EUR/USD Price Forecast: Sellers keep bulls in check

EUR/USD Current price: 1.0569

- Eurozone Sentix Investor Confidence deteriorated in December to -17.5.

- Market players stand in wait-and-see mode ahead of central banks’ announcements.

- EUR/USD is at risk of losing the 1.0500 mark, but not in the near term.

The EUR/USD pair hovers around 1.0560 ahead of Wall Street’s opening, with action limited across financial markets ahead of key events spread throughout this week and the next one. Most major central banks will announce their decisions on monetary policy, with the European Central Bank (ECB) scheduled for this Thursday. The ECB is widely anticipated to trim interest rates by 25 basis points (bps) each amid tepid growth in the Union.

President Christine Lagarde, however, has already warned inflation won’t fall into the ECB’s goal until late next year, cooling speculation about whether inflation could affect the upcoming decisions.

The macroeconomic calendar has little to offer today. The Eurozone released December Sentix Investor Confidence, which worsened to -17.5 from -12.8 in November. The United States (US) will release October Wholesale Inventories after the opening.

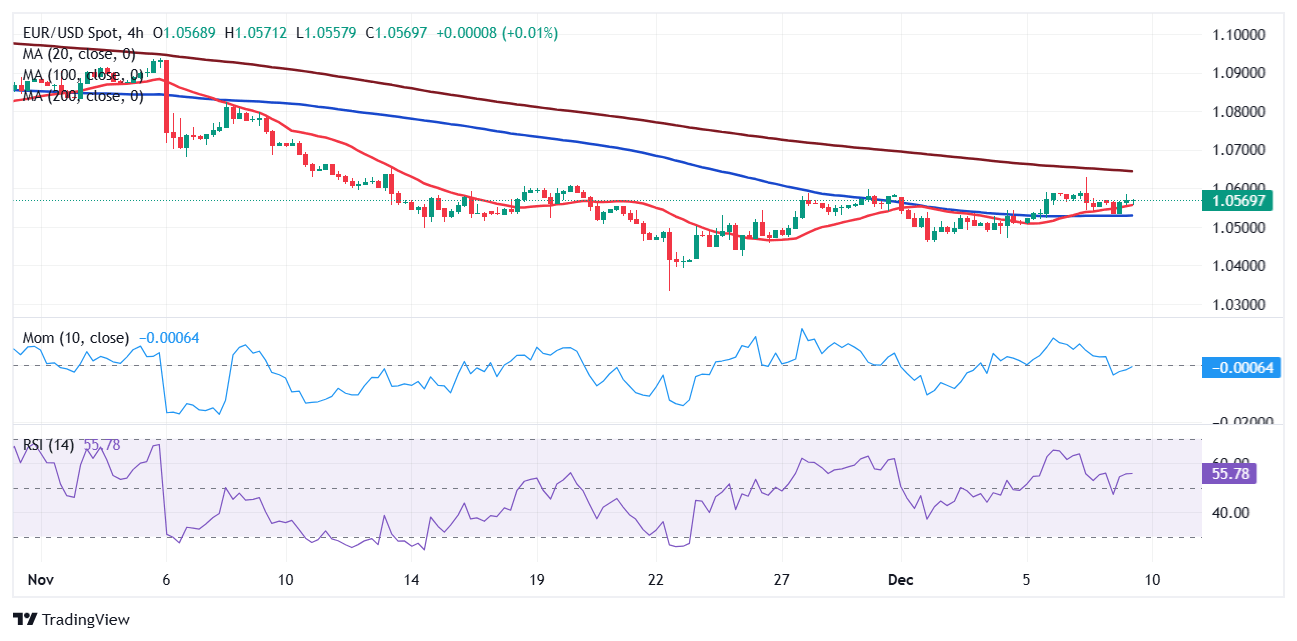

EUR/USD short-term technical outlook

Technically, the daily chart for the EUR/USD pair offers a neutral stance, with the bullish potential well-limited. The pair is finding intraday buyers around a bearish 20 Simple Moving Average (SMA,) which heads lower at around 1.0530. The 100 and 200 SMAs, on the contrary, gain downward traction far above the current level. Finally, technical indicators turned modestly lower, just below their midline, lacking directional strength enough to confirm a bearish extension.

The 4-hour chart shows EUR/USD is neutral. The pair develops above its 20 and 100 SMAs, with the shorter one advancing modestly above the longer one. Yet, at the same time, the 200 SMA gains bearish strength above the current level, suggesting prevalent selling interest. Finally, technical indicators hold above their midlines yet offer neutral-to-bearish slopes.

Support levels: 1.0500 1.0465 1.0420

Resistance levels: 1.0625 1.0660 1.0700

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.