fib retracement level of the downward move from the 1.0948 swing high to the 1.0825 low.

On the upside, the pair could face resistance near the 1.0875 level. The next resistance sits at 1.0900 or the 61.8% Fib retracement level of the downward move from the 1.0948 swing high to the 1.0825 low.

The main hurdle sits at 1.0920. A clear move above the 1.0920 resistance might send it toward the 1.0950 level. Any more gains might open the doors for a test of the 1.1000 zone in the coming days.

Immediate support is near the 1.0845 level. The next major support is near the 1.0820 level. A downside break and close below the 1.0820 support zone could open the doors for more losses. In the stated case, EUR/USD might decline toward the 1.0750 level.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

EUR/USD moves above 1.0850 toward the upper boundary of channel

EUR/USD advances for the third consecutive day, trading around 1.0860 during the Asian session on Monday. The analysis of the daily chart shows that the pair is positioned within a descending channel, suggesting a bearish bias.

GBP/USD holds positive ground above 1.2850, focus on Fed/BoE rate decision this week

The GBP/USD pair holds positive ground around 1.2885 during the Asian trading hours on Monday. The uptick of the pair is bolstered by the softer US Dollar amid the hope of an interest rate cut by the Federal Reserve in September.

Gold looks north as a Big week kicks in

Gold price is building on its previous recovery early Monday, having defended the key support at $2,360 on a weekly closing basis. Gold buyers fight back control heading into the critical central banks’ bonanza week, with the US Federal Reserve (Fed) – the main event risk for the bright metal.

Crypto weekly flashback and best trades for the week

Meme coins showed mixed results in the past week. Dogecoin, Shiba Inu and Pepe started their recovery early on Sunday while Dogwifhat and Bonk extend losses.

Investors hoping for a better week

Global markets will try their best to get into a better mood after contending with a tough wave of risk off flow in the previous week. Key standouts on Monday’s calendar come from UK consumer credit, mortgage approvals, and CBI trades, along with Dallas Fed manufacturing.