EUR/USD Price Forecast: US Dollar sinks on Trump’s tariffs

EUR/USD Current price: 1.0554

- United States tariffs on Mexico, Canada and China came into effect early on Tuesday.

- The US Dollar sank alongside global stocks amid concerns about US economic future.

- EUR/USD maintains its bullish momentum at fresh 2025 highs.

The EUR/USD pair is trading at its highest since last December, well above the 1.0500 mark amid broad US Dollar (USD) weakness. Financial markets are in risk-off mode, yet the Greenback falls amid speculation United States (US) President Donald Trump tariffs would negatively impact the local economy.

After back-and-forth announcements, fresh levies on Canadian, Mexican and Chinese imports into the US took effect early on Tuesday. Authorities from the affected countries did not take long to respond.

China’s Commerce Ministry announced additional tariffs of up to 15% on US imports of key farm products, including chicken, pork, soy and beef. Canada announced reciprocal tariffs, while Mexico’s response is on the way. As a result, global stocks plummeted alongside the USD.

Government bond yields are also on the move, with yields under pressure. The 10-year Treasury note currently offers 4.13%, down 4 basic points, while the 2-year note offers 3.89%, down 8 bps.

Data-wise, the Eurozone (EU) released the January Unemployment Rate, which matched the December reading with 6.2%, better than the 6.3% expected. The American session will bring minor housing-related figures and a couple of Federal Reserve (Fed) speakers. Still, trade-related headlines are likely to overshadow anything else.

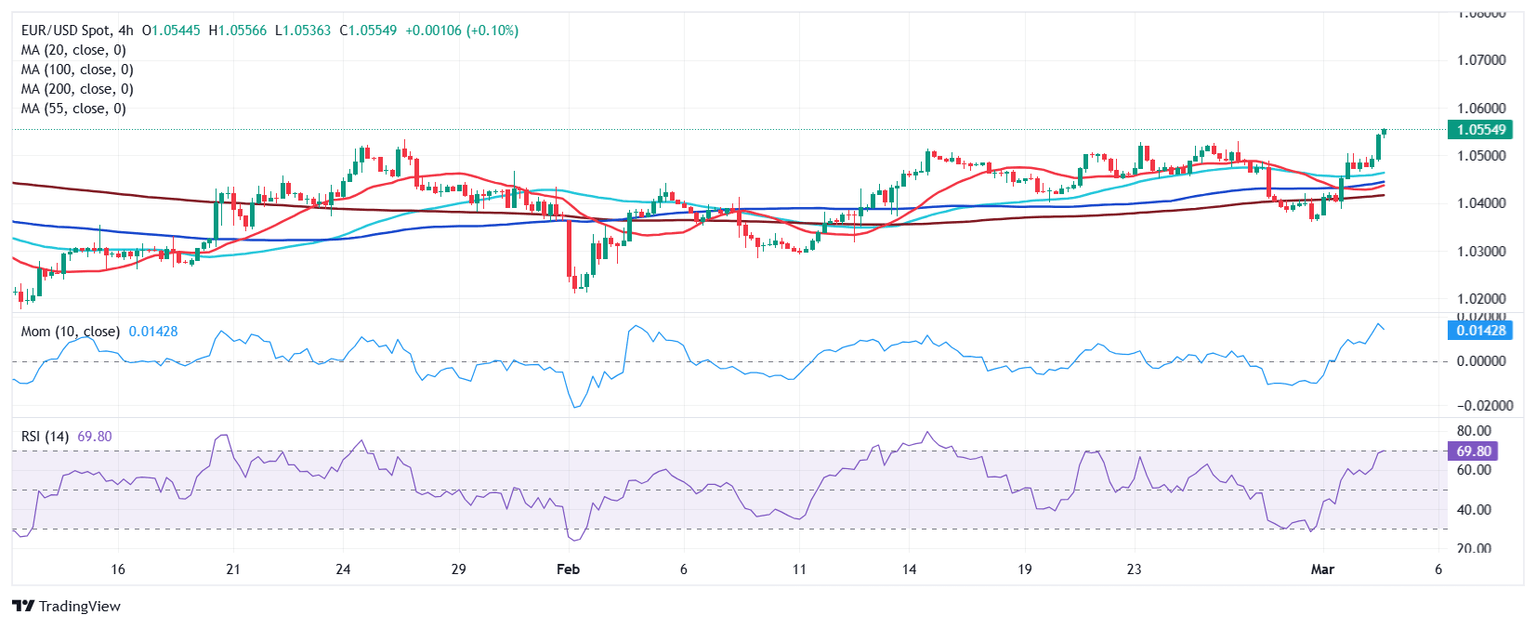

EUR/USD short-term technical outlook

From a technical point of view, the daily chart for the EUR/USD pair shows it is sharply up for a second consecutive day, pressuring the fresh 2025 high at 1.0556. Technical indicators in the mentioned time frame head firmly north, in line with additional gains ahead. Finally, EUR/USD is surpassing a bearish 100 Simple Moving Average (SMA) currently in the 1.0510 region. The 20 SMA advances below the longer one, in line with the dominant upward strength.

In the near term, and according to the 4-hour chart, the bullish momentum is quite strong. Technical indicators head sharply up, reaching overbought levels yet showing no signs of upward exhaustion. At the same time, EUR/USD soared past its moving averages, with bullish 20 and 100 SMAs converging at around 1.0440.

Support levels: 1.0520 1.0480 1.0440

Resistance levels: 1.0560 1.0605 1.0650

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.