EUR/USD Price Forecast: The 200-day SMA holds the downside

- EUR/USD came under pressure and broke below 1.0800 once again.

- The US Dollar found support from tariff jitters and risk-off trade.

- All the attention remains on April 2, or “liberation day”.

The Euro (EUR) briefly sank below the 1.0800 support on Monday, just to regain some composure afterwards and retake the area beyond that key level. The pair, in the meantime, managed to keep the distance from last week’s test of its critical 200-day Simple Moving Average (SMA).

The daily downtick in spot came in response to a decent bull run in the US Dollar (USD), which sent the US Dollar Index (DXY) back above the 104.00 mark as markets weighed intense tariff concerns and signs of slowing US economic growth.

It is worth noting that fanning the flames of current trade fears, Trump hinted at an additional 20% tariff on goods from the European Union, possibly within the next week, renewing worries of a transatlantic trade spat that could rattle global markets.

Trade war redux? Investors on edge

Trump’s tough talk—this time targeting autos, aluminium, and pharmaceuticals—has rekindled fears of a fresh trade war. While Canada and Mexico remain exempt until early April, global trade conditions remain murky.

From a monetary policy standpoint, fresh tariffs might prompt the Federal Reserve (Fed) to maintain a hawkish stance to counter inflationary pressures. Conversely, retaliatory measures and slower growth could push the Fed toward a more cautious path. This dynamic is injecting additional volatility into currency markets, with the Euro directly in the firing line.

Glimmer of hope for the Euro amid geopolitical shifts

On the geopolitical front, developments in Eastern Europe provided some relief. Ukrainian President Volodymyr Zelenskiy announced a ceasefire covering vital energy sites and Black Sea routes, aided by US-brokered deals that helped ease regional tensions.

President Trump also noted a potential US-Ukraine agreement on critical mineral revenue-sharing, which could pave the way for US companies to invest in Ukraine’s energy infrastructure. Although modest, these headlines helped the Euro find its footing.

Central banks: Holding steady, yet tilting toward easing

The Federal Reserve left rates unchanged earlier in the month but hinted at a possible 50 basis points of easing later this year. Fed Chair Jerome Powell acknowledged that tariffs are fuelling inflation concerns, but he signalled the central bank’s intention to wait for more data before taking action.

Across the pond, the European Central Bank (ECB) trimmed its key rate by 25 bps and suggested it may ease further if uncertainty persists. Updated ECB forecasts revealed weaker growth prospects and stubborn near-term inflation, though policymakers expect price pressures to moderate by 2026. ECB President Christine Lagarde also warned that a US-EU tariff clash could shave 0.5% off Eurozone GDP, even as she applauded Germany’s fiscal stimulus efforts.

Positioning: Euro bulls tiptoe back in

Speculative traders (non-commercial) have cautiously started to rebuild long positions on the Euro. Net longs rose for a third week in a row beyond 65K contracts—the highest level since late September 2024—while hedge funds extended their short positions, lifting total contracts to more than 100K, according to the latest CFTC data.

EUR/USD Technical Snapshot

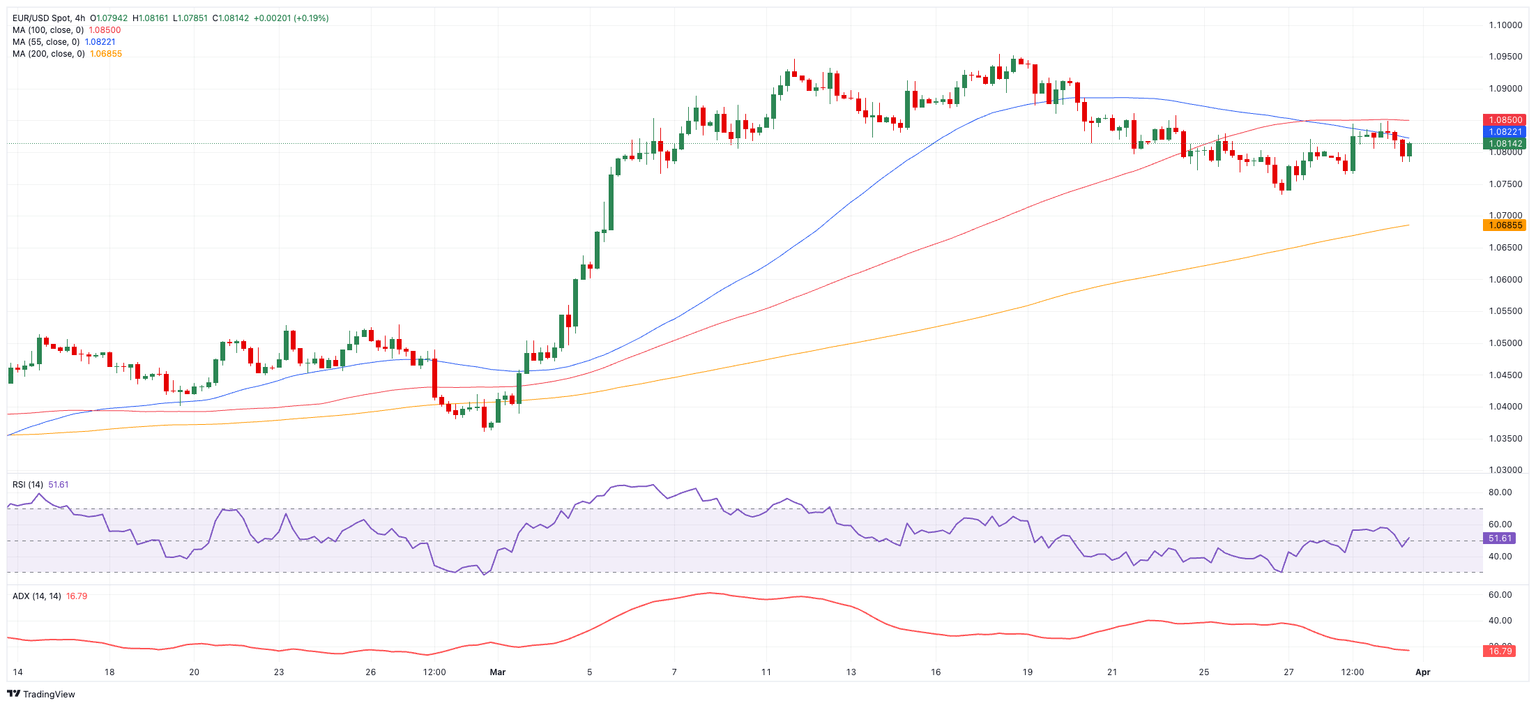

- Resistance Levels: Key resistance looms at 1.0954 (March 18 YTD high), followed by 1.0969 (23.6% Fibonacci retracement). A decisive push above the 1.1000 psychological barrier would signal a bullish shift.

- Support Zones: Initial support comes from the 200-day SMA at 1.0730. Below that, watch the 55-day SMA at 1.0561, the 100-day SMA at 1.0519, and the February 28 low at 1.0359. Further weakness could expose the weekly low of 1.0282 (February 10) and the 2025 bottom of 1.0176 (January 13).

- Momentum Indicators: The RSI near 57 suggests steady bullish momentum, while an ADX reading just above 26 points to a moderate but somewhat waning trend.

What to watch

EUR/USD remains acutely sensitive to headlines on trade policy, central bank moves, and geopolitical developments. Market watchers will keep a close eye on any further US-EU tariff updates, progress on the Russia-Ukraine truce, and potential shifts in Fed and ECB guidance to gauge the pair’s next move.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.