EUR/USD Price Forecast: Sellers aiming to lose the 1.0800 mark

EUR/USD Current price: 1.0811

- Concerns about the United States Presidential election’s outcome undermine the mood.

- European Central Bank President Christine Lagarde to speak at the IMF event.

- EUR/USD bearish case gaining strength, break below 1.0800 likely.

The EUR/USD pair bottomed at 1.0810 on Monday, recovering just modestly on Tuesday before resuming its slide ahead of Wall Street’s opening. Government bonds’ sell-off keeps leading the way across financial markets, backing the US Dollar against its major rivals. Pullbacks are limited given the dominant dismal mood reflected in the poor performance of global equities.

Markets are concerned about the upcoming US election and a potential victory from former President Donald Trump, as investors weigh the potential impact of Trump's fiscal and foreign policies on future interest rates and inflation. Persistent tensions between Israel and its neighbouring countries also undermine the mood.

Data-wise, the macroeconomic calendar had little to offer, except for a speech from European Central Bank (ECB) President Christine Lagarde. Lagarde is due to participate in a panel discussion titled "The Future of Cross-Border Payments: Faster Safer Together – Safe and Inclusive Fast Payments Across Borders" at the Annual Meetings of the International Monetary Fund (IMF) and the World Bank Group.

Later in the day, the United States (US) will offer the October Richmond Fed Manufacturing Index, while a couple of Federal Reserve (Fed) speakers will hit the wires and may or may not provide clues on future Fed actions.

EUR/USD short-term technical outlook

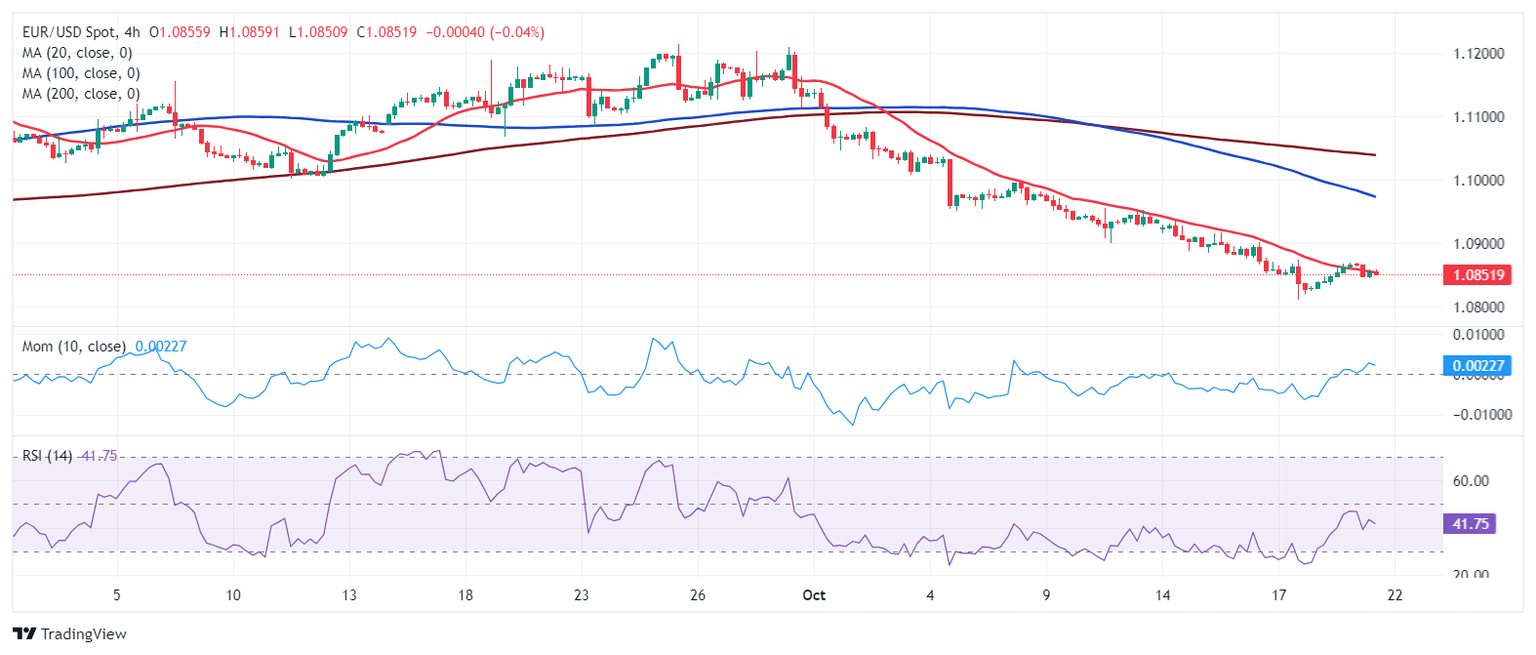

The daily chart for the EUR/USD pair shows that it trades near its daily low and is unchanged on a daily basis, which is technically bearish. The pair keeps developing below all its moving averages, with the 20 Simple Moving Average (SMA) heading firmly south above directionless 100 and 200 SMAs. Technical indicators, in the meantime, lack clear directional strength and consolidate within negative levels.

In the near term, and according to the 4-hour chart, technical readings support a bearish breakout. A bearish 20 SMA keeps leading the way south by offering dynamic resistance, currently at around 1.0840. The longer moving averages gain downward momentum far above the shorter one, in line with the persistent selling interest. Finally, technical indicators have resumed their slumps within negative levels, also supporting another leg lower.

Support levels: 1.0805 1.0770 1.0735

Resistance levels: 1.0840 1.0880 1.0920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.