EUR/USD Price Forecast: Outlook remains sour below 1.0870

- EUR/USD added to Friday’s rebound and surpassed 1.0600.

- The powerful Trump-led rally in the US Dollar ran out of further steam.

- Markets’ attention remains on economic data releases later in the week.

EUR/USD picked up pace on Monday, advancing past 1.0600 the figure to hit three-day highs following last week’s drop below the 1.0500 support, all amidst further correction in the Greenback.

The US Dollar’s daily decline came as optimism regarding the Trump-led rally appears to have waned among investors. On this, it is worth recalling that the sharp advance in the Greenback in the past few days came in response to anticipation of pro-growth policies from the incoming administration. This positive sentiment drove the Dollar Index (DXY) past the 107.00 mark, hitting new highs for the year during last week.

The move lower in the pair was also accompanied by a retracement in US yields across the board as well as a humble recovery in German 10-year bund yields.

On the central bank front, the Federal Reserve (Fed) cut its target interest rate by 25 basis points early in November, bringing it down to the 4.75%-5.00% range, in line with expectations. The Fed noted that inflation is inching closer to its 2% target, though early signs of a cooling labour market are starting to emerge, even with unemployment still low. Interestingly, the Fed’s latest statement showed a slight change in language, hinting that inflation has "made progress."

However, Fed Chair Jerome Powell suggested late last week that the Fed is in no hurry to continue reducing its interest rates, motivating bets for a December rate cut to shrink markedly to around 40%, according to CME Group’s FedWatch Tool.

Around the Fed, policymakers were treading carefully when considering the next steps in the easing cycle. That said, Richmond Fed President Tom Barkin expressed concerns last week about lingering uncertainties, including high wage settlements from unions and potential tariff hikes. He suggested these factors could make Fed policymakers hesitant to declare victory over inflation.

Meanwhile, across the Atlantic, the European Central Bank (ECB) lowered its deposit rate to 3.25% on October 17 but opted to hit pause on further rate adjustments, preferring to wait for more economic data before making additional moves.

Looking ahead, any trade policies from the Trump administration, especially tariffs on European and Chinese imports, could push US inflation higher. If the Fed responds with a cautious or hawkish tone, it might continue to support the US Dollar.

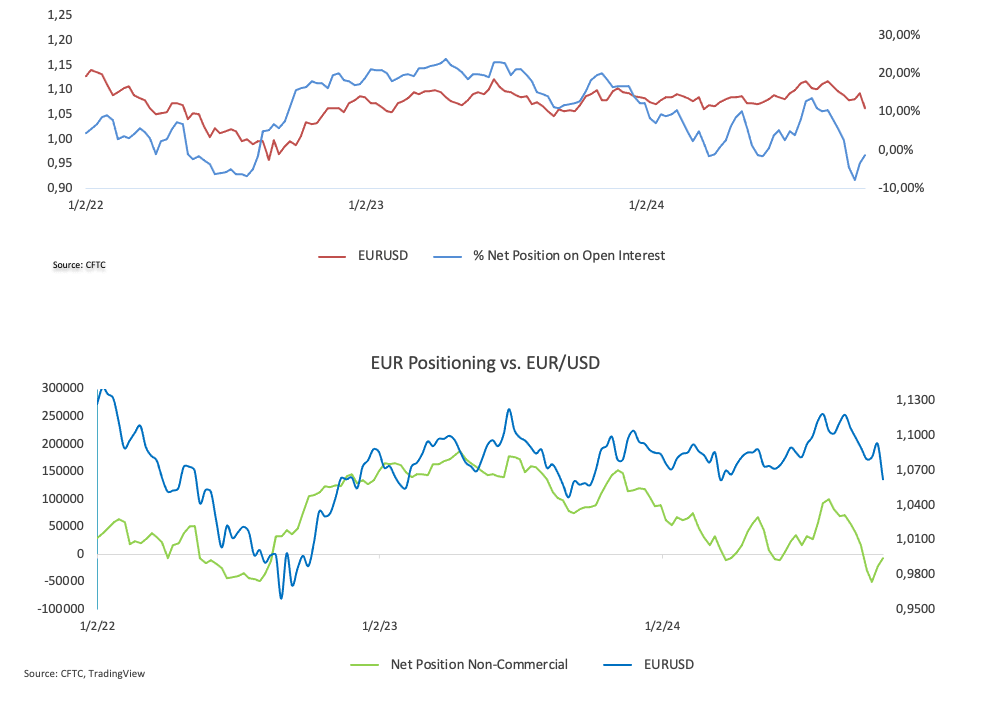

Meanwhile, speculative net short positions in the Euro (EUR) declined for the fourth week in a row, dropping to nearly 7.5K contracts, while commercial traders flipped to net sellers of the Euro after a brief two-week pause as overall open interest continued to decrease, as per the latest CFTC Positioning Report.

Technical Outlook for EUR/USD

Further losses may push the EUR/USD down to its 2024 bottom of 1.0495 (November 14), followed by the 2023 low of 1.0448 (October 3).

On the upside, immediate resistance is the 200-day SMA at 1.0862, followed by the provisional 55-day SMA at 1.0929 and the November high at 1.0936 (November 6).

Additionally, the short-term technical picture is negative as long as EUR/USD continues below the 200-day SMA.

The four-hour chart shows that a potential rebound might be in the offing. That said, initial resistance is at 1.0653 seconded by 1.0726. Next on tap on the downside comes 1.0495 prior to 1.0448. The Relative Strength Index (RSI) climbed to nearly 52.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.