EUR/USD Price Forecast: Upside momentum should accelerate above 1.0500

- EUR/USD rose above 1.0300, reversing three daily pullbacks in a row.

- The US Dollar faced fresh selling pressure despite higher US yields.

- Chief Powell reiterated the Fed’s cautious stance on monetary policy.

After a three-day negative streak, EUR/USD finally saw some light at the end of the tunnel, rebounding well past the 1.0300 mark to hit two-day peaks on turnaround Tuesday.

The pair’s recovery came as the US Dollar (USD) failed to extend its multi-day bounce, pushing the US Dollar Index (DXY) back to the boundaries of the key 108.00 support.

Despite US yields maintaining their upside bias, fresh trade tensions remaining in place and Chair Jerome Powell’s reiterating the Federal Reserve's (Fed) prudent stance when it comes to adjusting further its monetary policy, the Greenback suffered the resurgence of the downward bias.

Tariff drama fuels Dollar strength

United States (US) President Donald Trump’s ongoing tariff manoeuvres continue to stir the markets. While the widely debated 25% tariff on Canadian and Mexican imports has been postponed, the existing 10% duty on Chinese goods remains in place, adding to investor uncertainty.

Initially, this indecision prompted traders to reduce long USD positions, leading to some softness in the currency early last week. However, the tide turned after Trump doubled down on his protectionist stance, announcing plans to impose new 25% tariffs on all steel and aluminium imports. Adding to the pressure, he hinted at reciprocal tariffs on multiple nations, with details expected soon.

Despite Tuesday’s correction, the ongoing trade rhetoric is expected to keep fuelling the demand for the US Dollar, potentially leaving the pair struggling for direction.

Central banks take centre stage

Markets are now closely watching central bank policy shifts.

- Federal Reserve: At its January 28-29 meeting, the Fed held interest rates steady at 4.25%-4.50%, keeping investors in suspense about the next move. With strong US growth, persistent inflation and a tight labour market, policymakers are treading carefully, describing inflationary pressures as "elevated." For now, the Fed is taking a wait-and-see approach as Trump’s trade and fiscal policies create uncertainty.

At his semiannual testimony before Congress, Federal Reserve Chair Jerome Powell stated that the central bank is not in a rush to cut its short-term interest rate due to the strong economy, low unemployment, and inflation exceeding the Fed's 2% target. He noted that the economy has made significant progress over the past two years, with a 4% jobless rate and a 4% inflation rate. Powell also emphasised that easing too quickly could hinder progress in controlling inflation. Future cuts depend on continued inflation declines and a stable job market.

- European Central Bank (ECB): Meanwhile, across the Atlantic, the ECB cut rates by 25 basis points last week, in a widely expected move. With eurozone growth stagnating and inflation still above the 2% target, the central bank saw easing as necessary. ECB President Christine Lagarde reassured markets that further rate cuts would depend on incoming data, dismissing the possibility of more aggressive 50-basis-point reductions. She expressed confidence that inflation could be tamed by 2025, despite ongoing trade tensions.

Winners and losers in the trade war

The tariff landscape remains a double-edged sword:

- If prolonged tariffs drive US inflation higher, the Fed may adopt a more hawkish stance, further strengthening the US Dollar.

- If the tariff war extends to the European Union (EU), the euro could face additional headwinds, pushing EUR/USD closer to parity sooner than expected.

