EUR/USD Price Forecast: Sellers aim to challenge the year’s low

EUR/USD Current price: 1.0613

- German political turmoil and tepid data add pressure on the Euro.

- Demand for the US Dollar prevails in a risk-averse environment.

- EUR/USD maintains its strong bearish momentum and aims to break below 1.0600.

The US Dollar retains its positive momentum across the FX board, pushing EUR/USD close to its year low at 1.0600.

German data, in the meantime, weighed the Euro. The largest Union country published the ZEW survey on Economic Sentiment, which deteriorated by more than anticipated in November. The index fell to 7.4 from 13.1 in October, missing expectations of 12.8. Economic Sentiment in the Eurozone declined to 12.5, while the assessment of the current situation plunged to -91.4 points. According to the official report, “economic expectations for Germany have been overshadowed by Trump’s victory and the collapse of the German government coalition.”

On the one hand, Trump’s victory means potential fresh tariffs to the already battered manufacturing sector. On the other hand, Germany’s coalition government collapsed after Chancellor Olaf Scholz fired Finance Minister Christian Lindner. Lawmakers agreed to hold a federal election in February, while the Parliament will hold a confidence vote in mid-December.

Other than that, Germany confirmed the annualized Consumer Price Index (CPI) at 2.4% in October, as previously estimated.

Across the pond, the United States (US) released the October NFIB Business Optimism Index, which improved from 91.5 to 93.7. A couple of Federal Reserve (Fed) officials will be on the wires in the American afternoon, with nothing else to consider until Wednesday, when the US will publish the October CPI.

EUR/USD short-term technical outlook

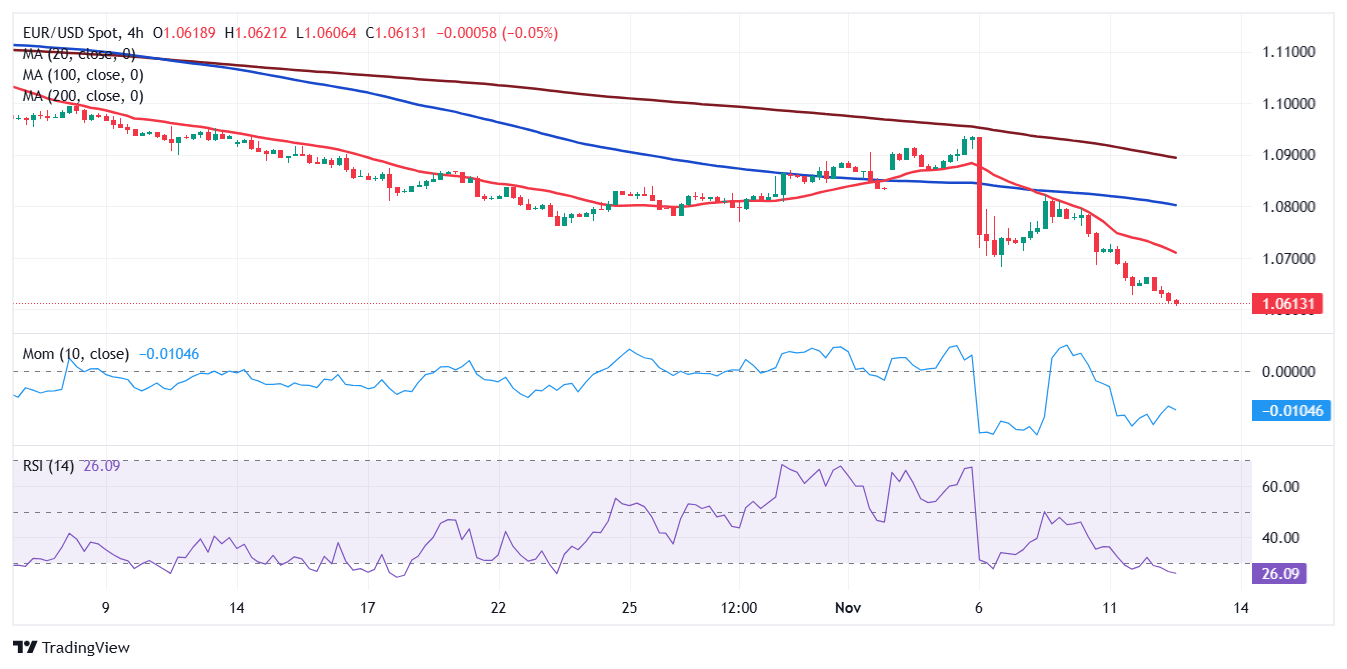

The EUR/USD pair trades a handful of pips above the 1.0600 mark and technical readings in the daily chart suggest the decline may continue. Technical indicators keep heading south within negative levels, without signaling oversold conditions neither or downward exhaustion. In the same chart, the 20 Simple Moving Average (SMA) accelerated lower below the 100 and 200 SMAs while roughly 200 pips above the current level.

EUR/USD is oversold in the near term. The 4-hour chart shows technical indicators extend their advances within oversold readings, not yet enough to suggest a potential reversal. All moving averages accelerated south well above the current level, reflecting sellers’ strength.

Support levels: 1.0600 1.0565 1.0520

Resistance levels: 1.0640 1.0685 1.0720

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.