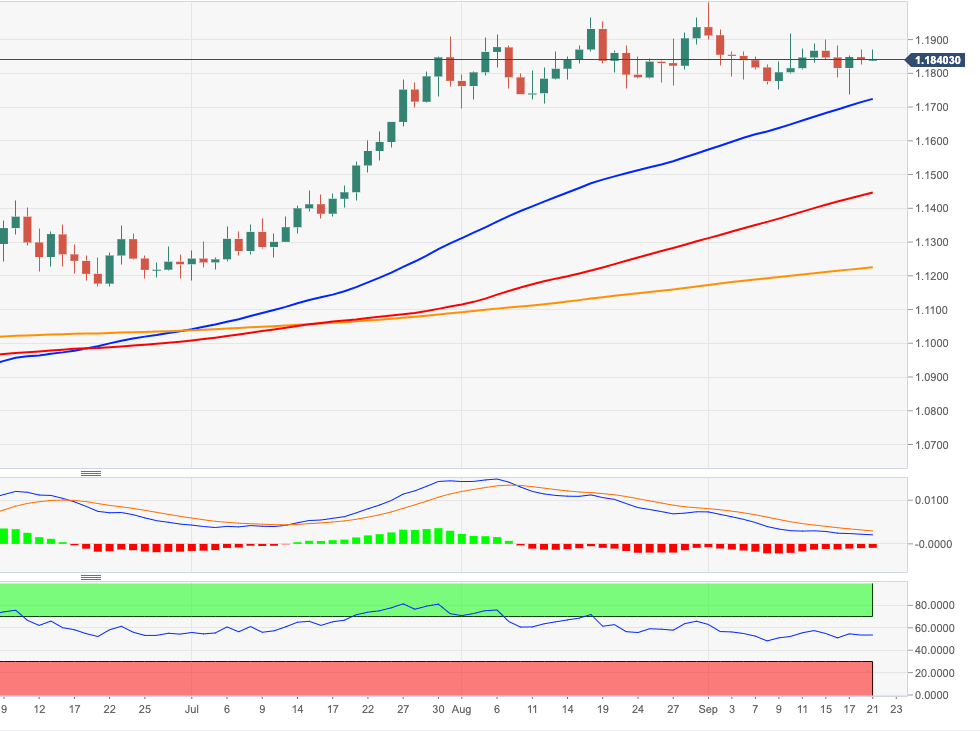

EUR/USD Price Forecast: Target emerges at the 1.19 mark… and above

- EUR/USD looks to break above the multi-session consolidative range.

- Further up aligns the key barrier at the 1.19 yardstick.

EUR/USD keeps navigating within the recent choppy range, looking to extend further north the ongoing rebound from last week’s monthly lows in the 1.1740/35 band and always looking to the broad risk appetite trends for direction.

In the meantime, markets are still debating between the preference for riskier assets and the safe haven universe and always against the backdrop of the generalized offered bias surrounding the greenback.

Later in the week, the focus of attention will definitely be on the testimonies by Chief Jerome Powell on Tuesday, Wednesday and Thursday along with several appearances from FOMC members. Data wise, flash PMIs on both sides of the Atlantic will be on top of the calendar as well as the usual weekly report on the US labour market. On Monday, ECB’s Christine Lagarde will participate at an online meeting of the Franco-German Parliamentary Assembly.

Near-term Technical Outlook

The continuation of the upside momentum in EUR/USD should target recent tops in the 1.1925/20 band (September 10). If the upside impetus gathers extra pace, then the investors’ focus will shift to the August’s peak at 1.1965 ahead of the 2020 high near 1.2010 recorded on September 1. The constructive view on EUR/USD is expected to remain unchanged as long as the critical 200-day SMA, today at 1.1224, holds the downside. On the opposite side, a breach of monthly lows in the 1.1740 should open the door to a potential deeper retracement to the more relevant contention area in the 1.1700 neighbourhood. A move to the latter, however, remains unfavourable at least in the short-term horizon.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.