Technical outlook: Key levels to watch

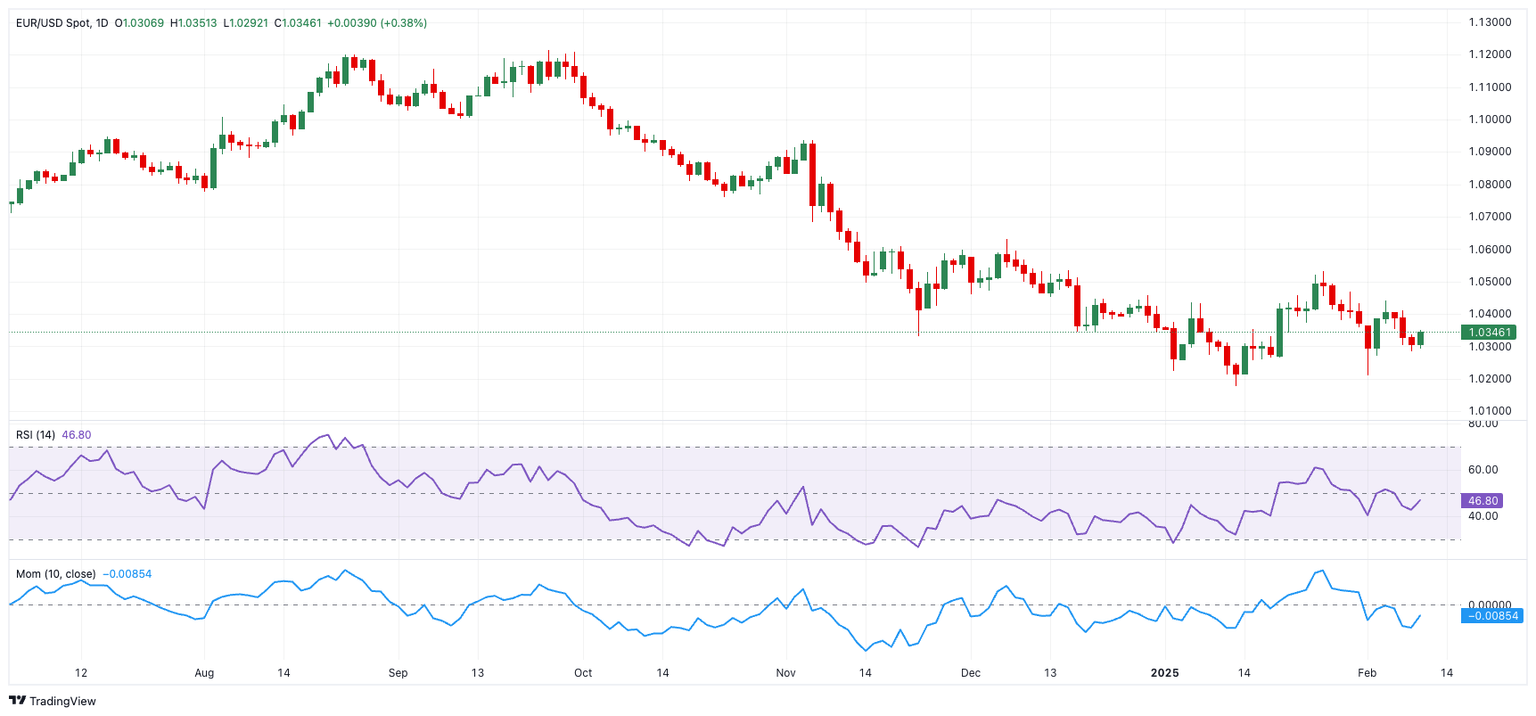

EUR/USD looks to have regained some traction from its recent lows near 1.0280.

The pair should find some solid support at the weekly low of 1.0209, set on February 3. A break below this level might cause a decline to 1.0176, the lowest mark observed in 2025 thus far.

On the upside, resistance is expected at 1.0532—the annual high from January 27—with additional obstacles at 1.0629 (the December peak) and the 200-day Simple Moving Average at 1.0752.

The Relative Strength Index (RSI) has bounced beyond 46, showing a pick-up of momentum, while the Average Directional Index (ADX) remains near 18, implying that the present trend may be fading.

EUR/USD daily chart

What’s next for the Euro?

EUR/USD faces a tough road ahead, caught between a resurgent US Dollar, diverging Fed-ECB policies and sluggish eurozone growth. With Germany’s economic slowdown adding to the pressure, the euro remains vulnerable to further declines.

While short-term rallies are possible, the broader outlook remains uncertain, with global market forces dictating the next move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.