EUR/USD Price Forecast: Sellers put pressure on weekly lows

EUR/USD Current price: 1.0774

- Concerns about looming US elections push market players into safe-haven US Dollar.

- US Consumer Confidence expected to have improved modestly in October.

- EUR/USD accelerates its slide after failing to reconquer the 1.0800 threshold.

The EUR/USD pair trades with a softer tone on Tuesday, breaking through the 1.0800 mark ahead of Wall Street’s opening. The US Dollar advances as caution intensifies ahead of first-tier releases and the United States (US) presidential election, scheduled for next week. Concerns revolve around a potential victory from former President Donald Trump and a drastic policy shift.

In the meantime, the US has quite a packed macroeconomic calendar this week, including fresh growth and inflation updates and multiple employment-related figures ahead of Friday's Nonfarm Payrolls (NFP) release.

So far, the country released the Goods Trade Balance, which posted an unexpected deficit of $108.2 billion in September, according to preliminary estimates. The reading was much worse than the $-96.1 billion expected. More relevant figures will come in the American session, as CB will release October Consumer Confidence, foreseen at 99.5, slightly better than the previous 98.7. The US will also publish JOLTS Job Openings.

EUR/USD short-term technical outlook

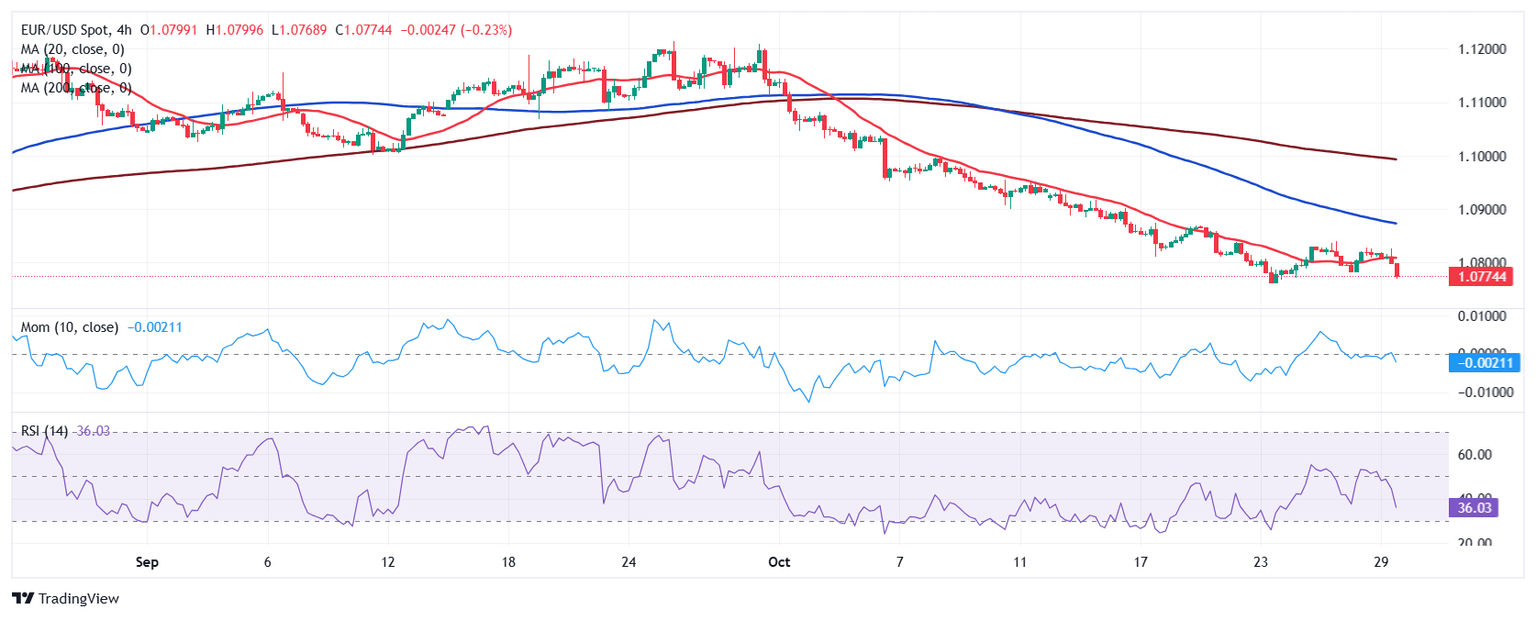

The EUR/USD pair approaches its weekly low, and technical readings in the daily chart support a downward extension. On the one hand, technical indicators have turned south within negative levels, reflecting increased selling interest. On the other, the 20 Simple Moving Average (SMA) has accelerated lower after crossing below a flat 100 SMA and approaching a directionless 200 SMA.

In the near term, and according to the 4-hour chart, the risk of a downward extension has increased. Technical indicators resumed their declines, heading lower almost vertically below their midlines. At the same time, the pair broke lower after battling around a flat 20 SMA. Finally, the longer moving averages maintain their downward slopes well above the shorter one, indicating that sellers are unwilling to give up.

Support levels: 1.0755 1.0710 1.0667

Resistance levels: 1.0820 1.0865 1.0900

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.