EUR/USD Price Forecast: Too soon to retarget 1.1000?

- EUR/USD advanced to three-week highs beyond 1.0930.

- The US Dollar lost further ground as US election remained under way.

- The Fed meets on Thursday and is expected to cut rates by 25 bps.

EUR/USD built on Monday’s marginal advance and rose further on Tuesday, reaching the area above the 1.0930 level, or new three-week highs, extending its auspicious start to the new trading week.

In addition, spot surpassed the critical 200-day Simple Moving Average near 1.0870, a positive technical signal that bodes well for the continuation of the recovery, at least in the very near term.

Meanwhile, the US Dollar lost further momentum, causing the US Dollar Index (DXY) to flirt with three-week lows in the mid-103.00s amidst a broad-based rebound in both US and German bond yields.

On the monetary policy front, a 25-basis-point rate cut by the Federal Reserve (Fed) is fully priced in for later in the week, as ongoing disinflation and signs of a cooling labour market support this expectation.

Across the Atlantic, the European Central Bank (ECB) recently implemented a 25-basis-point rate cut on October 17, bringing the Deposit Facility Rate down to 3.25%, as anticipated. ECB officials remain cautious on further rate moves, emphasising the need to monitor upcoming economic data.

Meanwhile, market participants should closely follow the developments from the US election, where bets seem to slightly lean towards a second term by Republican Donald Trump, which, according to the majority of opinions, should be supportive of a stronger US Dollar going ahead.

As both the Fed and ECB consider their next moves, EUR/USD’s direction will largely depend on broader economic trends. With the US economy currently outperforming the eurozone, the Greenback could remain strong in the near term, while a potential Trump win in the upcoming election might further bolster the Greenback.

In terms of market positioning, speculative net shorts in the euro rose to two-week highs, surpassing 50K contracts, amid a modest uptick in open interest.

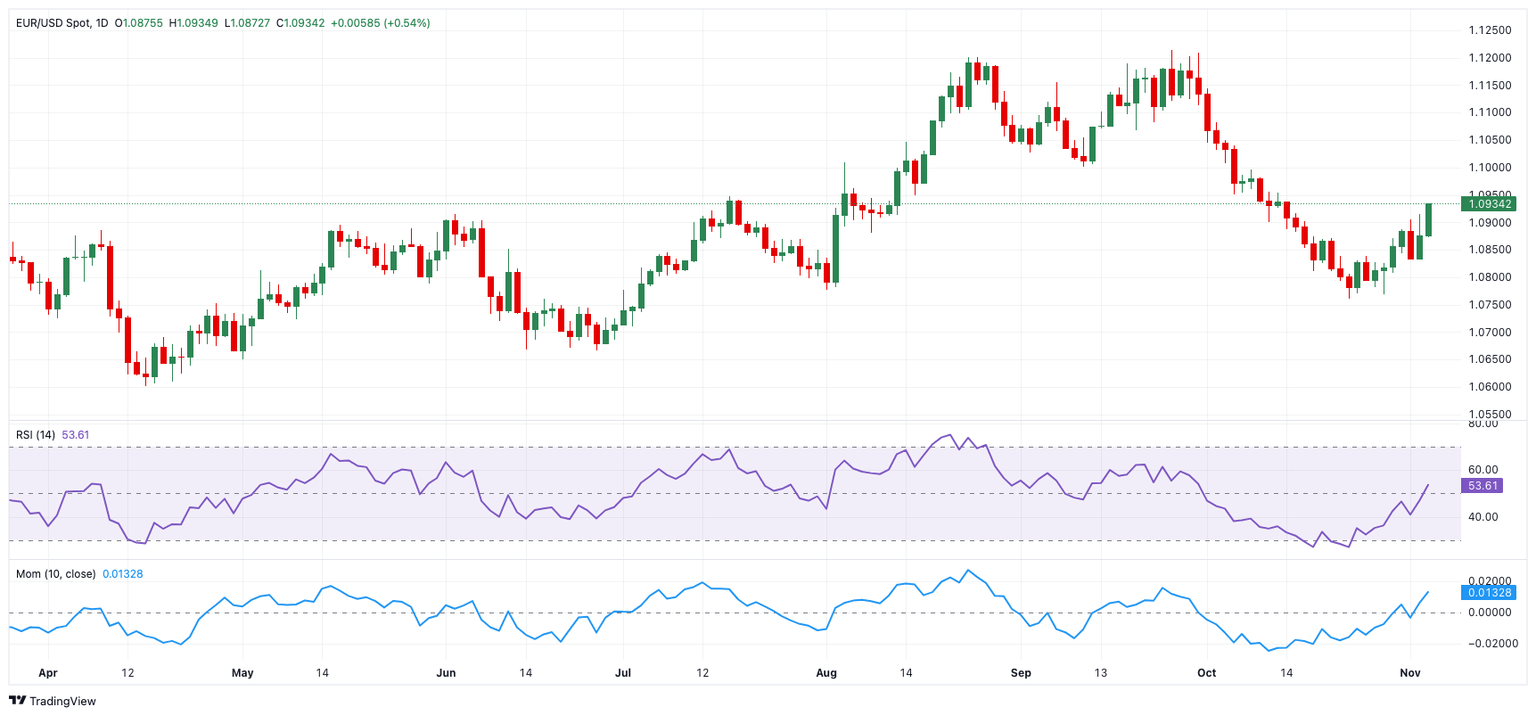

EUR/USD daily chart

EUR/USD short-term technical outlook

Extra gains might propel EUR/USD to a November high of 1.0934 (November 5), ahead of the preliminary 100-day and 55-day SMAs of 1.0940 and 1.1008, respectively. The 2024 top of 1.1214 (September 25) comes next, prior to the 2023 peak of 1.1275 (July 18).

On the downside, first support is seen around the October low of 1.0760 (October 23), before the round level at 1.0700 and the June low of 1.0666 (June 26).

Meanwhile, if EUR/USD convincingly breaks above the 200-day SMA, the pair's outlook will brighten.

The four-hour chart indicates a continuation of the ongoing rebound. Against this, the first barrier is 1.0925, seconded by 1.0954 and then 1.0996. On the flip side, there is interim contention at the 100-SMA and the 55-SMA at 1.0846 and 1.0838, respectively, ahead of 1.0830. The relative strength index (RSI) improved past 64.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.