EUR/USD Price Forecast: Pressure mounts as uncertainty weighs

EUR/USD Current price: 1.0786

- European Central Bank officials delivered dovish comments, weighing on the EUR.

- United States Durable Goods Orders rose a modest 0.9% in February.

- EUR/USD turned bearish in the near term, although the downward momentum is limited.

The EUR/USD pair extends its downward route on Wednesday, trading in the 1.0780 region early in the American session. Markets remain cautious amid United States (US) President Donald Trump’s latest tariff announcements, and ahead of a slew of Federal Reserve (Fed) speakers.

Earlier in the week, investors were optimistic that Trump’s reciprocal tariffs coming into effect on April 2 would be less widespread than anticipated, but the US President made it clear on Tuesday that levies would probably be “more lenient than reciprocal,” and more widespread than earlier estimated.

In the meantime, the Euro (EUR) is unable to advance amid dovish comments from European Central Bank (ECB) officials. On the one hand, policymaker Fabio Panetta said on Wednesday, the central bank “must remain pragmatic and data-driven in setting the policy rate,” adding the ECB should now focus more on inflation expectations than the estimated neutral level in setting rates.

Also, Bank of France head Francois Villeroy de Galhau noted that US tariffs could have a limited impact on European inflation but added that they could reduce the Eurozone Gross Domestic Product (GDP) growth by 0.3% in a full year.

Meanwhile, the US published February Durable Goods Orders, which rose by 0.9%, beating the -1% expected but shrinking from the previous 3.3%.

EUR/USD short-term technical outlook

From a technical point of view, the daily chart for the EUR/USD pair shows it trades in the red for a sixth consecutive day, while it keeps posting lower lows. The same chart shows the price is pressuring a still bullish 20 Simple Moving Average (SMA), which remains above directionless 100 and 200 SMAs. Technical indicators, in the meantime, head lower with uneven strength, still holding above their midlines, yet reflecting increased selling interest.

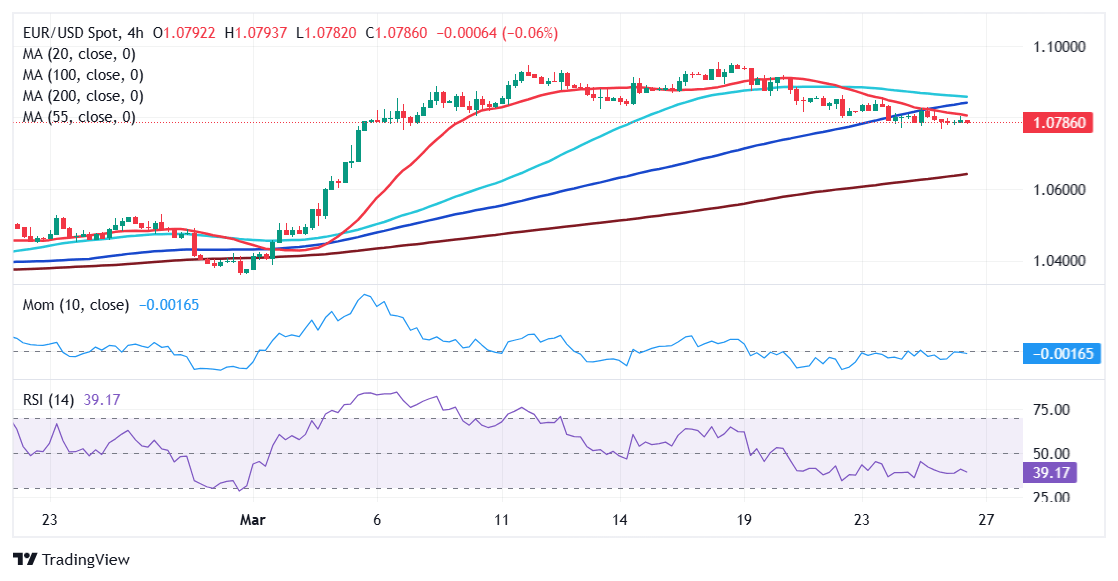

In the near term, and according to the 4-hour chart, the EUR/USD pair is confined to a tight consolidative range, while developing below the 20 and 100 SMAs. The shorter one gains downward traction below the longer one, adding to the bearish case. Finally, technical indicators turned south within negative levels, although without enough strength to confirm a steeper decline.

Support levels: 1.0745 1.0710 1.0675

Resistance levels: 10830 1.0860 1.0905

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.