EUR/USD Price Forecast: Strong barrier emerges at 1.0600

- EUR/USD’s recovery seems to have stalled around the 1.0600 region.

- The resurgence of the geopolitical factor lent support to the US Dollar.

- The final HICP in the euro area hit the ECB’s target in October.

EUR/USD struggled to maintain its recent upside impulse on Tuesday, coming under fresh selling pressure soon after a failed attempt to regain the area above the 1.0600 mark following two daily advances in a row.

The daily drop in spot came amid humble gains in the US Dollar (USD), which was reinforced by the resumption of geopolitical jitters and the flight-to-safety environment. That said, the Dollar Index (DXY) hovered around the 106.30 zone against the backdrop of declining US yields across the spectrum as well as steady demand for the safe haven universe.

On the monetary policy front, the Federal Reserve (Fed) recently cut interest rates by 25 basis points, lowering the target range to 4.75%-5.00%. The move was in line with expectations, as inflation continues to edge closer to the Fed's 2% goal. However, early indications of a cooling labour market have emerged, despite persistently low unemployment. In its November statement, the Fed acknowledged inflation progress, but Chair Jerome Powell emphasized that the central bank is not rushing into further rate cuts. This cautious stance has tempered expectations for a December rate reduction and was behind a big chunk of the Dollar’s late gains.

Meanwhile, Fed officials remain wary of persistent inflation risks. Richmond Fed President Tom Barkin highlighted uncertainties such as high wage settlements and potential tariff increases, which could complicate the Fed's ability to declare victory over inflation.

Across the Atlantic, the European Central Bank (ECB) recently lowered its deposit rate to 3.25% in October but has since adopted a wait-and-see approach, holding off on additional rate adjustments until more data becomes available.

Looking ahead, any new trade policies from the Trump administration, such as tariffs on European or Chinese goods, could reignite inflationary pressures in the US. If the Fed maintains a cautious or even hawkish stance in response, the US Dollar could find renewed support.

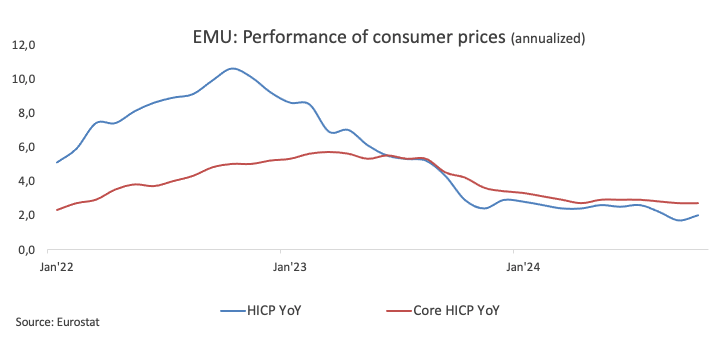

Data wise, the final Harmonised Index of Consumer Prices (HICP) in the euro bloc showed consumer prices rising by 2.0% in the year to October and 2.7% over the last twelve months when it came to the core HICP.

On the positioning side, speculative net short positions in the Euro have been narrowing for four consecutive weeks, dropping to around 7,500 contracts. However, commercial traders have flipped back to net sellers of the Euro after a brief pause, reflecting cautious sentiment as overall open interest continues to decline, according to the latest CFTC report.

EUR/USD daily chart

Technical Outlook for EUR/USD

Further losses may drive the EUR/USD down to its 2024 bottom of 1.0495 (November 14), followed by the 2023 low of 1.0448 (October 3).

On the upside, the 200-day SMA at 1.0862 provides immediate resistance, followed by the provisional 55-day SMA at 1.0920 and the November high at 1.0936 (November 6).

Furthermore, the short-term technical picture is unfavourable as long as EUR/USD remains below the 200-day SMA.

The four-hour chart indicates that a gradual comeback could emerge on the horizon. That said, initial resistance is at 1.0653, followed by 1.0726. The next negative target is 1.0495, followed by 1.0448. The Relative Strength Index (RSI) rose to about 52.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.