EUR/USD Price Forecast: Next on the upside emerges 1.1000

- EUR/USD’s bullish attempt faltered just ahead of the key 1.1000 barrier.

- The US Dollar alternated gains with losses in the upper end of the range.

- Industrial Production in Germany expanded above estimates in August.

EUR/USD ended Tuesday’s session around the 1.0970 region, barely changing from Monday’s closing level. Earlier in the day, spot attempted to retest the 1.1000 hurdle, although the move lacked follow-through.

In the meantime, the US Dollar (US) maintained a sidelined tone amidst mixed US yields across the curve, while investors remained prudent following news of potential ceasefire talks between Israel and Hezbollah.

Globally, the recent risk-off sentiment outweighed any optimism around China’s stimulus efforts aimed at boosting its post-pandemic economy.

On the monetary policy front, market expectations remained for further easing by the Federal Reserve (Fed) in the months ahead. However, the likelihood of a large rate cut diminished, especially after September’s stronger-than-expected US jobs report.

Fed Chair Jerome Powell reiterated a data-driven approach to future rate decisions, signalling that the pace of rate reductions might slow. Markets are currently pricing in a possible 25 basis-point rate cut at the Fed’s November and December meetings.

Still around the Fed, officials have signalled on Tuesday their support for further interest rate cuts. St. Louis President Alberto Musalem endorsed additional reductions as the economy progresses, while New York President John Williams indicated that more cuts could be warranted "over time" following September’s half-point reduction. Finally, FOMC Governor Adriana Kugler also expressed strong backing for recent cuts and would support further easing if inflation continues to decline as anticipated.

Across the Atlantic, the European Central Bank (ECB) took a more cautious stance at its recent meeting due to inflationary and economic pressures. In her latest remarks, ECB President Christine Lagarde noted that while inflation remains elevated in the Eurozone, restrictive monetary policies are starting to ease, which could bolster growth. The ECB expects inflation to hit its 2% target by 2025.

Earlier in the week, ECB Vice President Luis de Guindos recently indicated that Eurozone growth could be weaker in the near term but remained optimistic about a recovery, driven by rising real incomes and loosening monetary policies. Additionally, French Central Bank Chief François Villeroy de Galhau suggested that low economic growth might lead to inflation undershooting the bank's 2% target, which could prompt rate adjustments. He predicted further deposit rate changes and anticipated a return to a "neutral" rate by 2025.

Recent data revealed that Eurozone inflation, measured by the Harmonized Index of Consumer Prices (HICP), fell below the ECB's target in September, reaching 1.8% year-on-year. This does nothing but reinforce the view that the ECB might consider additional rate cuts in the next few months.

With further rate cuts anticipated from both the Fed and the ECB, the outlook for EUR/USD appears increasingly focused on macroeconomic conditions. On this, the US economy is expected to outpace its European counterpart, which could translate into additional strength for the US Dollar.

When it comes to positioning, Non-Commercial traders (speculators) reduced their net long positions in the Euro to their lowest since late August, while Commercial players cut their net short positions to a six-week low amidst a modest drop in open interest, according to the CFTC Positioning Report for the week ending October 1.

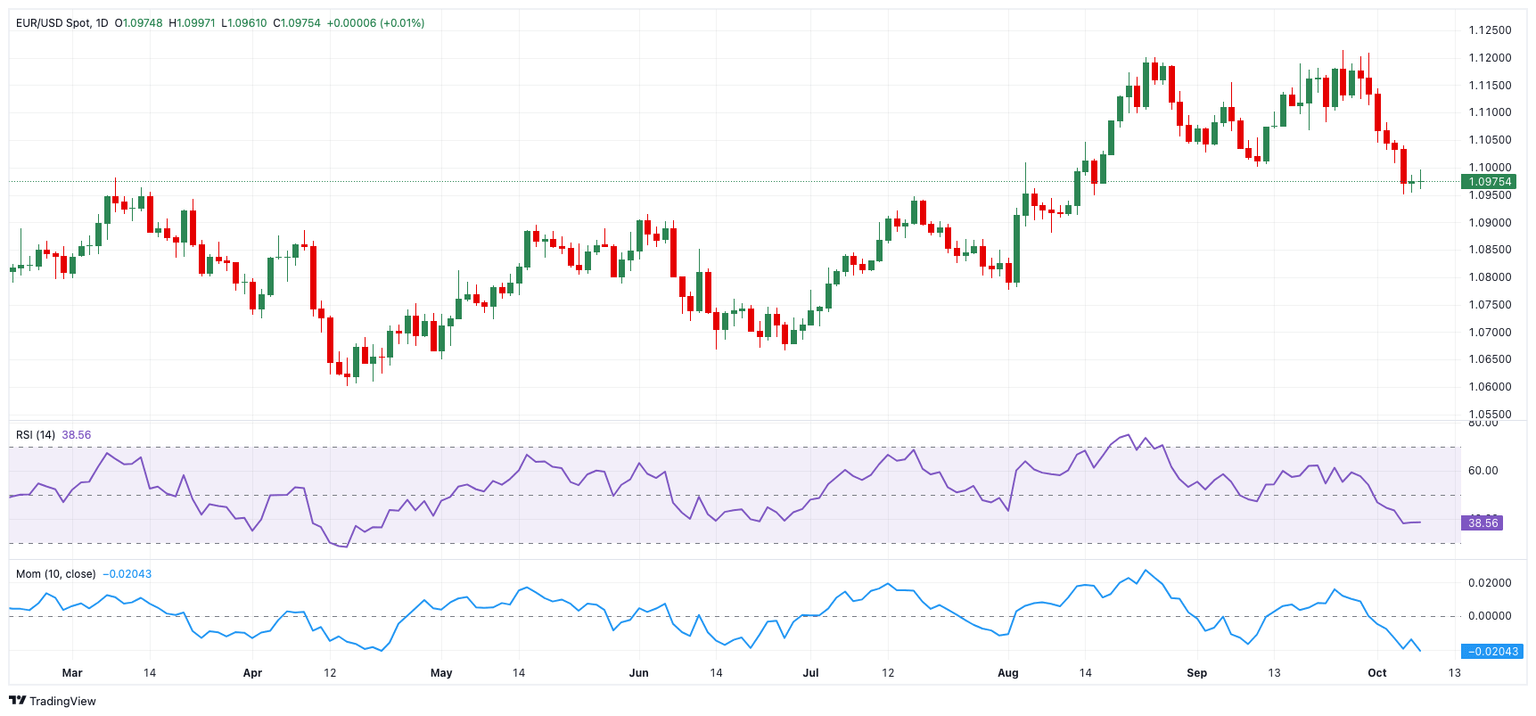

EUR/USD daily chart

EUR/USD short-term technical outlook

Further declines may prompt the EUR/USD to test the October low of 1.0950 (October 4), ahead of the weekly low of 1.0881 (August 8).

On the upside, there is a provisional hurdle at the 55-day SMA at 1.1032, prior to the 2024 top of 1.1214 (September 25), followed by the 2023 peak of 1.1275 (July 18) and the 1.1300 round level.

Meanwhile, the pair's rising trend is expected to continue as long as it stays above the critical 200-day SMA of 1.0873.

The four-hour chart shows a consolidative development for the time being. The initial resistance level is 1.1082, ahead of the 200-SMA of 1.1094, and 1.1143. On the other side, the initial contention aligns at 1.0950, followed by 1.0913 and then 1.0881. The relative strength index (RSI) dropped to about 35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.