EUR/USD remains stuck between SMAs [Video]

-

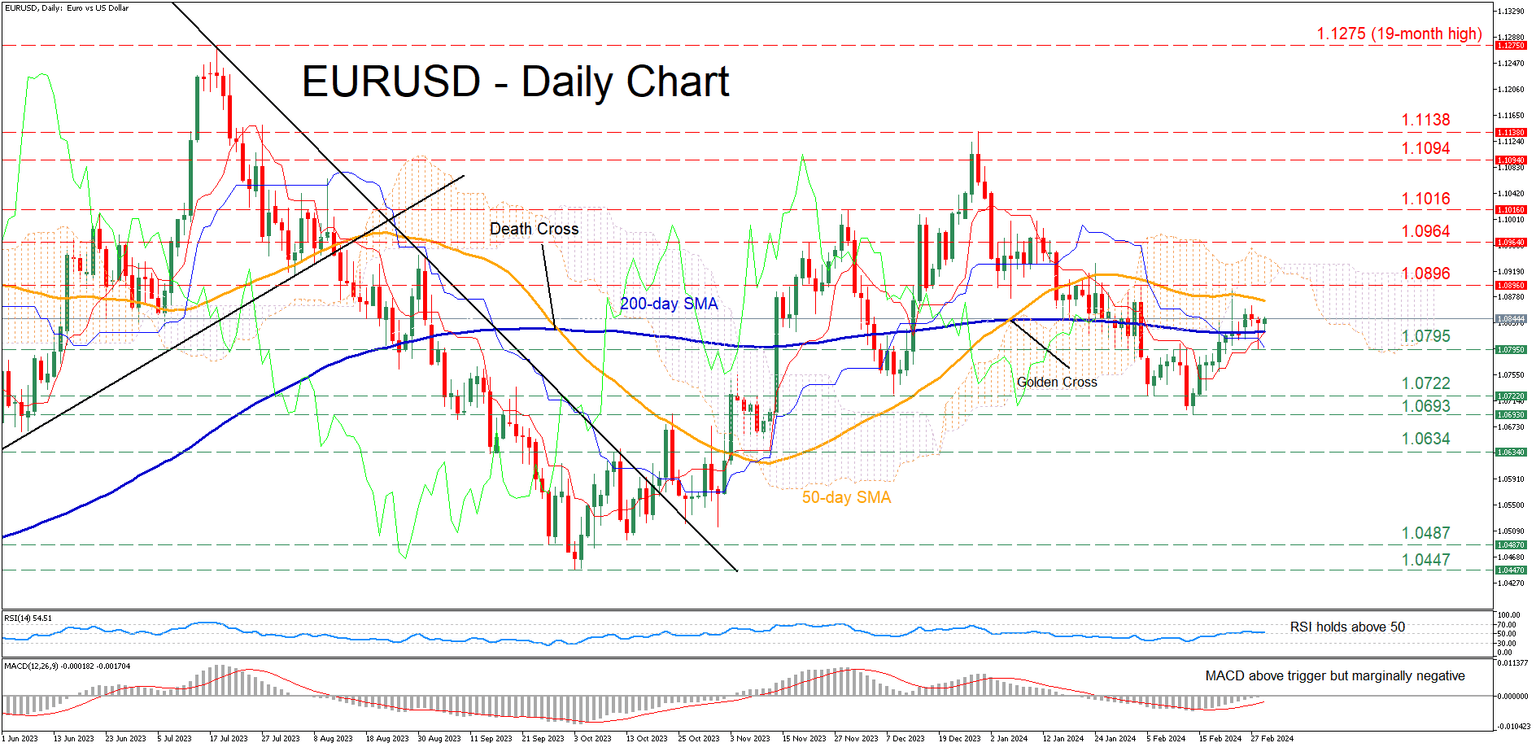

EURUSD trades in a range defined by 50- and 200-day SMAs.

-

Momentum indicators are marginally tilted to the upside.

![EUR/USD remains stuck between SMAs [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/world-currencies-53600634_XtraLarge.jpg)

EURUSD has posted a mild recovery following its pullback from the December high of 1.1138 to the 2024 bottom of 1.0693. However, the pair’s rebound has stalled at the congested region that includes the 50-day simple moving average (SMA) and Ichimoku cloud, with the price consolidating between the 50- and 200-day SMAs.

Considering that both the RSI and MACD are providing cautiously positive signals, the pair might claim the 50-day SMA and test the January-February resistance of 1.0896. Higher, the November resistance of 1.0964 could prove to be the next barrier for the bulls to overcome. A violation of that territory could pave the way for the November high of 1.1016.

Alternatively, should the pair fall back below the 200-day SMA, immediate support could be found at the 1.0795 hurdle. Sliding beneath that floor, the price may challenge the December bottom of 1.0722. Even lower, the 1.0634 barricade could provide downside protection.

In brief, even though EURUSD’s rebound has come to a halt, the 200-day SMA has prevented further declines. Therefore, a break above or below the recent range defined by the pair's SMAs is likely to be followed by an aggressive move in the same direction.

Author

Stefanos joined XM as a Junior Investment Analyst in September 2021. He conducts daily market research on the currency, commodity and equity markets, from a fundamental and a technical perspective.