EUR/USD surges to three-year high amid economic uncertainty

-

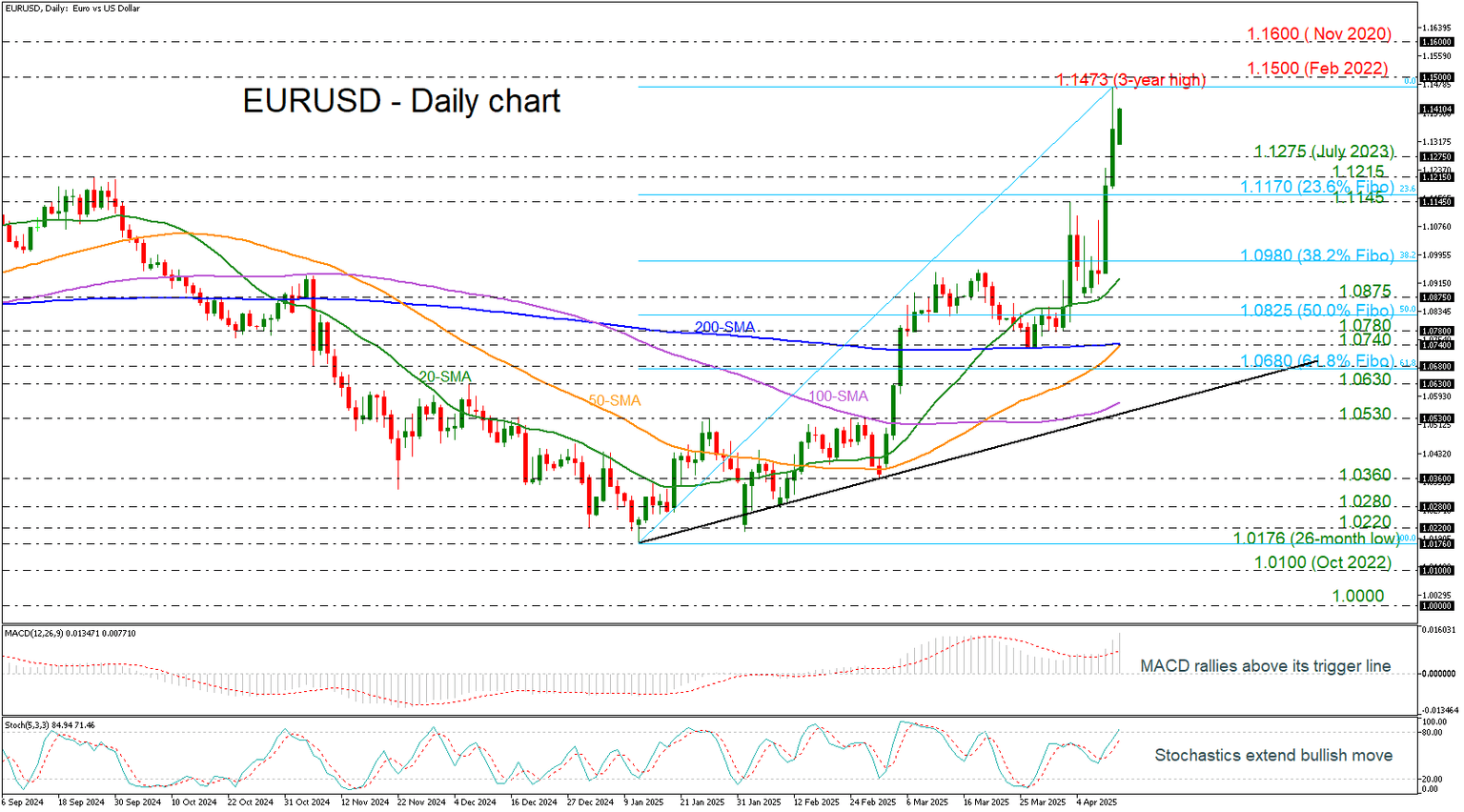

EUR/USD flies 5% near 1.1500.

-

Momentum oscillators extend upside move.

EUR/USD has seen incredible gains over the last two sessions, adding around 5% and reaching a new three-year high of 1.1473. Investors are worried about the impact of aggressive tariffs and the potential slowdown in US economic growth, while the annual inflation rate in the US eased for a second consecutive month to 2.4%, exasperating the boost in the euro.

According to technical oscillators, the MACD is rising above its trigger and zero line with strong momentum, while the stochastic is trying to enter the overbought region, confirming the bullish bias. The 50- and the 200-day simple moving averages (SMAs) are ready for a bullish crossover near 1.0740.

More advances could send traders toward the 1.1500 psychological mark, taken from the peaks in February 2022, while even higher, the inside swing low in November 2020 at 1.1600 may pause upside actions.

However, in the case of a bearish correction, the pair may retest the July 2023 high at 1.1275 ahead of the 1.1215 support. Below that, the 23.6% Fibonacci retracement level of the up leg from 1.0176 to 1.1473 at 1.1170 and the previous peak at 1.1145 may act as turning points for the market.

To sum up, EUR/USD is experiencing a sharp bullish tendency in the short term, but negative movements are also on the table.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.